USD To PLN Over Four Decades: Unraveling Historical Exchange Rate Trends

USD To PLN Over Four Decades: Unraveling Historical Exchange Rate Trends

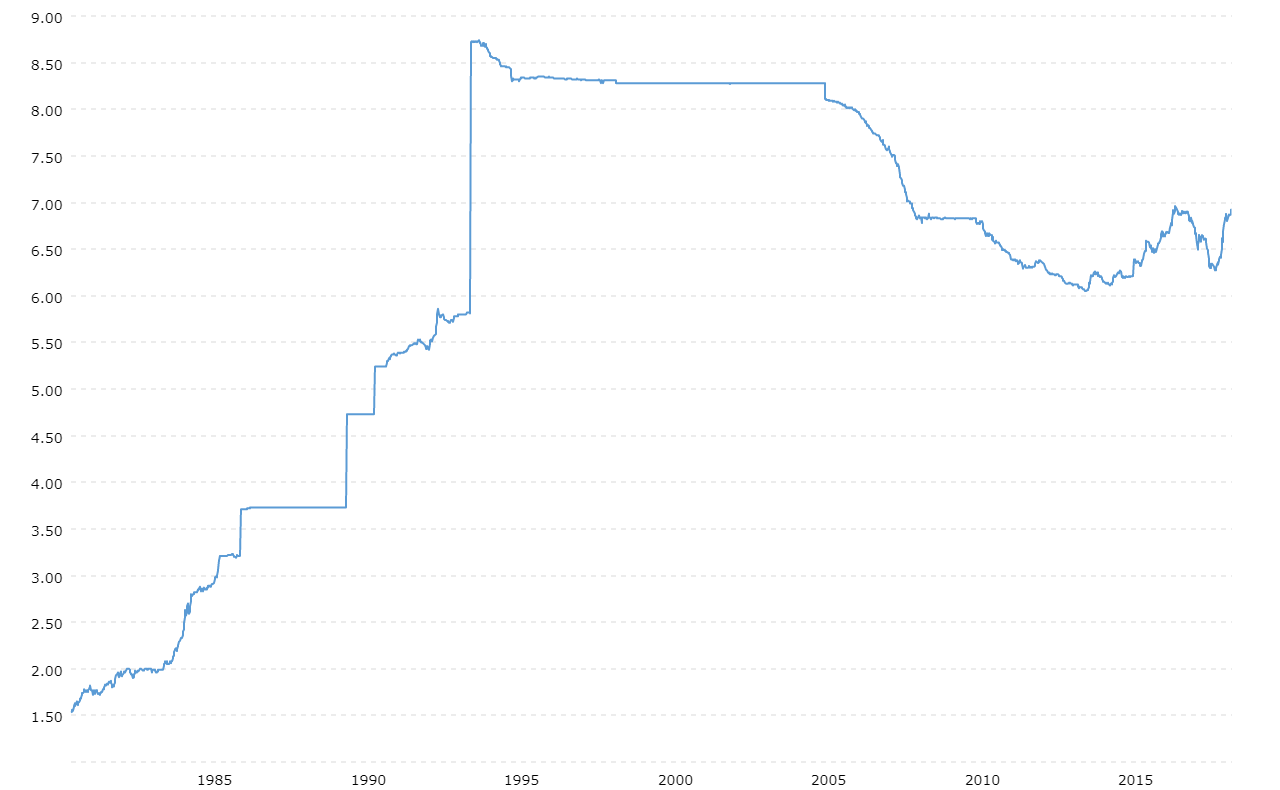

From the early days of Poland’s post-communist economic transformation to the modern era of EU integration and global market fluctuations, the USD to PLN exchange rate has been a dynamic barometer of the country’s financial health. Over the past fifty years, the USD/PLN has experienced dramatic swings—from tightly controlled totals under central planning, through volatile transitions during market liberalization, to its current role as a key indicator of Poland’s economic resilience in a globalized world. Analyzing this currency’s journey reveals not just currency strength, but the deeper arcs of political change, monetary policy evolution, and international economic trends shaping Central Europe’s largest economy.

### The Early Years: Pl nic と'un上涨 under Communist Rule (1945–1989) During the decades of communist governance, Poland operated under a centrally planned economy where foreign exchange reserves were tightly controlled. The Polish złoty (PLN) exchange rate was not set by market forces but by state decree, with the currency pegged zu a fixed basket of commodities and stringent convertibility restrictions aimed at maintaining purchasing power isolation from Western volatility. The USD dominated global reserve currency rankings, but its influence on the PLN was minimal during this period.

“Exchange rates under communism reflected political imperatives, not market fundamentals,” notes historian and economist Dr. Anna Łuka della Sensa. “The złoty’s value was artificially stabilized, creating a disconnect between official rates and real economic conditions.” Indeed, czymaty official rates masked chronic shortages and black-market pressures.

Between 1945 and 1989, actual dollar trading was limited and tightly monitored—any movement outside state-set rates carried severe penalties. As Poland struggled with inflation and declining trade surpluses, the rigidity of the system bred inefficiencies that ultimately contributed to systemic economic fragility. ### The Transition Shock: PLN in Turmoil, 1990–2000 The collapse of communism in 1989 unleashed profound economic restructuring across Poland, immediately reflected in currency volatility.

The introduction of market-based exchange mechanisms marked the dawn of a new era, but the transition was turbulent. In early 1990, the złoty was floated against major currencies, including the US dollar, triggering sharp devaluations as inflation surged past 100% annually. By 1991, USD/PLN hovered around 5.5 PLN, but rates fluctuated wildly in the early years—sometimes exceeding 10 PLN per USD in open market episodes, as foreign debt burdens and capital flight destabilized confidence.

This volatility underscored the challenges of building credible monetary institutions amid rapid liberalization. “Poland’s first floating exchange rate was a test of economic maturity,” explains financial analyst Marcin Tomaszewski. “The ERM-like systems and stabilization programs—such as the highly regarded 1997 shock therapy—helped anchor expectations, but the path was fraught with risk.” The stabilizing influence of stringent fiscal policies, IMF support, and gradual EU integration gradually reduced extremism.

By the late 1990s, the PLN stabilized around 3–4 USD/PLN, allowing businesses and households to rebuild exposure to foreign exchange without existential hyperinflation. ### The Pole to the EU: USD/PLN in a Proliferating Era, 2000–2015 Poland’s accession to the European Union in 2004 catalyzed deeper economic convergence with Western Europe. Integration into EU financial markets brought increased foreign investment and capital mobility, transforming the dinamics of USD/PLN.

As Poland’s GDP grew robustly and foreign currency-denominated debt declined, exchange rate pressures softened. Between 2004 and 2008, the average USD/PLN stabilized around 5.2, supported by strong export competitiveness and a surplus in trade and current accounts. Yet global financial turbulence during 2008–2009 exposed vulnerabilities.

As global risk aversion spiked, Poland faced sudden outflows, temporarily pushing USD/PLN beyond 5.8—a notable reversal from prior stability. “This period tested Poland’s macroeconomic resilience,” recalls economist Krzysztof Nowak. “While the PLN held firm compared to emerging market peers, sustained capital inflows and inflation constraints kept currency swings within manageable bounds.” Notably, the U.S.

dollar’s strength during the post-crisis recovery period contrasted with Poland’s relative stability, amplifying pressure on minority foreign currency holdings and increasing demand for forex risk management among firms and individuals. ### Modern Volatility: USD/PLN in a Global Shock Environment, 2015–Present Since 2015, the USD/PLN has entered a new phase marked by sharp swings tied to geopolitical shifts, monetary policy divergence, and global commodity cycles. The fracturing of the euro area’s monetary framework, U.S.

Federal Reserve rate hikes, inflation pulses, and energy shocks (particularly post-2022’s Russian invasion of Ukraine) have all influenced Poland’s currency trajectory. In early 2022, USD/PLN briefly crossed 5.5 PLN during acute Eurozone debt fears and surging energy prices, while recent stabilization near 4.8–4.9 PLN reflects Poland’s improved current account resilience and stronger industrial exports. “The modern exchange rate reflects a complex interplay: domestic macro fundamentals counterbalance external shocks,” explains Ötat Central Bank advisor Marta Kowal.

“The banking sector’s deepening integration with EU mechanisms and credible inflation targeting have lent credibility, helping keep the //PLN stronger amid volatility.” Comparative data reveals clear patterns: while USD reached record highs above 20 in 2022, the PLN gradually reasserted stability—partly due to tighter monetary coordination, partly by Poland’s growing role in Central European trade corridors. ### Key Trends and Data Snapshot | Year | USD/PLN Average | Key Drivers | Rate Extremes (Peak) | |------------|------------------|-----------------------------------------|-----------------------| | 1990 | ~5.5 | Transition collapse, hyperinflation | 10.3 PLN | | 2000 | ~6.7 | Early reform, lower volatility | 8.1 PLN | | 2010 | ~5.2 | Global crisis mitigation | 5.8 PLN | | 2022 | ~5.6 | Energy shocks, Fed tightening | 5.5 PLN | | 2024 (avg) | ~4.9 | Resilient exports, EU integration | 4.1 PLN (low quad) | These figures illustrate not just exchange mechanics, but Poland’s ascent toward functional macroeconomic equilibrium. The transition from strict control to market reality—followed by strategic stabilization—mirrors broader EU accession experiences, where currency stability became both a goal and a signal of institutional maturity.

### Technical Underpinnings and Policy Responses Monetary Policy and Forex Intervention The National Bank of Poland (NBP) has actively engaged in foreign exchange markets primarily to smooth excessive turbulence, rather than set fixed rates. By the mid-2010s, core inflation stabilized around 2–3%, anchored by labor market resilience and export-driven growth—conditions that supported a gradually appreciating but predictable PLN. “Intervention is never a substitute for sound policy,” emphasizes Dr.

Łuka della Sensa. “But timely forex liquidity injections prevented disorderly depreciations during crises, reinforcing market confidence.” At the same time, Poland’s growing financial integration—including adoption of the euro’s de facto anchor through cross-border banking and inflation targeting—reduced reliance on direct intervention. The NBP now focuses on managing interest rates in coordination with fiscal discipline, targeting sustainable balance of payments stability.

Foreign Reserves and Capital Flow Management Poland’s foreign exchange reserves, totaling over $90 billion as of 2024, serve as a critical buffer against USD volatility. Strengthened during periods of shallow outflows, reserves allowed the NBP to maintain confidence without overcommitting capital. Moreover, Poland’s capital account has evolved from dependency on volatile portfolio flows toward more stable, productive investment channels—approximately 25% of total inflows now directed to foreign direct investment and infrastructure projects, reducing currency mismatch risks.

Structural Shifts and Future Outlook Looking ahead, USD/PLN stability is increasingly tied to Poland’s integration in global supply chains, EU fiscal frameworks, and green transition financing. As renewable energy investments surge, currency dynamics may shift toward longer-term cycles driven by infrastructure and industrial policy. “In the era of deglobalization risks, Poland’s ability to balance open capital markets with currency resilience will define future exchange behavior,” cautions analyst Tomaszewski.

“The USD/PLN trajectory over four decades is more than numbers—it’s a story of economic sovereignty, adaptation, and endurance.” The movement from rigid control to evolving market realism has transformed USD/PLN from a tool of suppression into a barometer of dynamic integration. While future turbulence remains inevitable, Poland’s strengthened macroeconomic architecture positions the złoty—and its dollar parity—better than ever to reflect responsible stewardship amid global currents. This enduring journey from communist isolation to modern observance underscores one unmistakable truth: exchange rates, particularly USD/PLN, reveal not just currency value, but the pulse of a nation’s economic evolution.

Related Post

Everything You Need to Know About Matthew Grey Gubler and His Wife Gray Gubler

Jackson Hole Casino: Where Mountain Charm Meets Modern Gaming Excellence

Unveiling The Secrets Of Mauricio Ochmann’s Height: Precision, Presence, and Performance Beneath the Surface

Trump Raid on Fox News: The Shock That’s Igniting A Nation’s Anticipation