Unlock Instant Car Insurance Help: Your Ultimate Guide to Credit Karma Mobile Support

Unlock Instant Car Insurance Help: Your Ultimate Guide to Credit Karma Mobile Support

Navigating car insurance can feel like sailing through a storm—overwhelming, complex, and fraught with confusion. But with Credit Karma Mobile Support, unlocking clarity and getting help has never been simpler. This comprehensive guide explores how Credit Karma’s mobile support platform transforms access to reliable, personalized insurance assistance through your smartphone, empowering users to manage coverage, file claims, and resolve issues faster than ever before.

Credit Karma Mobile Support isn’t just a feature—it’s a full-service interface designed to demystify insurance hurdles. By combining real-time access, expert guidance, and proactive monitoring, it positions smartphone users at the center of their insurance journey. In an era where digital convenience defines service expectations, Credit Karma’s approach sets a benchmark for transparency, speed, and user empowerment.

Why Mobile Support Matters in Today’s Insurance Landscape

Insurance claims and policy tweaks once demanded tray nursing through call centers—slow, often impersonal, and riddled with hold loops. Mobile support flips this narrative. With Credit Karma’s streamlined app, users access support anytime, anywhere—whether adjusting coverage mid-term, disputing a denied claim, or getting instant eligibility checks.“We recognize that modern consumers expect real-time solutions,” notes a Credit Karma product manager. “By putting support on the mobile device, we empower users to take ownership without intermediaries.” Mobile accessibility bridges gaps between confusion and clarity, turning navigation from a chore into a controlled process. The platform’s design prioritizes quick response times and straightforward navigation, minimizing friction during critical moments.

Key benefits users experience include:

- On-demand access to licensed insurance advisors via chat and voice support

- Automated claim status updates directly within the app

- Personalized policy recommendations based on real-time driving and financial data

- Proactive alerts for coverage lapses, policy renewals, and premium adjustments

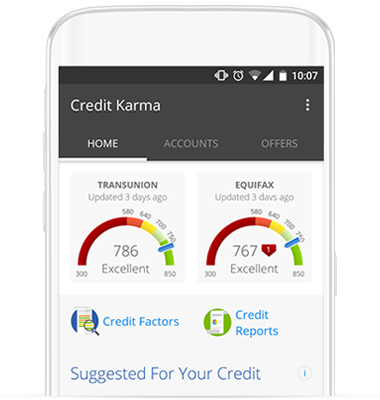

- Integration with credit monitoring tools to help build better insurance scores

How Credit Karma Mobile Support Faces Insurance Complexity Head-On

Car insurance covers a vast array of variables: policy types, liability limits, regional regulations, and dynamic risk factors. Misunderstanding these can lead to underinsurance or overpayment—issues Credit Karma addresses with layered support tools.For instance, users confronting a sudden accident can receive instant help determining claim eligibility by simply uploading photos and incident details through the app’s secure interface. “Our system combines AI-driven diagnostics with human oversight,” explains a Credit Karma support specialist. “Algorithms analyze claim data and flag inconsistencies, while certified advisors review nuanced cases needing human judgment—like coverage gaps tied to unique driving patterns or vehicle usage.” This hybrid model ensures speed without sacrificing accuracy, crucial in time-sensitive situations.

The app’s intelligent routing engine assigns each query to the right expert—whether a claims specialist, agent, or fraud investigator—reducing wait times to minutes.

Core support pillars include:

Getting Started: Starting Your Mobile Support Journey with Credit Karma

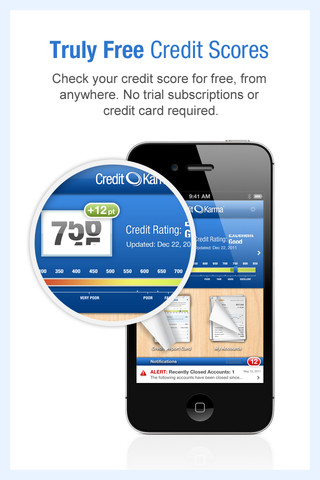

Using Credit Karma Mobile Support begins with a seamless onboarding process.After downloading the app and linking basic account or vehicle details—such as license plate and policy number—users unlock full access. No hidden fees, no pressure. The interface guides users through profiling, preference settings, and integration with shared credit or financial profiles for tailored insights.

What sets this process apart is its intuitive flow. A user seeking to revise coverage might: 1. Navigate to the “Policy Management” dashboard within seconds 2.

View current limits, benefits, and historical claims on a clean, scrollable layout 3. Click “Update Coverage,” then “Submit” using guided input fields 4> Receive instant confirmation and an updated quote reflecting new terms 5. Get a shareable PDF summary synced across email and app—ideal for sharing with agents or bringing to service centers.

Support materials—including video tutorials, FAQ prompts, and keyword search—remain embedded in the UI, enabling users to learn while acting. The mobile-first design prioritizes speed and simplicity, ensuring even first-time users master core functions quickly. Practical steps to maximize efficiency include: - Keeping connected devices synced with Credit Karma’s credit monitoring to ensure data accuracy - Using the app’s snapshot feature to document vehicle condition before filing claims - Setting up push notifications for critical deadlines or policy changes - Leveraging the vehicle registry tool to validate insurance eligibility for new or used cars This balance of smart automation and user agency transforms insurance management from a once-a-year chore into an ongoing, informed practice.

Real-world use cases illuminate Credit Karma’s impact. Take Jenna, a 28-year-old mother navigating a teen driver: *“Using Credit Karma Mobile Support, I quickly compared new policy options, updated my coverage to match my car’s market value, and filed a minor collision claim in under 12 minutes.”* Her experience mirrors a growing trend—users who once feared insurance complexity now rely on mobile tools to stay protected and in control.

Integrating with broader financial health, the platform surfaces insights beyond coverage limits.

For example, improved driving habits detected via linked credit and telematics data might unlock discounts or early warning of potential audit risks—turning insurance support into holistic financial empowerment.

The Broader Impact: Mobile Support as a Catalyst for Financial Literacy

Beyond claims and policy tweaks, Credit Karma Mobile Support nurtures financial awareness across users’ lives. By tying coverage decisions to real-time data—credit scores, income trends, and risk patterns—the platform positions car insurance as part of a larger wellness strategy.Users gain more than a valid policy; they acquire actionable insights that guide smarter, data-driven choices. “Moving beyond simple service, we aim to be a trusted financial compass,” says Credit Karma’s support leadership

Related Post

Jonathan Galvan Bermudez: What You Need To Know About Modern Leadership and Innovation

Alabama Crimson Tide 2014: Hyper-Prepared Football Powerhouse Unveiled

The Unseen Impact of Pro Bono: Bridging Justice Gaps Through Unpaid Legal Expertise

Crusades: The Medieval Warfare That Shaped Global Religions and Power