V Pass Id: The Next Evolution in Secure Digital Identity Verification

V Pass Id: The Next Evolution in Secure Digital Identity Verification

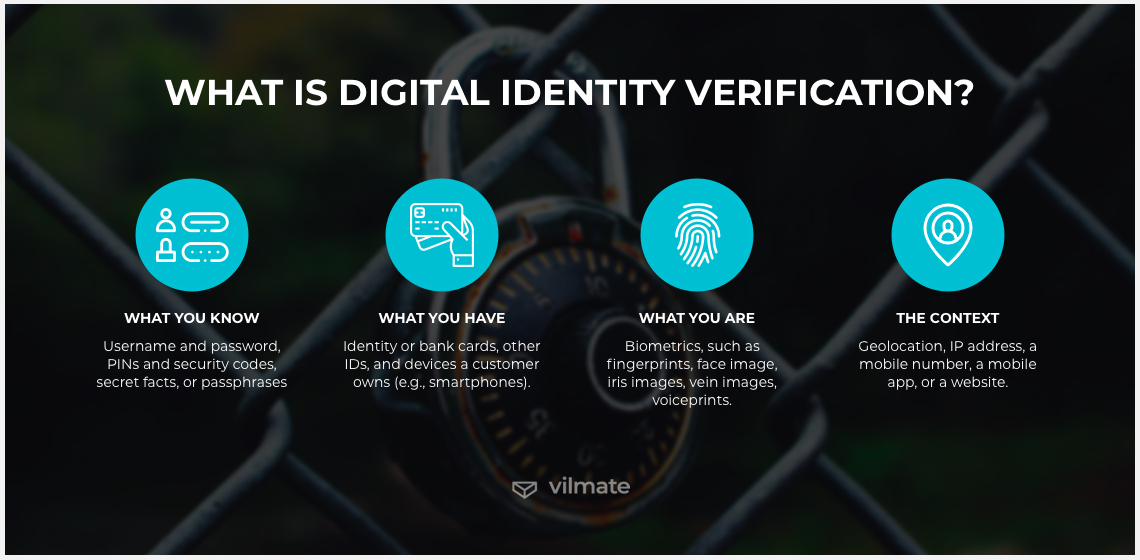

In an era defined by digital transformation, the reliability of identity verification stands as a cornerstone of financial security, regulatory compliance, and user trust. Enter V Pass Id — a cutting-edge identity verification technology rapidly reshaping how organizations authenticate individuals across banking, fintech, and government services. Unlike traditional verification methods reliant on static documents or single-factor checks, V Pass Id leverages a dynamic, multi-layered approach combining biometrics, cryptographic verification, and decentralized identity frameworks.

This evolution ensures unprecedented accuracy, fraud prevention, and seamless user experiences — marking a definitive leap forward in digital identity assurance.

The Core Mechanics: How V Pass Id Delivers Unmatched Security

At the heart of V Pass Id lies a tripartite architecture: biometric authentication, cryptographic verification, and decentralized identity management. Each component works in concert to create a verification system that is resistant to forgery, replay attacks, and unauthorized duplication. - **Biometric Authentication**: V Pass Id integrates high-fidelity biometrics such as facial recognition, voice profiling, and fingerprint analysis.

These features are not captured once but continuously authenticated in real time, ensuring the individual presenting the identity remains the genuine person. Unlike static photos or voice recordings vulnerable to spoofing, live, dynamic biometric signals provide a tamper-proof assurance layer. - **Cryptographic Verification**: Each verified identity is secured using public-key infrastructure (PKI) and digital signatures.

When a user enrolls, a unique cryptographic hash of their biometric data is generated and stored locally or in a secure vault—never raw biometrics. During authentication, a challenge-response protocol confirms identity without exposing sensitive data, encrypting all communications end-to-end. - **Decentralized Identity Frameworks**: Built on blockchain-inspired distributed ledger technology, V Pass Id stores identity credentials in user-managed digital wallets.

This eliminates centralized data hoarding, reducing breach risks and empowering users with full control over their digital footprints. Verification requests are processed with permissioned access, ensuring privacy by design. As industry expert Dr.

Elena Torres, cybersecurity lead at the Global Identity Consortium, notes: “V Pass Id represents a paradigm shift — moving from identity checks that can be stolen or faked to verifiable credentials rooted in real-time biology and cryptography.”

This tri-length defense mechanism fundamentally disrupts traditional identity theft vectors. Credential stuffing, phishing, and synthetic identity fraud lose efficacy when every verification step relies on unique, live biometrics backed by unbreakable encryption and user sovereignty.

Real-World Applications: From Banks to Blockchain Nation-States

V Pass Id’s impact is already tangible across public and private sectors. Financial institutions are deploying it to meet stringent KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements with greater precision and efficiency.

Unlike legacy systems that depend on manual document review or outdated facial templates, V Pass Id shortens onboarding to minutes, slashes fraud losses, and enhances customer trust. In government services, nations experimenting with digital national IDs are adopting V Pass Id to deliver secure, verifiable online access to social benefits, voting, and healthcare. Estonia’s e-Residency program, for example, has explored V Pass Id integration to strengthen cross-border digital identity frameworks while preserving citizen privacy.

E-commerce platforms are also embracing the technology to combat account takeover fraud. By embedding V Pass Id at checkout and login points, merchants reduce chargeback rates and protect revenue streams. A 2023 pilot by a major North American retailer reported a 67% drop in synthetic identity fraud within three months of deployment.

Education institutions and healthcare providers are not far behind. Universities use V Pass Id to authenticate prospective students and defend against identity fraud in admissions, while clinics leverage it for secure telehealth access — ensuring only authorized patients receive medical records and services. The system’s adaptability underscores its role as a versatile backbone for any identity-critical operation.

User Experience and Accessibility: Seamless Verification Without Compromise

A common misconception is that advanced security always comes at the cost of usability — but V Pass Id debunks this myth.

Through intuitive mobile and web interfaces, users complete verification via a quick facial scan or voice prompt on standard smartphones. No need for specialized hardware or lengthy forms. The technology respects accessibility by supporting multilingual prompts, adjustable luminance settings for biometrics, and fallback options for users with temporary impairments.

“V Pass Id isn’t just secure,” says Marcus Lin, Head of Digital Identity at FinTech Innovators Alliance. “It’s inclusive and fast — making secure authentication effortless even for non-technical users.”

Biometric liveness detection scans replicate real-time facial movements, heartbeat patterns, or voice inflections to thwart spoofing attempts using photos or recordings. Meanwhile, adaptive algorithms learn from each interaction, improving recognition speed and accuracy over time without increasing false rejections.

The Road Ahead: Scaling Trust in a Connectivity-Driven World

As global digital interactions expand — propelled by smart cities, IoT ecosystems, and cross-border e-commerce — the demand for robust, user-centric identity solutions is non-negotiable. V Pass Id rises to this challenge not merely as a verification tool but as a foundational layer for digital trust. Market forecasts project the global identity verification market to exceed $70 billion by 2030, with technologies like V Pass Id driving much of that growth.

Yet adoption hinges on interoperability, regulatory alignment, and consumer education — areas where industry collaboration remains pivotal. “V Pass Id isn’t a silver bullet,” acknowledges Dr. Jane Kapoor, director at the International Digital Trust Initiative.

“But as a modular, future-proof platform, it offers a scalable path to secure digital identity at scale — one that balances innovation with responsibility.”

With data privacy laws tightening worldwide and cyber threats evolving, V Pass Id stands out as a pragmatic, effective response. By combining real-time biometrics, encryption, and user ownership, it sets a new benchmark for how digital identities can be protected, verified, and trusted in the modern age — transforming skepticism into confidence, friction into fluency, and risk into resilience.

As both technology and society grow more interconnected, V Pass Id is not just shaping identity verification — it’s redefining the very foundation of digital trust.

Related Post

Burton Cummings & Cheryl: The Quiet Strength Behind a musical Legacy, Captured In Flickr’s Hidden Archive

Van Gaal’s Press Conference: Strategic Insights and Shifts That Redefined expectations

Unveiling the Truth: Savannah James’ Height, Life Journey, and Cultural Impact in Context of 2024 Oscars

Mae Capone’s Grandchildren: Guardians of a Legacy Forged in Crispus Bossy’s Shadow