Tracking Your Money Transfer Easy Steps And Tips

In a world where cross-border payments and digital transfers shape daily life—from sending money to friends abroad to receiving payments from overseas clients—tracking your money transfer is no longer a luxury, but a necessity. Whether you’re using fintech apps, bank services, or remittance platforms, understanding how to monitor transfers in real time ensures security, accountability, and peace of mind. With simple steps and practical tips, anyone can transform the act of transferring funds from mysterious and stressful into transparent and controlled.

Why Tracking Your Money Transfer Matters

Every financial transaction carries inherent risks—timing delays, misrouted payments, or hidden fees that erode value.Tracking your money transfer demystifies the process, turning uncertainty into clarity. It allows you to verify that funds arrive on schedule, confirm recipient receipt, and identify irregularities instantly. As the International REMIT Association notes, “Timely, accurate transfers are the backbone of global financial inclusion—but tracking ensures reliability.” This precision fosters trust in digital systems, particularly as cross-border transfers increasingly bridge economic divides worldwide.

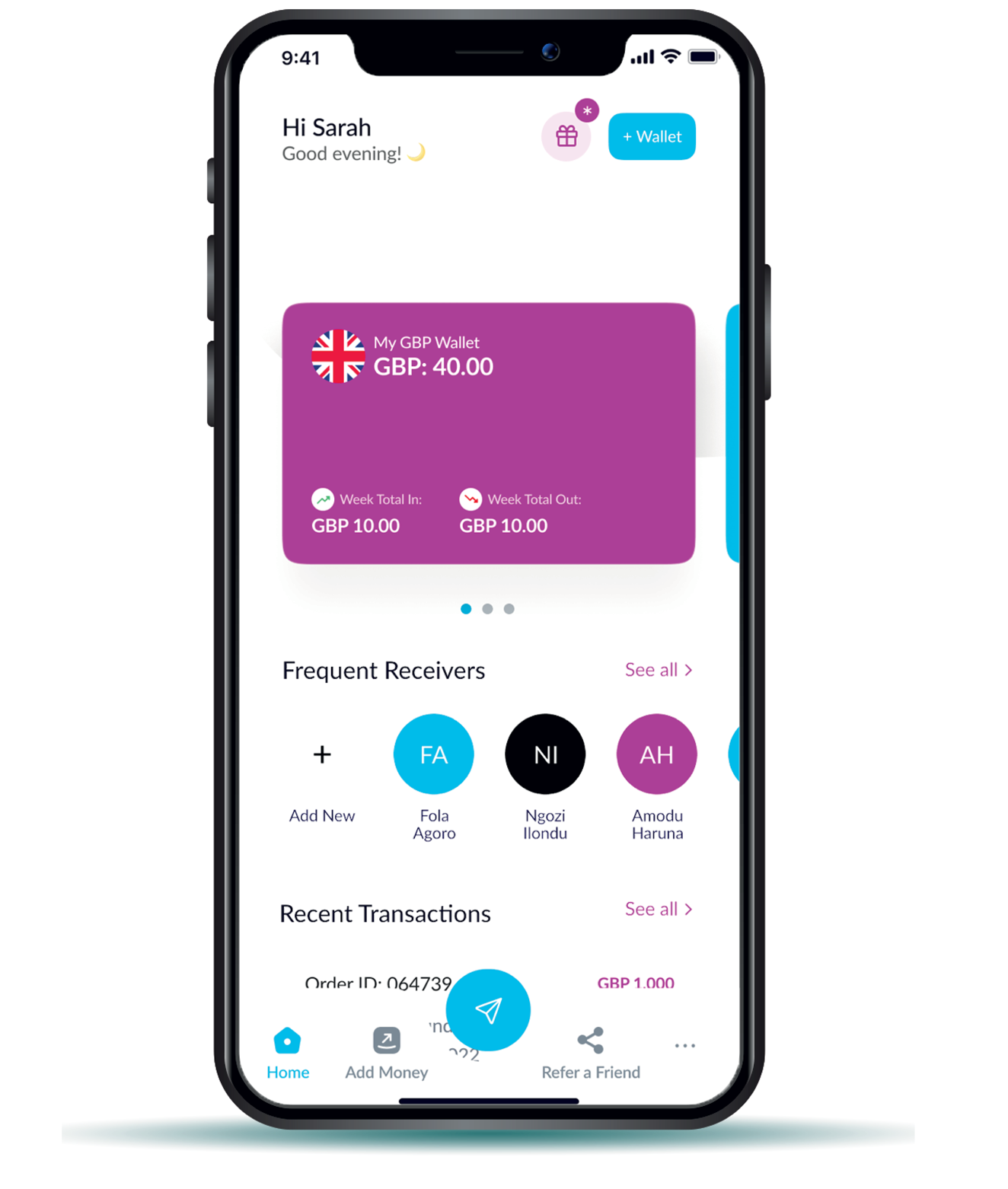

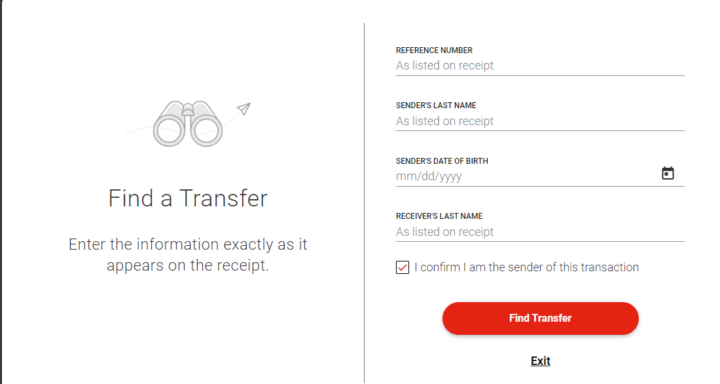

Step 1: Choose the Right Transfer Platform with Built-In Tracking

Not all money transfer services deliver the same visibility.To begin, select platforms that integrate tracking natively—ideally apps or websites with real-time status updates, unique tracking IDs, and secure login access. Popular services like Wise, PayPal, and Western Union now offer seamless dashboard monitoring, pushing notifications at key milestones: when the transfer initiates, is processed, and successfully delivered.“The best platforms don’t just move money—they keep you in the loop,” explains financial services analyst Mira Chen. “A dedicated tracking portal with clear milestones eliminates ambiguity and empowers users to act quickly if delays occur.”

- Compare provider reporting features: Does the service include email/SMS alerts and a centralized dashboard?

- Verify if tracking IDs are unique per transaction for accurate status checks.

- Ensure the platform offers 24/7 access regardless of time zone or device type.

Step 2: Activate and Monitor Real-Time Status Updates

Modern money transfer systems rely on instant status updates that shift tracking from passive to active.As soon as you initiate a transfer, register to receive notifications—whether via push alerts, email, or SMS—and monitor progress through the provider’s tracking interface. Timing variances often occur due to intermediary banks or currency conversion zones; tracking helps identify whether delays stem from system checkpoints or external processing lags. “Real-time visibility isn’t about speed alone—it’s about predictability,” says tech finance guide Daniel Rao.

“Users who monitor status hourly are 60% faster at resolving issues compared to passive trackers.”

Step 3: Leverage Tracking Tools Beyond the Basics

Beyond live updates, advanced tracking features add layers of control and insight. Turn on geolocation alerts—when a transaction crosses a key hub, informing you of potential delays or handling by trusted partners. Enable status thresholds: set alerts for processing, outgoing confirmation, and final delivery to stay ahead of billing cycles.Platforms like Wise and Remitly also provide transaction histories with embedded forex rates and fees, giving a full financial picture. “These tools turn data into decision-making,” notes cybersecurity expert Aisha Patel. “You’re no longer guessing—you’re informed.”

Many services grant users access to historical tracking data, allowing hindsight on past transactions to verify consistency and performance over time.

This archival function helps detect fraud patterns or unreliable rhythms in service reliability. For businesses handling payroll or recurring payments, scheduled reports automate progress review, minimizing administrative overhead.

Step 4: Understand Common Delays and How Tracking Helps Mitigate Risks

Even with tracking, payments may stall—but transparency empowers faster responses. Confirmed first delays often stem from initial submission errors, currency conversion wait times, or charging bank hold-ups.Real-time tracking flags these hold-ups immediately, giving users critical time to contact support, verify recipient info, or adjust transfer parameters. “Delays happen—but tracking transforms them from crises into manageable exceptions,” explains Maria Lopez, a remittance compliance consultant. “Delayed delivery now means you know exactly when and why it’s stuck, enabling proactive resolution.”

Step 5: Verify Receipt and Confirm Delivery Safely

Upon arrival, never assume success.Track all confirmation points: does the service show “delivered,” “credited,” or “pending

Related Post

Snake River in Wyoming: The Lifeline of the Yellowstone Basin

From Kartograff to Motion Control: The Enduring Legacy of Wii Sports Theme

How to Join a Roblox Group: Master Group Invitations, Invite Friends, and Find Your Virtual Tribe

Saying Your First Name in Spanish A Quick Guide to Mastering Personal Introduction