Why Your Box at UPS Now Costs More: The Hidden 2022 Surge Behind FedEx and USPS Rates

Why Your Box at UPS Now Costs More: The Hidden 2022 Surge Behind FedEx and USPS Rates

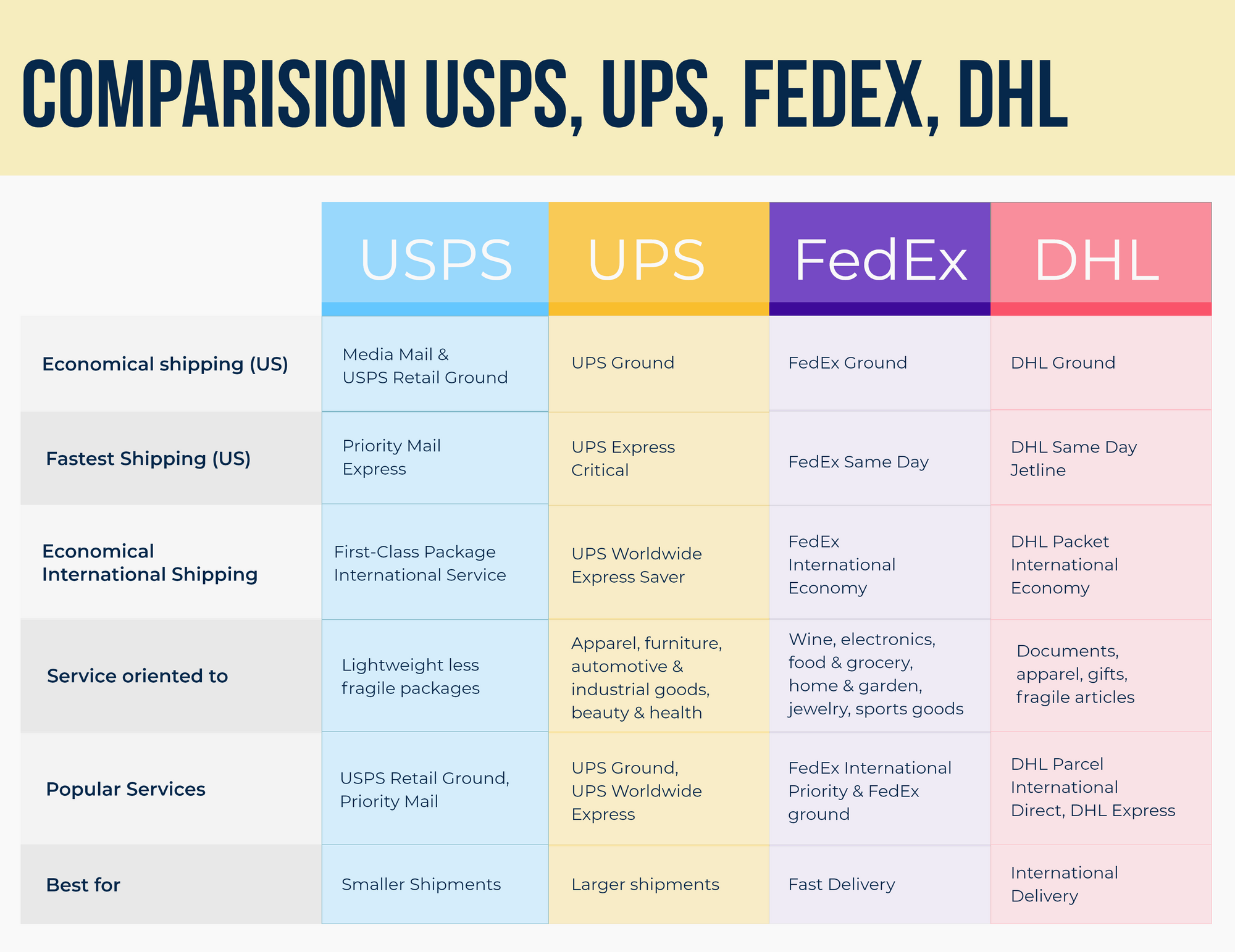

Prices for shipping a standard box through major carriers have soared across 2022 and beyond, leaving shippers puzzled by steep increases—most notably at UPS, FedEx, and USPS. What initially appeared as a simple logistics cost jump revealed deeper structural pressures tied to inflation, fuel volatility, labor shortages, and regulatory shifts. The surprising factor driving this price trajectory wasn’t just broader economic inflation but a unique constellation of supply chain bottlenecks and operational recalibrations that reshaped the shipping landscape.

Shipping Rates Soar: The 2022 Price Surge Across Carriers

Over 2022, UPS, FedEx, and USPS all implemented significant rate hikes on domestic and international boxes, with average shipping costs climbing by 30% to over 50% in some corridors. For a typical 2x2x2 box—once priced at $12–$15 in early 2021—2022 rates typically ranged from $25 to $42, depending on weight and destination. FedEx and UPS led the charge, raising standard ground and priority box prices by an average of $8 to $15 per unit.USPS, constrained by shrinking mail volumes and legacy infrastructure, followed with double-digit increases, especially for second-class and priorage boxes. But what turned these generalized spikes into a defining economic sigh for small businesses and e-commerce sellers was the asymmetry in how each carrier adjusted pricing.

The Surprising Factor: Fuel Costs, Labor, and Infrastructure Strains

While broad inflation was a known precursor, the real wildcard was the cascading impact of sharply rising fuel prices and persistent labor shortages.By mid-2022, crude oil prices had surged past $100 per barrel—up over 75% from prior levels—directly hollowing out carrier margins unless prices were adjusted. FedEx reported fuel costs alone rising by 90% year-over-year, prompting a $2.80 average increase per box on fuel surcharges. UPS responded with similar currency, while USPS faced fixed costs tied to aging delivery vehicles and outdated sorting facilities, forcing them to pass through higher maintenance and energy bills.

Yet, fuel was not the sole driver. Labor shortages crept into the equation fastest. The U.S. freight and postal sectors struggled to recruit enough drivers, sorters, and customer service personnel.

UPS cut allowances and raised wages incrementally, but attrition and retroactive scheduling delays disrupted consistent service. With fewer workers handling more consignments, carriers increased cost buffers to cover delays, overtime, and emergency staffing—losses hidden in dynamic pricing algorithms. FedEx actively monitored regional labor markets, adjusting rates for high-shortage zones with surcharges up to $7 more per box where staffing gaps obscured efficiency.

USPS, dependent on informationcompiling postal workers funded by federal appropriations, found fewer levers to offset rising costs, resulting in visible rate steps for key mail classes. These shaped a fragmented market where small-business shippersDepending on geography and service urgency encountered vastly different price jumps—not just by carrier, but by route and timing.

For the average consumer shipping a medium box across the continental U.S., the shift from $15 to $35 was not just a number—it represented a household budget adjustment.

E-commerce sellers recalibrated shipping policies, introducing minimum order thresholds to offset lost margins. Meanwhile, FedEx and UPS introduced tiered pricing models, bundling services and volume discounts to stabilize revenue amid volatility. But beneath these surface shifts lay a deeper recalibration: carriers were no longer priced primarily on distance or weight, but on risk—risk of fuel spikes, labor instability, and infrastructure decay.

The surprise wasn’t higher prices, but how systemic stress in energy and workforce markets rewrote pricing logic across the entire domestic shipping ecosystem. The ripple effects endure. In 2023, while starts to normalize, many companies still cite “post-pandemic volatility” as a constant, highlighting how that 2022 inflection point permanently altered expectations.

The box at UPS—or anywhere—now carries a legacy price not just of weight and destination, but of a year when supply chains, labor, and fuel converged in a costly, inflectionary moment. Ultimately, understanding a box’s price at UPS or USPS demands looking beyond simple weights and corridors: it requires grasping the fragile balance of energy markets, human capital, and legacy systems that now shape every shipment’s bottom line.

Related Post

Marcellus Hunter: Architect of Modern Discourse on Race, Media, and Power

Charlie Damelio’s Nude Exposure: From TikTok Star to Cultural Flashpoint

End the People’s Quest: Ewr To Lax Transforms Urban Mobility Forever

Unblocked Games G Plus Survival Race: Master the Art of Outlasting the Circle