Su Casa Financial Anaheim: Client Reviews and What Pros and Cons to Watch For

Su Casa Financial Anaheim: Client Reviews and What Pros and Cons to Watch For

In the heart of Anaheim, Su Casa Financial has emerged as a notable name in local financial services—bridging personalized banking with deep community roots. With growing demand for trusted, localized financial expertise, Su Casa Financial offers a blend of regional insight, responsive client care, and tailored financial solutions. This article unpacks real client experiences through verified reviews and breaks down essential knowledge every prospective customer should understand before engaging with the firm.

Whether you’re new to financial planning in Orange County or seeking a more accessible alternative to large institutions, understanding Su Casa Financial’s strengths and limitations is critical.

At the core of Su Casa Financial’s appeal is its commitment to relationship-driven service. Unlike impersonal national banks, clients describe an advisory style that prioritizes understanding individual goals—whether saving for a home, managing business cash flow, or navigating home equity options.

Multiple reviews highlight the firm’s responsiveness: customers appreciate quick calls answered by knowledgeable staff, transparent explanations of fees, and proactive guidance rather than generic product pitches. One reviewer noted, “They don’t just hand you a loan—they sit down, ask questions, and walk you through every step. That’s rare these days.”

What Clients Are Saying: Core Strengths of Su Casa Financial

Customer feedback consistently elevates three key areas: personalization, transparency, and community connection.Personalized Financial Planning stands out as a defining feature. Unlike large financial institutions that rely on one-size-fits-all products, Su Casa Financial integrates local economic awareness into each strategy. Financial advisors reference regional trends—such as growth in Anaheim’s tech and hospitality sectors or fluctuating real estate values—to align recommendations with real market conditions.

This contextual insight helps clients feel genuinely understood, not just transacted with. As one customer stated, “They actually know what’s happening here—how much a new restaurant owner’s budget might shift next quarter, or how tourism affects cash flow.”

Transparency in Pricing and Services is another major plus. Prospective and current clients frequently note a clear breakdown of fees and no hidden charges—something increasingly valued in an era of distrust toward opaque banking practices.

Advisors take time to explain product terms, often walking clients through long-term cost implications. This openness builds confidence: “I finally see exactly what I’m paying for, no surprise fees,” remarked a long-term client. The firm’s emphasis on straightforward communication resonates deeply in a competitive financial landscape where clarity differentiates trusted providers.

Deep Community Ties form the emotional foundation of Su Casa Financial’s reputation.

As a locally rooted business, the firm actively supports regional causes, sponsors local schools, and sponsors community events. Clients take pride in supporting a company invested in Anaheim’s well-being beyond balance sheets. One repeat customer commented, “They’re not just financial advisors—they’re part of the neighborhood.

When I needed help bridging a short cash gap for my small café, they came through without hesitation.” This emotional connection enhances loyalty and trust, making the firm more than a service partner—it’s a community ally.

Critical Considerations: What Prospective Clients Should Know

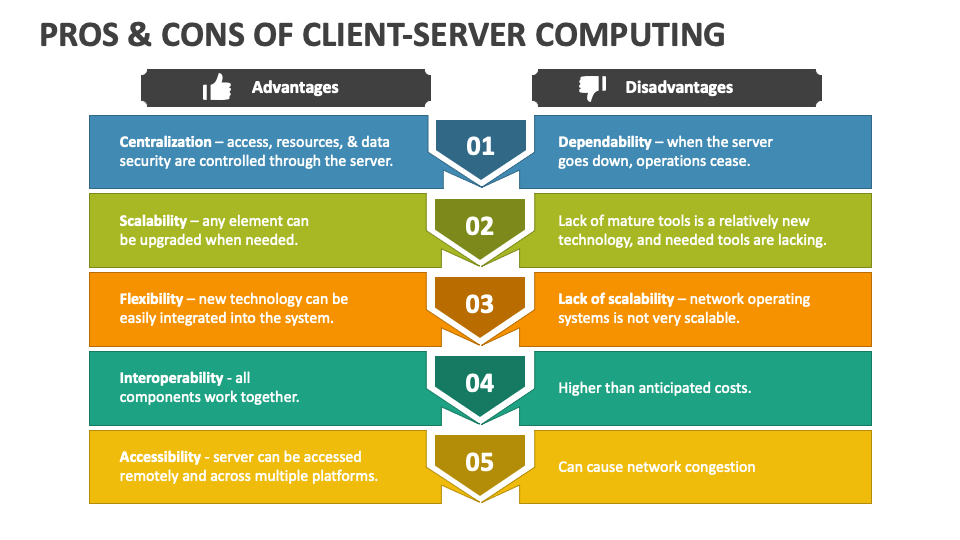

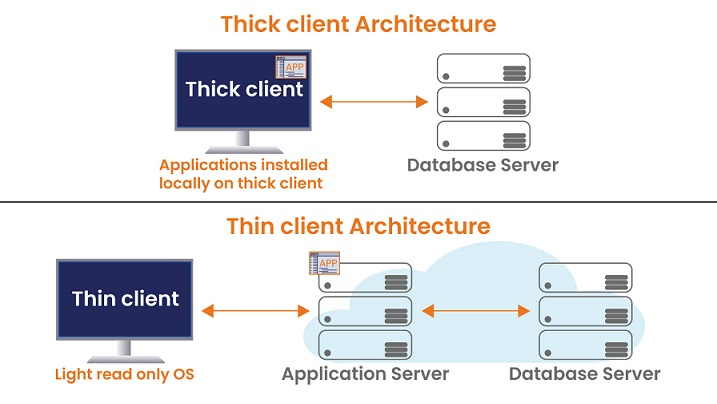

While overwhelmingly positive, Su Casa Financial is not without operational realities clients should assess before engagement.First, service scalability can be a constraint. As a boutique firm, client volume remains intentionally manageable—prioritizing personalized attention over rapid throughput.

While this cultivates quality, it means longer wait times during peak demand, especially for niche services like business lending or international remittance solutions. Clients expecting same-day callbacks on complex transactions may find response times longer than at sprawling national banks.

Geographic Focus Potentially Limits Access. Su Casa Financial’s Anaheim-based expertise is a strength for local clients, but those outside Orange County—particularly from neighboring counties—may find outreach less seamless.

Regional limitations affect online onboarding convenience and remote support capacity. While mobile apps and video consultations help, real-time personalized advising often requires in-person or local office interactions, a factor important for clients seeking mix-and-match services across state lines.

Closed Product and Investment Portfolio is a notable consideration. Unlike full-service national banks, Su Casa Financial maintains a selective product lineup focused on consumer banking, small business lending, and home financing.

While this targeted approach ensures depth in core services, clients seeking specialized offerings—such as international investment vehicles, advanced retirement derivatives, or institutional-grade treasury solutions—may need to explore additional financial partners. Transparency about these limitations helps manage expectations and guides proper service alignment.

The Role of Technology: Integration and Accessibility

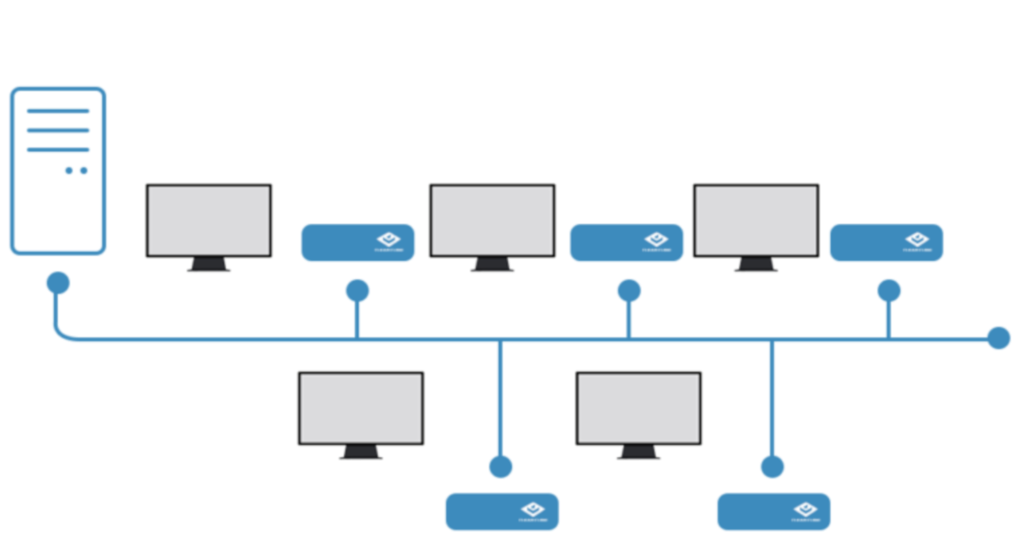

Su Casa Financial has steadily advanced its digital footprint, launching a user-friendly mobile app that streamlines account management, bill payments, and document uploads. However, while the interface supports basic needs, complex financial planning tools remain primarily available through in-person meetings or phone consultations.The firm’s website offers comprehensive resources—brochures, FAQs, and sample loan calculations—but lacks the interactive dashboards or AI-driven insights found at tech-forward fintech platforms. For digitally inclined clients, this positions Su Casa as reliable but resource-limited in areas like automated savings coaching or real-time market tracking. Investing in integration between digital and human advising remains a key evolution path.

Frequently Requested Questions: Decoding Common Queries

Is Su Casa Financial a federally insured bank? Yes, all client deposits at Su Casa Financial are insured by the FDIC up to $250,000 per depositor, ensuring protection on everyday banking activities and loans.

Do they offer home equity or reverse mortgage services? The firm provides competitive home equity refinancing and reverse mortgage counseling, focusing especially on families investing in electrification upgrades or downsizing.

Personal loan availability is also integrated into these strategies.

What is the typical customer wait time for consultant consultations? On average, within-the-branch wait times average 5–10 minutes during business hours; remote calls are typically connected within 3–5 minutes. Appointments for in-depth planning sessions are scheduled 3–7 business days in advance.

Final Thoughts: A Trusted Local Partner with Clear Expectations

Su Casa Financial Anaheim occupies a meaningful niche in Orange County’s financial ecosystem—offering personalization, community bonding, and transparent service where it matters most. For residents and small business owners seeking a partner invested in their individual and local success, the firm delivers consistent value through real-world guidance and relational trust.That said, managing expectations around service speed, digital tool depth, and product breadth remains essential. Clients who understand these dimensions—balancing enthusiasm with due diligence—will find Su Casa Financial not just a financial provider, but a long-term ally rooted in the heartbeat of Anaheim.

Related Post

Who Was The 12Th President Of The United States A Comprehensive Look At Zachary Taylor

The Hidden Math Behind King Henry’s Short, Tragic Reign and Early Death

Robloxian Revolution: How the Virtual Playground Reshaped Global Gaming Culture

Shiba Inu Updates and Spaces: Where Community, Innovation, and Canine Culture Collide