Unveiling the Won: How South Korea’s Currency Powers a Modern Economic Powerhouse

Unveiling the Won: How South Korea’s Currency Powers a Modern Economic Powerhouse

When the faint clink of a South Korean won echoes through bustling Seoul’s markets, it carries the weight of a nation’s economic evolution. The Korean won, symbolized by ₩ and rooted in a rich monetary history, is far more than a medium of exchange—it is a lens into South Korea’s transformation from post-war recovery to global technological leadership. As the world’s 11th most traded currency, the won reflects decades of resilience, policy innovation, and cultural identity—all encapsulated in a single, dynamic financial instrument.

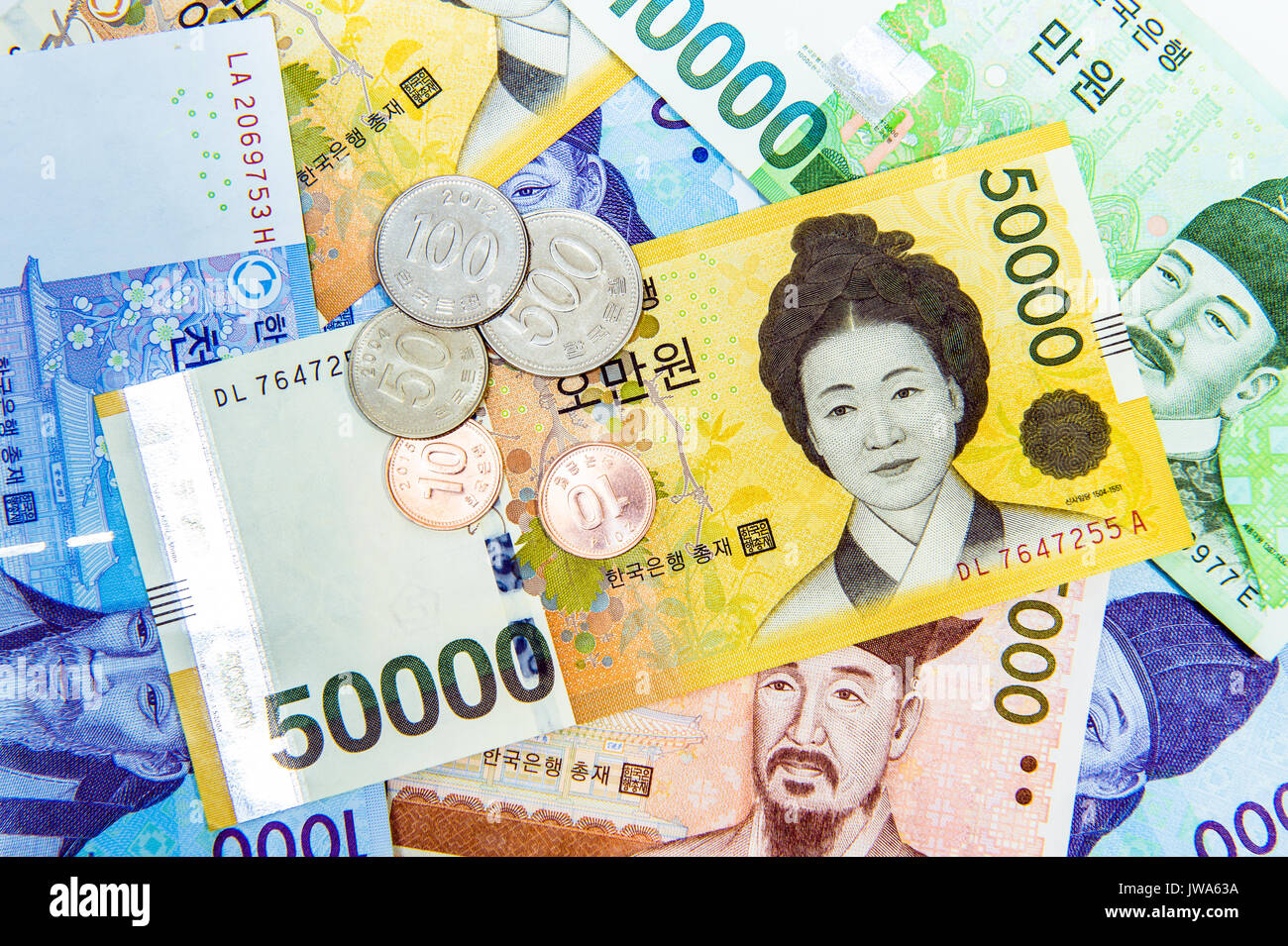

At its core, the won is the official legal tender of South Korea, issued and managed by the Bank of Korea (BOK), the nation’s central banking authority. Introduced in 1945, shortly after Japan’s surrender at the end of World War II, the won replaced the former Japanese krewa during a pivotal moment of national sovereignty. Since then, its design has evolved dramatically—from basic paper notes featuring iconic landmarks like the royal palace to modern banknotes adorned with characters from Korean classical literature and cutting-edge anti-counterfeiting technology.

Today’s ₩—featuring 11,000 won coins and ₩1,000, ₩5,000, ₩10,000, ₩50,000, and ₩100,000 banknotes—embodies both tradition and innovation, blending traditional Korean motifs with digital security standards such as holographic strips and color-shifting ink.

The value and stability of the South Korean won are shaped by a combination of domestic policy and global market forces. The BOK employs an managed free float system, maintaining monetary discipline to control inflation—currently targeted around 2.0%—while navigating challenges like trade dependencies and foreign exchange volatility.

As a highly export-driven economy, South Korea’s currency is deeply tied to global demand, especially for semiconductors, automobiles, and consumer electronics. The won’s strength directly impacts corporate profitability; a stronger won benefits importers but pressures exporters, illustrating the delicate balance policymakers must sustain. During economic turbulence—such as the 1997 Asian Financial Crisis or the 2020 pandemic—currency fluctuations tested investor confidence, but strategic interventions and structural reforms have consistently restored stability, underscoring the BOK’s role as guardian of financial resilience.

Beyond macroeconomics, the won shapes everyday life in profound ways. Everyday transactions—from street food purchases to public transit—occur seamlessly through a mobile-first payment ecosystem increasingly shaped by the won’s digital integration. The rise of smartphones and fintech platforms has accelerated contactless payments, QR code transfers, and wearable devices, all standard denominators of South Korean commerce.

Banks like KB Kookmin and Shinhan continue to innovate, launching apps that link real-time won conversions, cross-border transactions, and even international merchant partnerships. This seamless fusion of cash heritage and digital convenience reflects a nation where tradition meets future-ready finance.

Internationally, the won’s footprint extends well beyond Korea’s borders.

While not yet a reserve currency, its role in global markets has grown steadily, ranked among the top 20 by the IMF. Trade agreements with over 56 countries—including the U.S., China, and ASEAN partners—have increased demand, particularly as multinational firms invoice in local currency to reduce transaction costs. The mit Zusammenhang with South Korea’s large manufacturing base and rising soft power, including Hallyu (Korean Wave) exports, enhances the won’s desirability.

Central banks and investors view it as a stable emerging-market currency with growing institutional credibility, offering diversification in global portfolios.

Design Meets Identity: The Symbolism on the Won

Each South Korean won note tells a story. The current ₩1,000 bill features Poem and Prayer Hall, a nod to Korea’s literary and spiritual heritage, with verses from classical poet Jeong Jeon and submitted works celebrating peace and unity.The 5,000 won note honors world-renowned author Parkかない、 whose novels explore human resilience, while the 10,000 won bill showcases Lee Am, a master of 15th-century Joseon ink painting, reflecting Korea’s artistic roots. Currency design, overseen by the Culture, Sport and Tourism Ministry in collaboration with the BOK, intentionally weaves narrative and identity into tangible form—transforming paper and metal into symbols of national pride and continuity.

Technological adaptation defines the modern won.

Contactless payments via T-Money cards and mobile wallets now dominate urban mobility, while real-time exchange tools on banking apps enable seamless cross-border currency conversion. During major events like the 1988 Seoul Olympics or the 2018 Winter Games, the won gained international visibility, reinforcing South Korea’s emergence on the world stage. Today, QR code payments and e-wallets extend this momentum, signaling a future where the won flows as effortlessly as data across platforms and generations.

The dynamic nature of South Korea’s currency mirrors its broader economic and cultural evolution. From post-war reconstruction to becoming a high-tech leader, the won has adapted to shifting realities without losing its symbolic heart. As digital finance accelerates and global trade evolves, the won is poised to grow in relevance—anchored by South Korea’s innovation, institutional strength, and enduring legacy.

In every transaction, design, and market move, the won stands not just as money, but as a testament to a nation’s resilience and vision.

Related Post

Jovenesenaccion.Inclusion: Redefining Equity Through Active Civic Engagement

My Meaning Dissected: What ‘Meaning’ Reveals About Human Purpose, Culture, and Connection

Impresiones Santa Ana: Unfolding the Soul of Costa Rica in Costa Rica’s Heart

Find That Tune With a Hiss: How Humming Unlocks Hidden Songs