Top 10 Quotex Traders Redefining Success: Who’s Dominating the Platform?

Top 10 Quotex Traders Redefining Success: Who’s Dominating the Platform?

The Quotex trading platform has rapidly evolved into a powerhouse hub for retail and institutional traders alike, driven by an elite cadre of top performers who consistently deliver exceptional returns. With cutting-edge tools, real-time analytics, and a vibrant community of savvy traders, Quotex is setting new benchmarks for performance, strategy, and user experience. In a tightly contested digital landscape, a closer examination reveals the names and traits of the most influential traders dominating the platform—bringing transparency, insight, and measurable success to aspiring and seasoned market observers alike.

There’s no mystery behind Quotex’s surge—its ecosystem rewards precision, discipline, and algorithmic rigor. But what distinguishes today’s top traders isn’t just their skill; it’s their mastery of the platform’s depth. From quantitative modeling to sentiment analysis, Quotex offers tools that amplify expertise.

Yet, behind every high-performing account lies a strategist—each contributing unique data interpretations, adaptive risk management, and relentless execution.

1. The Algorithmic Architect: Code-Driven Dominance

At the top stands the “Algorithmic Architect”—a trader who blends deep programming fluency with market intuition.These individuals program custom execution strategies, optimize backtests, and build adaptive AI models that learn from live market shifts. “We don’t just trade; we engineer probabilistic edge,” one platform insider noted. Their code runs automated executions during volatile windows, minimizing human error and maximizing opportune entry points.

Their success hinges on continuous refinement—refining edge through iterative testing and real-world feedback loops.

2. The Sentiment Strategist: Reading the Market’s Pulse

No strategy thrives without contextual awareness.The Sentiment Strategist excels at analyzing global news flows, social media chatter, and macroeconomic commentary. Leveraging natural language processing (NLP) and sentiment scoring tools on Quotex, they anticipate market moves before they register in price data. “The crowd speaks in narratives—we distill that noise into actionable signals,” explains a top performer.

Their edge lies not in predicting outcomes, but in reading the collective mood and adjusting positioning ahead of consensus shifts.

3. The Risk-Management Maven: Calculated Courage

Success in volatile markets demands discipline—and the Risk-Management Maven embodies this ethos.Mastery of position sizing, dynamic stop-loss tactics, and volatility-adjusted trade scaling defines their methodology. “Volatility is your friend—if you respect it,” a leading trader warns. These traders treat risk not as a constraint, but as a core component of strategy.

They use Quotex’s advanced dashboards to simulate stress scenarios and maintain portfolio resilience, turning uncertainty into opportunity.

4. The Momentum Hacker: Riding the Trend Waves

Trend-following is timeless, but Quotex traders refine it with surgical precision.The Momentum Hacker identifies breaking patterns early—using real-time charting, price action detection, and machine learning filters. “Trends have lifespans; you’ve got to hunt them while they last,” one winner reflects. They integrate multiple timeframes and cross-asset signals, exploiting momentum across equities, forex, and commodities with minimal slippage and maximum timing accuracy.

5. The Futures Innovator: Mastering Leverage and Liquidity

Within futures trading, Quotex players like the Futures Innovator leverage framework depth, futures roll strategies, and volatility capture. Profiting from contango or backwardation structures, they exploit discount/premium movements around roll points.“Leverage is powerful—but only when deployed with intent,” a veteran notes. Trends are extended through tactical roll maneuvers, preserved capital via dynamic hedging, and liquidity is optimized through smart order routing and futures curves analysis.

6.

The Market Microstructure Specialist: Timing the Tick Latency equals profit. The Market Microstructure Specialist thrives in the smallest timeframes, dissecting order book dynamics, bid-ask spreads, and tick size behavior. They execute micro-trades on millisecond scales, capitalizing on fleeting inefficiencies.

“Micro = macro—if you ride the tick, you control the pace,” says one. Advanced Quotex tools enable precise slippage control and optimal execution, turning price granularity into consistent returns.

7.

The Copy-Agile Trader: Learning from the Best True mastery often comes from osmosis. The Copy-Agile Trader doesn’t reinvent the wheel—they analyze top-performing strategies, replicate proven patterns, and integrate them into their routines. “I don’t chase luck; I study edge,”

Related Post

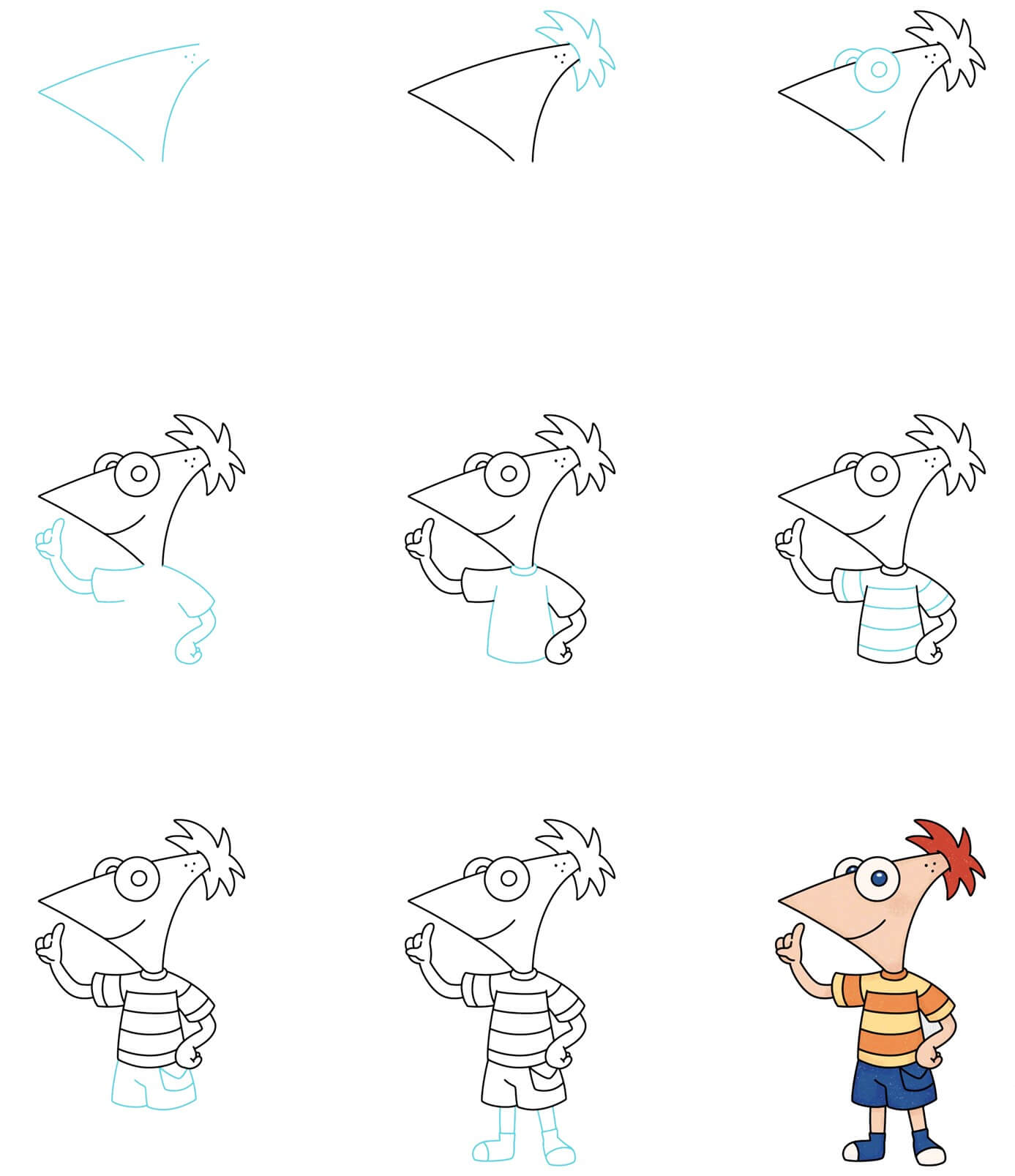

The Idea Machine: Phineas, Ferb, and Vanessa’s Unforgettable Summer Adventure

Gerald Ford in 1975: Steering a Nation Through Crisis with Quiet Resolve

Comprehensive Guide to Marie OsmondNet Worth: Unveiling the Financial Reality Behind a Renowned Entertainer

BetterThisWorld and BetterThisTech: Pioneering Ethical Innovation in a Rapidly Evolving Tech Landscape