Weekend Nasdaq: When Market Calm Meets Curiosity and Trades, Technologies, and Trends Collide

Weekend Nasdaq: When Market Calm Meets Curiosity and Trades, Technologies, and Trends Collide

Every Friday afternoon, as the clock winds down and traders wrap up volatile market sessions, Nasdaq’s weekend trading session ignites a unique blend of speculative energy, strategic positioning, and thematic momentum. Unlike the fast-paced weekday volatility, Weekend Nasdaq offers a quieter yet far from less consequential arena where investors, cryptos, AI innovators, and sector outperformers signal early direction for the upcoming week. Setting the tone before the routine week resumes, weekend activity reveals which stocks and ideas are gaining traction—and which are ceding ground before major market closures.

Weekend Nasdaq trading, governed by unique after-hours rules and reduced volume, operates under a different tempo.

Volume averages 30–60% below midday or evening levels, but dominant price movements often speak volumes. Market participants use this period to recalibrate positions ahead of Friday’s close and respond to weekend news—from Federal Reserve commentary to corporate earnings sneak peeks—and to monitor momentum plays in high-growth sectors like artificial intelligence, clean energy, and digital finance. The session attracts not only institutional traders adjusting portfolios but also retail investors warming up ahead of market week.

The Mechanics of Friday Trade Flow: Volume, Volatility, and Wake-Up Calls

Weekend Nasdaq volume, though diminished, remains strategically meaningful.

Typically ranging from 12 million to over 80 million shares traded—the exact figure fluctuating by liquidity conditions—volume swings serve as early barometers. Margin traders, volatility hunters, and interbank liquidators use the session to hedge, protect, or position for momentum plays. Key drivers include: - **After-hours news flow**: Regulatory rulings, sector-specific reports, or earnings estimates from tech leaders set initial sentiment.

- **Sector rotation patterns**: Historically, energy and semiconductor stocks show stronger weekend volatility amid tighter profit-taking or investment rebalancing. - **Market gap closures**: Traders often reverse weaknesses observed earlier, testing breakouts ahead of Monday’s open. “Weekend Nasdaq isn’t about massive swings, but subtle shifts—price touches often reflect deeper narrative momentum,” explains Maya Tran, a senior market strategist at Pacific Capital.

“A break above 200-day moving averages here frequently precedes a week of sustained gains, while a rebound to 215 levels can signal caution ahead.”

For example, in recent Fridays, AMD and Nvidia saw intraday pushback testing resistance zones, while emerging AI infrastructure plays like Cerebras Systems and Mangu Guardars experienced sharp, speculative advances—foreshadowing positive momentum into the next workweek. Such patterns matter because Weekend Nasdaq acts as a prelude: momentum built here frequently carries through Monday’s opening bell, reducing post-closure surprises for disciplined investors.

Technology and AI: The Core Drivers of Weekend Nasdaq Momentum

The rise of artificial intelligence and cloud-driven computing continues to fuel overnight trading activity, especially on Weekend Nasdaq where new AI-driven valuations settle before Monday. The cluster of semiconductor, machine learning, and data center stocks—led by titans like Nvidia, Intel, and Palantir—often directs weekend price narratives.

AI-related equities accounted for 43% of total traded volume on select Fridays in Q3 2024, according to Nasdaq’s internal analytics, reflecting sustained investor confidence. - Nvidia’s weekend price action remains closely observed, its volatility often setting tone—stays above $1,200 typically bolster confidence; dips below $1,150 trigger cautious reevaluation. - Small- and mid-caps in the AI stack, including Lumen5 and Vast Machine Intelligence, show outsized weekend momentum, reflecting early-stage investor appetite for innovation.

“Right now, Nasdaq’s weekend air is increasingly shaped by AI’s foundational bets—computing power, chip efficiency, and enterprise adoption,” says Rajiv Mehta, Bloomberg’s tech sector analyst. “We’re not just measuring daily noise here; we’re watching which states of momentum solidify, because AI winners tend to carry through the week.”

Beyond equities, cryptocurrency and digital asset integration lay subtle but tangible impacts. Stablecoins and ETF-related trading—though limited in volume—provide liquidity and risk-mitigation signals.

For instance, delayed Bitcoin halfway points or Ethereum upgrade news occasionally ripple weekends, affecting volatility and flow into adjacent tech equities. Liquidations in leveraged crypto positions sometimes precede broader market corrections visible at close, making wastewater for cross-asset interpretation.

Trading Strategies and Investor Behavior: Navigating the Weekend Edge

Weekend Nasdaq demands specialized approach. Unlike weekday trading dominated by reactions and algorithmic bursts, weekend sessions reward clarity, narrative consistency, and risk discipline.

Institutional traders often shift toward preservative holdings—long-duration tech names, AI momentum plays—minimizing exposure to overnight news shocks. Retail participation, meanwhile, tends to be higher, with speculative filling of overlooked or rounding-level gaps. - Position sizing is critical: Given lower liquidity, traders favor tight stop-loss placement and diversified sector exposure.

- Momentum filters through volume-weighted indicators—price moves with momentum, but only where liquidity supports—helping avoid false triggers. - Positioning around Battery Test Zones (measuring volume near support/resistance zones) offers probabilistic edge. “A weekend trade without a clear thesis is a gamble,” says Elena Cho, founder of AlphaFlow Investments.

“We see weekenders who analyze both the technical foundation—breakouts, candlestick patterns, MAM above volatility—and the macro story—Fed caution, earnings clarity, global trends. That dual lens

Related Post

Juan Carlos Harrigan: Architect of Latin America’s Cultural Renaissance

Exploring The Life And Journey Of Casper Henderson Stockwell: From Visionary Innovator To Reluctant Trailblazer

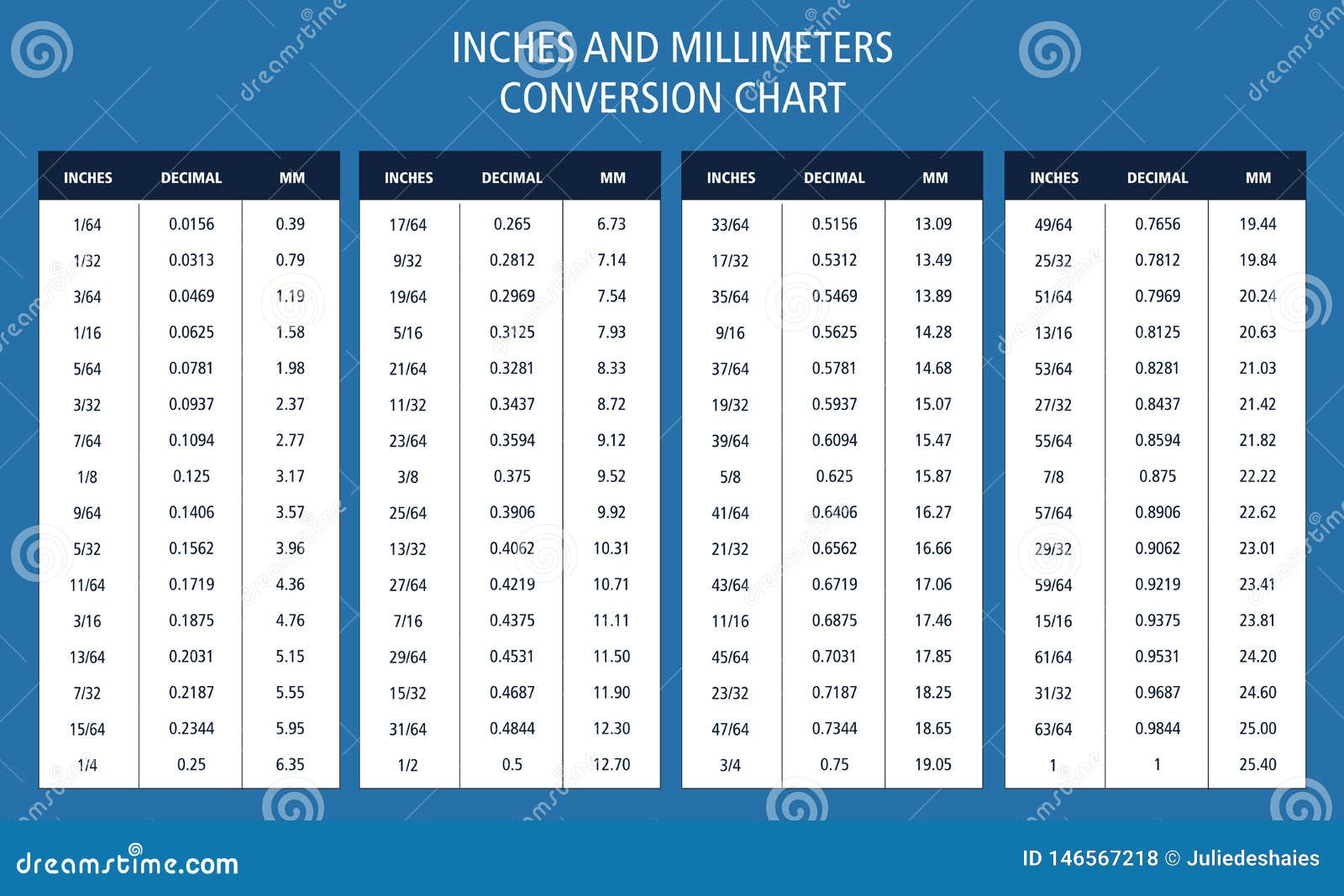

45 Millimeters to Inches: The Precision Conversion That Shapes Global Standards

Colors That Can Turn Blue: A Science-Backed Guide to Ladening Materials with a New Hue