Trf Money: Redefining Access to Financial Power in the Digital Era

Trf Money: Redefining Access to Financial Power in the Digital Era

In a rapidly evolving financial landscape, Trf Money has emerged as a transformative force, democratizing access to flexible, user-centric financial tools. By integrating cutting-edge technology with inclusive design, Trf Money empowers individuals and small businesses with financial solutions once reserved for large institutions—easy, transparent, and immediate. From dynamic payment processing to real-time money management, Trf Money isn’t just another fintech platform; it’s a catalyst for economic empowerment.

p≤ Trf Money’s core innovation lies in its seamless fusion of speed, accessibility, and control. Unlike traditional banking systems constrained by rigid procedures, Trf Money enables users to send, receive, and manage funds with unprecedented agility. Whether launching a side income, receiving payments globally, or budgeting in real time, the platform responds instantly to user needs.

"This isn’t just digital banking—it’s financial autonomy," says Daniel Voss, Trf Money’s Director of Product Innovation, emphasizing how the platform removes barriers historically faced by underserved markets. Alongside rapid transactions, Trf Money emphasizes financial transparency. Every movement is logged with precision, allowing users to track income and expenses with clarity that builds confidence and fosters smarter decisions.

This level of visibility combats widespread distrust in financial systems, especially among younger users and gig economy participants.

Central to Trf Money’s appeal is its modular financial toolkit, designed for both simplicity and sophistication. Key features include: • Instant cross-border payments: Transfer money internationally with minimal fees and seconds instead of days.

• Flexible payment plans: Set up installment payments for larger purchases or services without lengthy approvals. • Real-time balance tracking: Watch funds flow in real time through an intuitive dashboard. • Automated reconciliation: Reconcile transactions automatically, reducing administrative overhead.

• Multi-currency support: Operate seamlessly across global markets without hidden currency charges. These tools collectively address common pain points in personal and small-business finance—complexity, delays, and lack of control—turning everyday money management into a streamlined, confident experience.

One of Trf Money’s most impactful offerings is its tailored approach to financial inclusion.

By integrating subscription models and flexible repayment terms, the platform reaches populations often excluded from traditional credit and banking: freelancers, remote workers,micro-entrepreneurs, and users in emerging economies. As Maria Chen, a small business owner using Trf Money to expand her online market presence, explains: “Before Trf Money, managing international payments was chaotic and slow. Now I receive funds instantly, pay suppliers on my own schedule, and keep a clear eye on revenue—this has reversed my growth trajectory.” Trf Money’s user-first philosophy extends to its interface: intuitive design minimizes learning curves, while AI-driven insights guide users toward smarter spending, saving, and investment decisions.

From automated savings buckets to alert systems for overspending, the platform adapts to individual habits, not the other way around.

Security remains a foundational pillar of Trf Money’s technology stack. Leveraging end-to-end encryption, biometric authentication, and real-time fraud detection, Trf Money protects user data with enterprise-grade safeguards.

Regular third-party audits validate system integrity, reinforcing user trust in an era where financial data breaches threaten confidence. This commitment to safety enables users to engage with confidence, even in high-volume transaction environments. “The strength of Trf Money isn’t just in its features—it’s in its trustworthiness,” notes cybersecurity analyst Raj Patel.

“When users know their assets are secure, they participate more fully in the digital economy.” This secure foundation, combined with responsive support teams available around the clock, transforms occasional users into loyal advocates who rely on Trf Money as both a financial partner and a digital ally.

Looking ahead, Trf Money continues to expand its ecosystem. Strategic partnerships with global payment networks, e-commerce platforms, and financial education providers are extending its reach.

Planned integrations include embedded finance solutions for non-financial apps, enabling seamless monetization for businesses without building fintech infrastructure from scratch. These advancements signal a broader shift: Trf Money is not just a payment tool but a financial infrastructure layering trust, flexibility, and accessibility into everyday commerce. As digital transactions grow in volume and complexity, platforms like Trf Money bridge the gap between consumer needs and institutional capability—making financial empowerment not just an ideal, but a practical reality.

In a world where speed, security, and inclusion define financial success, Trf Money stands at the forefront, proving that the future of finance belongs to those who demands more—not less—from their financial tools.

Related Post

The Sun Sus dominates the Sky, Fueling Climate and Energy Forecasts — Joe Bastardi’s Solar Report

America vs Portland: How to Watch Live Events in the Digital Battlefield

Platinum Under the Cosmic Crown: How Queen Princesses Stole the Spotlight Live at Princess of the Universe

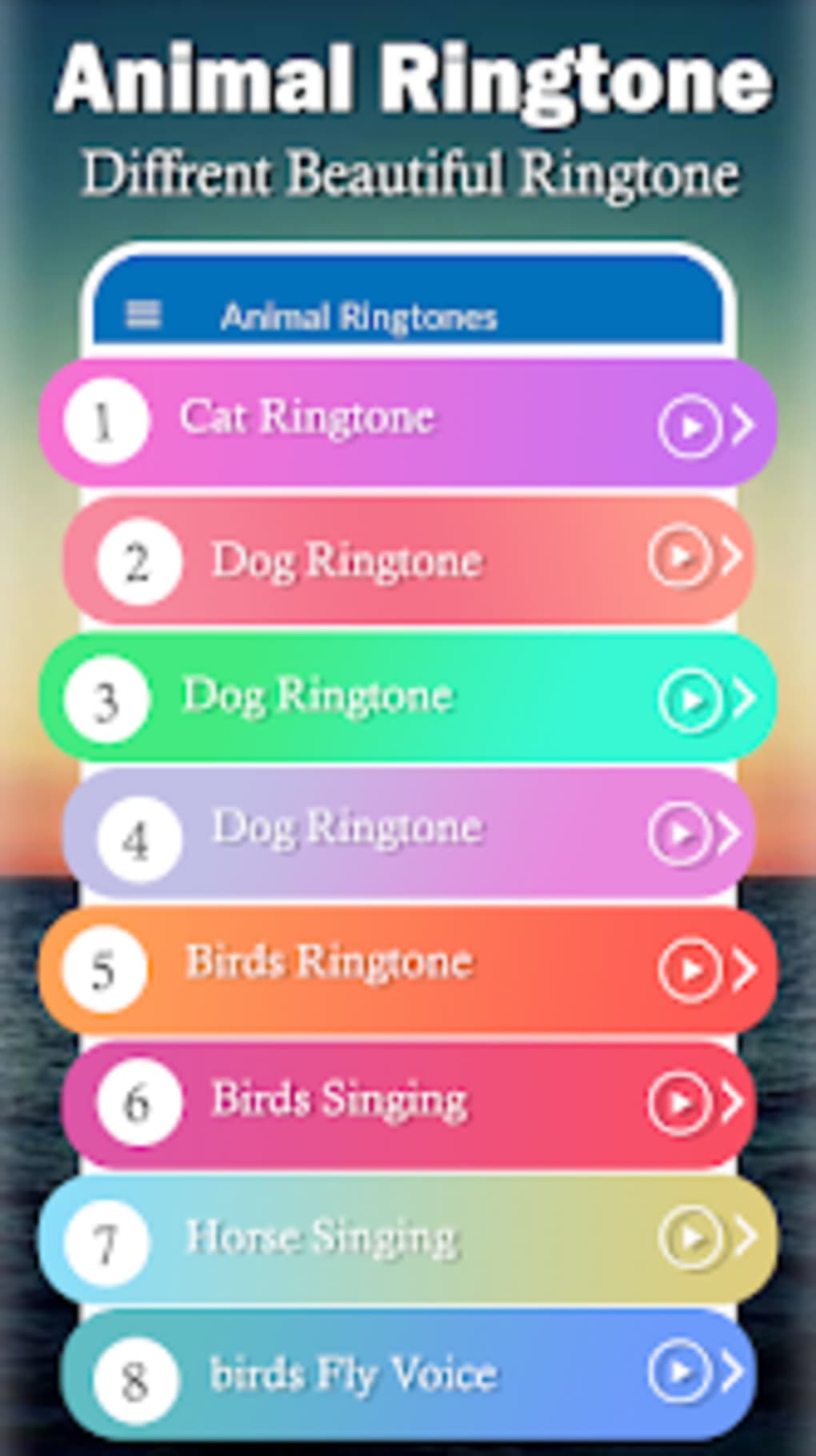

Roar Ringtone: Download The Best Animal Sounds to Transform Your Phone into a Wildlife Soundstation