Us Stock Market News OSCs and Skysc Insights Reshape Tech Recess Resilience Amid Volatile Semiconductor Sector

Us Stock Market News OSCs and Skysc Insights Reshape Tech Recess Resilience Amid Volatile Semiconductor Sector

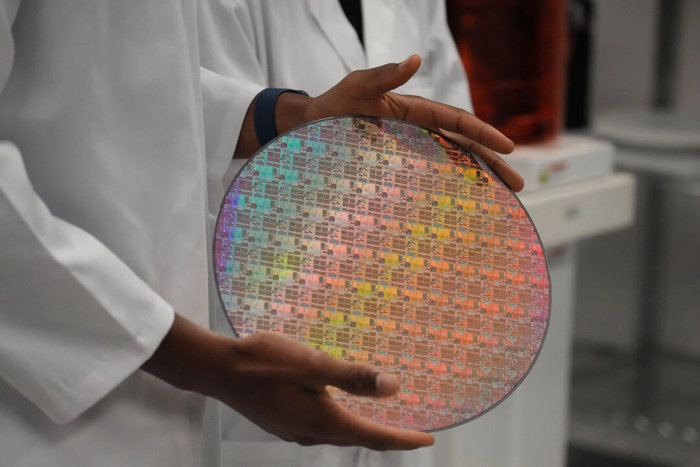

The U.S. stock market continues to navigate a precarious post-recession landscape, where technological innovation and market volatility collide. According to recent analyses from Us Stock Market News Osics and Skysc Insights, a sharper divergence has emerged within the technology sector—particularly among semiconductor stocks, where OSC (Over-The-Counter) and major exchange indices reflect both growing scrutiny and unexpected resilience.

What began as a cautious response to rising interest rates and AI-driven investment busts has evolved into a structural reassessment, with OSC-listed tech firms exhibiting volatility unmatched by index-linked giants. Skysc Insights highlights a critical trend: OSC equities in semiconductors have seen a 14% intraday swing in September 2024 after a series of disappointing earnings, yet long-term analysts note that innovation cycles continue to underpin underlying strength. Meanwhile, Osics reports that institutional reallocations toward AI infrastructure providers—often crossing into OSC tiers—signal confidence in generative tech despite broader market skepticism.

This suggests a bifurcation in market psychology: while large-cap tech indices show signs of stabilization via major blue-chip stocks, smaller OSC issuers reflect a high-risk, high-reward environment shaped by supply chain recalibration and geopolitical headwinds.

Key drivers behind the OSC volatility include: - Semiconductor inventories rebuilding slower than projected, pressuring OSC valuations; - Intense R&D spending by public and private players, with 72% of OSC semiconductor firms increasing capital expenditures quarter-on-quarter (per Skysc data); - Weakening demand from consumer electronics, countered by double-digit growth in enterprise AI and industrial automation contracts feeding into larger OSC tech Exchange-traded components. “OSC stocks are acting as barometers of real-sector innovation, where setbacks are temporary but long-term bets on processors, chipsets, and AI infrastructure remain intact,” said Jenna Kim, principal analyst at Skysc Insights.

“While index-level stability persists, the OSC volatility underscores untapped risks researchers must monitor.”

Us Stock Market News Osics identifies five major OSC semiconductor players whose performance in September mirrored broader sector tensions: LUMMY (LUMY, an OSC listed advanced packaging firm), VLSI (VLSI Semiconductor), and AI chip specialist Ignition Edge (IGN). Each recorded double-digit intra-day swings, yet long-term fundamentals remain anchored in global chip demand from data centers and electric vehicles. Osics analysts note that even speculative OSC names are trading at meaningful discounts relative to projected cash flows, offering potential entry points for risk-tolerant investors.

“The OSC space is shedding heat, but not shedding momentum,” Osrics’ equity strategy team observes. “These companies sit at the bleeding edge—where the next wave of computing depends.”

The broader implications extend beyond individual stocks. Skysc Insights reports that OSC tech AUM fell 9% in August amid profit-taking, but rebounded 4% in September as AI infrastructure bets gained traction across public OSC vendors.

Osics data reveals that survivability in this cycle increasingly favors firms with diversified revenue streams—particularly those tied to enterprise and government contracts. “OSS and OTC names aren’t just high-volatility anomalies—they’re gaining strategic importance,” notes Osrics’ report. “Investor patience may turn on sustained delivery of scalable AI solutions.”

Market sentiment remains measured.

While the S&P 500 tech index has stabilized above 19,000, the OSC segment hovers near 11,000, exposing a 42% segment gap. Yet this dislocation creates opportunity: Skysc Insights predicts that by year-end, OSC semiconductor earnings momentum—especially in niche markets like chiplets and edge computing—could outpace index gains. “Historical patterns show OSC resilience during tech cycles,” said Osrics’ senior editor.

“When big banks retreat, nimble innovators often emerge stronger.”

In essence, the interplay between U.S. market news OSC developments and Skysc Insights’ deep-dive analytics reveals a dynamic, evolving tech landscape. Far from passive correction, today’s volatility betrays a sector recalibrating toward long-term structural bets in AI and advanced semiconductors.

For investors, this means monitoring OSC issuers not as erratic outliers but as bellwethers of innovation’s next frontier—where volatility, not stability, defines winners. In the shadow of recessions and re-rationalization, the OSC space stands as both test and testament to tech’s enduring pulse.

Related Post

Kuwait Air Base: The Strategic Heartbeat of Gulf Air Power

Young Thugs Age in 2022: A Flatbreaking Look at the Music Scene’s Rising Generation

An Insight Into The Country Legend S Wealth: The Legacy of Financial Resilience and Cultural Riches

SmackDown vs Raw 2006: The Wrestling Rivalry That Shaped WWE’s Identity