Unlock Seamless Banking: The Essential Westlake Financial Login and Payment Guide

Unlock Seamless Banking: The Essential Westlake Financial Login and Payment Guide

In an era where digital convenience reigns, secure, intuitive access to financial tools defines modern money management. The Westlake Financial Login and Payment Guide stands as a critical roadmap, offering users a step-by-step blueprint to safely navigate online banking, authenticate transactions, and execute payments with clarity and confidence. Whether you’re a first-time digital banker or a seasoned user, understanding the login protocols and payment systems embedded in Westlake’s platform ensures both efficiency and security.

This definitive guide deciphers the inner workings of Westlake’s digital ecosystem, empowering users to manage finances without friction or fear.

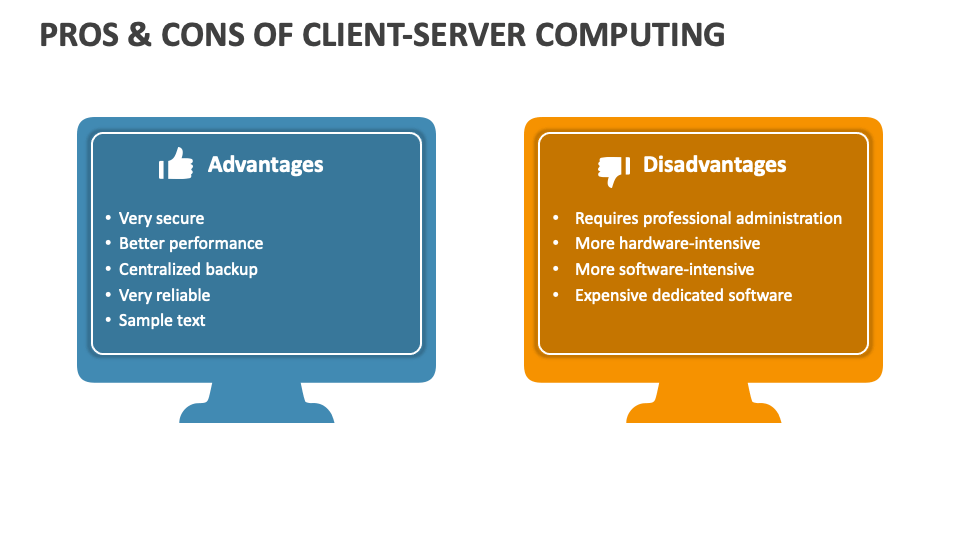

At the core of Westlake Financial’s user experience lies a robust login infrastructure designed to balance accessibility and protection. The platform employs multi-layered authentication methods — including biometric verification, one-time passwords (OTPs), and device recognition — to safeguard accounts against unauthorized access.

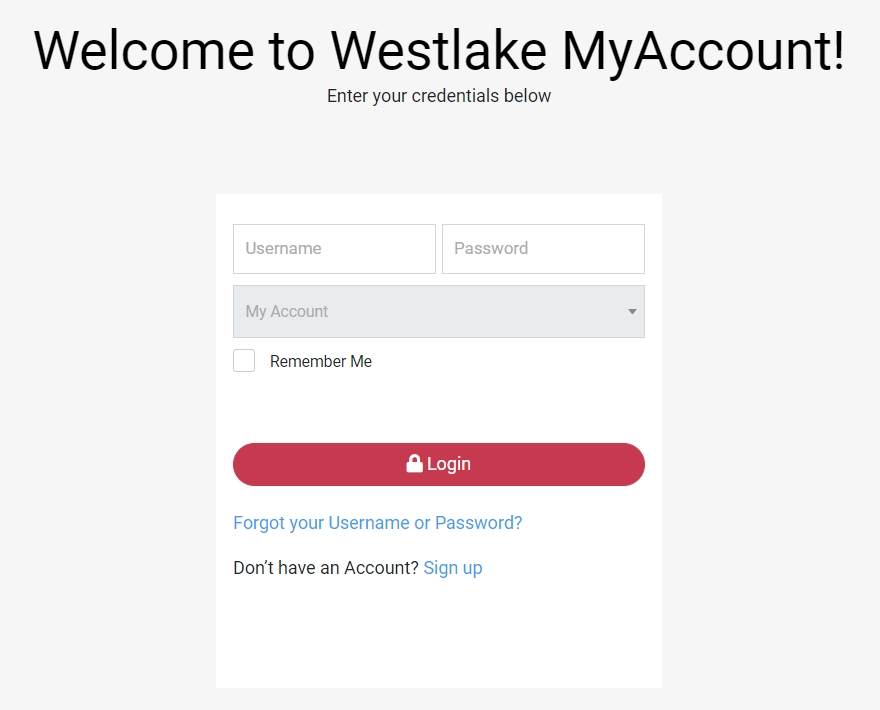

According to the Westlake Financial Login and Payment Guide, “Your security is our foundation; every login is verified through active shields to ensure only you gain entry.” This integrated approach prevents phishing attempts and credential theft, setting a benchmark in safe digital banking. Users begin their journey by accessing Westlake’s secure portal via desktop or mobile, where they input credentials through a streamlined interface. Once authenticated, users unlock dashboards that consolidate banking accounts, recent transactions, and payment history—all consolidated in one intuitive space.

The guide stresses that “ease of access without compromise” defines Westlake’s design philosophy, with login times averaging under two seconds and responsive error alerts that appear in real time.

Once logged in, navigating to the payment section follows a logical, user-centered workflow.

Payment Initiation and Verification: From Setup to Execution

users begin by selecting the desired payment type—whether transferring funds between linked accounts, paying bills, or settling with partner services.The platform requires pre-verification of beneficiary details, often supported by automated validation checks that flag inconsistencies instantly. This step — highlighted in the guide as the “critical gatekeeper” of financial accuracy — reduces errors and prevents costly mistakes.

The actual payment process unfolds through three secure stages: input, verify, and confirm. First, users enter recipient information, payment amount, and optional notes — each field subjected to real-time formatting and validation rules.

“Every detail matters,” notes a Westlake expert, “and our system ensures accuracy from the moment data is entered.” Once confirmed, users receive a digital summary grabbing attention with key data: payee name, amount, timestamp, and transaction ID. Only after this final review does the payment proceed — requiring either biometric confirmation or a dynamic OTP dispatched via SMS or authenticator app.

Westlake Financial emphasizes transparency across the entire payment lifecycle, offering real-time tracking and automated notifications that keep users in constant control. Each transaction leaves a visible digital footprint, accessible via a detailed recent activity log that supports reconciliation and fraud monitoring.

The guide notes, “We believe informed users are empowered users—every charge is accounted for, every timeline known.” This emphasis on clarity enhances trust and reduces anxiety often tied to digital transactions.

Beyond simple transfers, Westlake’s platform supports integrated payments to utilities, subscriptions, and merchant partners—all accessible through centralized, secure menus. The login system integrates with these functions, ensuring that even complex payment flows remain simple and intuitive. For enterprise clients, the guide highlights dedicated APIs and bulk payment options, allowing businesses to automate recurring transactions while maintaining full control over security protocols. Security remains paramount throughout.

The login and payment modules leverage end-to-end encryption, with data flows protected from header to foot. End-to-end encryption ensures that payment details and login credentials are unreadable to intermediaries, reinforcing confidentiality. Biometric authentication adds a layer that physical passwords cannot replicate, drastically lowering breach risks.

“Multi-factor verification is non-negotiable,” the guide states. “We store nothing but what you authorize, and every login is monitored for anomalies.”

User education is another pillar of Westlake’s approach. The Login and Payment Guide is designed not just as a reference, but as a learning tool.

Step-by-step instructions, video walkthroughs, and contextual pop-ups guide users through setup, troubleshooting, and best practices. This commitment to empowerment transforms potential stress into confidence. As one finance professional observed, “Knowing the system reduces user hesitation — they learn to trust, and trust fuels financial discipline.”

Real-world Application and Safety Net

Consider common pain points: a delayed login due to forgotten credentials, or a misdirected transfer due to typos.The Westlake system addresses these with in-app resilience. “If you second-guess a transaction,” the guide advises, “Westlake remembers: a single tap undoes error, a full screen redo reverses misdirection.” Reimbursement requests, expired cards, or failed payments trigger instant, clear alerts—not opaque errors. Instant customer support, accessible directly from the payment interface, ensures no issue drags on uncalled.

This proactive safety net turns friction into frictionless recovery.

interoperability further strengthens Westlake’s ecosystem. Financial institutions, fintech partners, and government services integrate smoothly, yet users remain fully in control of authentication and authorization.

This flexibility — designed with user sovereignty in mind — allows seamless transitions between platforms without repeated logins or redundant verification, balancing convenience with critical security. In conclusion, the Westlake Financial Login and Payment Guide emerges not only as a practical roadmap but as a comprehensive framework for secure, efficient digital finance. By merging intuitive design, rigorous authentication, and transparent data flow, Westlake enables users to manage money with confidence.

Whether accessing funds, executing payments, or reviewing transactions, the platform delivers reliability with real-time insight. For anyone entering Westlake’s digital banking world, diving into the guide isn’t just advisable — it’s essential for mastering modern finance with peace of mind.

Related Post

Su Casa Financial Anaheim: Client Reviews and What Pros and Cons to Watch For

Stay Ahead: Master Dynamic Event Tracking with PSEIIWIVBSE News’ Real-Time Updates

When Missions Align: Unveiling the Deep Meaning Behind Organizational Partnerships

Master Chem Lab Survival: How Limiting Reagents Transform Precision in Practice Problems