U.S. Bank’s ABA Routing Number: The Silent Engine Behind Every Transaction

U.S. Bank’s ABA Routing Number: The Silent Engine Behind Every Transaction

Every debit or wire transfer you make in the U.S. relies on a precise, unseen code—its ABA routing number. Among銀行 institutions, U.S.

Bank stands out for its consistent use of the ABA routing number, a critical identifier encrypted in every transaction. Whether you’re splitting a bill, setting up direct deposit, or making payments at a retail store, the U.S. Bank routing number ensures funds move securely and accurately across the financial system.

This article unpacks how this nine-digit code powers daily banking, what it means for customers, and why it remains essential in modern finance.

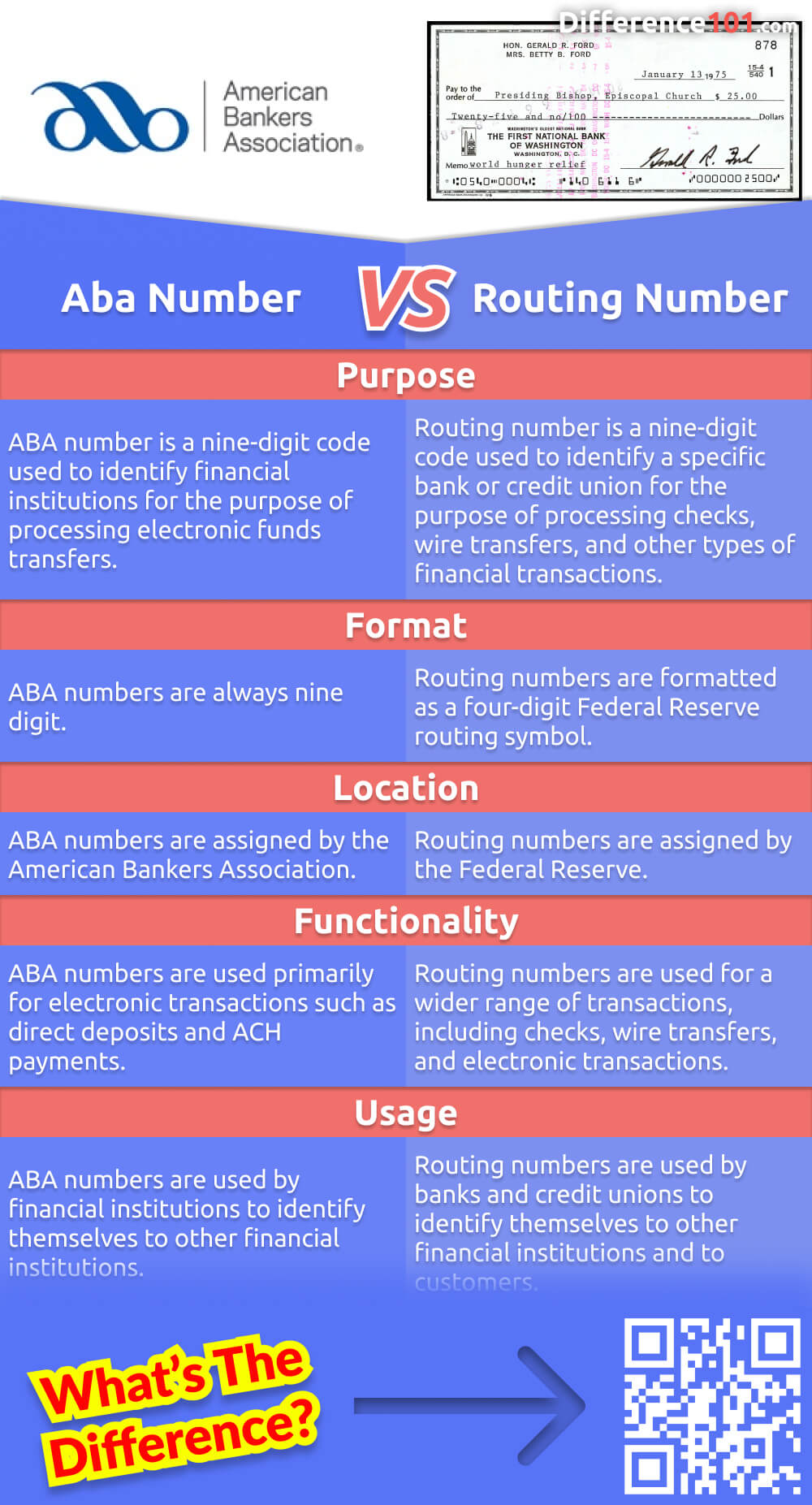

At its core, the ABA routing number is a nine-character code administered by the American Bankers Association. For U.S.

Bank, this number—000.__.XXX—serves as a blockchain-level signal directing financial networks where money flows. Unlike account numbers that vary by customer, the routing number uniquely identifies the bank and its vertreten institution within the federal ABA system. “The routing number acts as a financial zip code,” explains financial technology analyst Rachel Cole.

“It routes transactions to the correct receiving bank branch, enabling seamless processing across ATMs, cleared checks, and electronic transfers.”

U.S. Bank’s routing number format follows the standardized ABA structure. The first four digits (000–000) identify the Federal Reserve district, often aligning with the bank’s head office location.

The next four digits (____) pinpoint a specific financial institution within that district, while the final digit is a check digit ensuring compliance with security standards. This structured system eliminates ambiguity: every transaction involving a U.S. Bank routing number is routed with millisecond precision.

For consumers, recognizing the routing number prevents costly errors.

Direct deposits—critical for payroll, Social Security, and government benefits—depend entirely on this nine-digit code. “A single digit glitch can divert thousands of dollars to the wrong account,” warns banking professional David Wu. For example, a misinput of even one digit could send a salary payment to a competitor’s bank, causing delays and potential overdraft fees.

Thus, verifying routing numbers through official bank websites or ACH services is nonnegotiable.

U.S. Bank supports widespread accessibility, enabling customers to locate their routing number easily through digital platforms.

When setting up payment authorizations or debit cards, the routing number is embedded in secure forms, reducing risk of exposure. Branch staff routinely confirm routing details before processing interbank transfers, reinforcing security. Beyond direct deposits, ABA routing numbers enable ACH withdrawals, e-check routing, and cross-institutional transfers—all foundational to modern cashless economies.

The technological backbone behind these routing numbers is robust. Every transaction involving U.S. Bank’s routing number travels through the Automated Clearing House (ACH) network, where ABA codes ensure payments clear reliably.

ACH processes process over 20 billion transactions annually in the U.S., with routing numbers acting as the unique gateways. The Federal Reserve and the National Automated Clearing House Association (NACHA) oversee compliance, ensuring routing integrity and reducing fraud.

Why do banks like U.S.

Bank maintain these codes securely? Because routing numbers are more than identifiers—they are access keys. Mischaracterization of a routing number can stall payments, delay refunds, or compromise identity verification.

U.S. Bank has implemented advanced validation protocols?including real-time checks against ACH network databases?to ensure customers engage only with legitimate institutions. This proactive approach protects.User experience without sacrificing safety.

In practice, the benefits reach deeply into everyday financial life. Consider Maria, a small business owner who automates payroll via bank-direct deposit. “Using U.S.

Bank’s routing number every time my employees get paid? It’s non-negotiable. A wrong number would freeze payroll, impacting clients and trust.” Her experience reflects broader trends: reliable routing underpins financial inclusion, enabling timely access to income for millions of Americans.

Another typical use case involves splitting expenses through digital wallets or peer-to-peer platforms. When splitting a restaurant bill using a platform linked to U.S. Bank, the routing number ensures funds reach the correct account—even across different financial institutions.

“These systems rely fully on accurate routing,” says Cole. “The technology converges routing data with transaction timing, allowing near-instant settlement.”

The reliability of U.S. Bank’s routing infrastructure contributes significantly to trusted, efficient banking.

While digital transactions occur at light speed, the underlying ABA code ensures precision amid volume. Unlike static account numbers that vary per customer, the routing number remains constant and central—fonctionarial backbone of clearing systems nationwide. For fintech innovators, developers, and everyday users alike, understanding and safeguarding this number is critical to financial functionality.

In an era defined by seamless digital payments, the ABA routing number—especially U.S. Bank’s clear, consistent format—remains indispensable. It bridges fragmented institutions, validates intent, and enables trust in every transfer.

Behind every secure transaction, an unseen number directs funds with clarity and purpose. As financial technology advances, this nine-digit code persists as a silent sentinel of stability.

Default Details of U.S.

Bank’s ABA Routing Number System U.S. Bank’s routing number, formatted as 000._._._X, operates within a nationally standardized framework maintained by the American Bankers Association (ABA). The first three digits identify the bank’s federal reserve district, often aligned with major metropolitan headquarters—such as 000 for the East Federal Reserve district.

The next four digits pinpoint a specific financial institution within that area, allowing precise routing across thousands of local branches. The final digit functions as a check digit, a mathematical safeguard that validates the number’s integrity and reduces transmission errors.

This structured format supports interoperability across the Federal Reserve’s ACH network, the clearinghouse backbone for electronic payments.

Financial institutions use ABA routing numbers to authorize and process direct deposits, wire transfers, ATM withdrawals, and automated bill payments. Routing number accuracy directly influences transaction speed and security; discrepancies greater than one digit trigger alerts through banking verification systems, often blocking payment attempts.

U.S.

Bank ensures its routing number is publicly maintained in trusted financial databases and clearly documented in customer-facing tools. When initiating a transfer or setting up recurring payments, users access the routing number through secure interfaces, minimizing risk of exposure. Branch employees routinely verify routing details before processing large or time-sensitive transactions, following strict compliance protocols overseen by both bank risk teams and federal banking standards.

Security considerations are paramount: U.S. Bank employs encryption and multi-factor confirmation methods when routing numbers are shared electronically. This prevents unauthorized access and aligns with federal regulations like the Truth in Lending Act and the Electronic Fund Transfer Act.

By standardizing formats and validating inputs at every stage, U.S. Bank strengthens confidence in transaction reliability, ensuring the routing number remains a trusted conduit for financial activity.

Related Post

Burke Mountain Academy: Your Ultimate Campus Exploration Guide

Son Forced Mother: A Haunting Landscape with Deep Social and Psychological Undercurrents

The Global Clockwork: Mastering PST Time Zone Time Across Pst

Iilithium Americas Corp (LAC) Sparks Surge with Key Developments in Electric Vehicle Lithium Supply Chain