Top 10 Cryptocurrencies By Market Cap: A Quick Guide to the Giants of Digital Finance

Top 10 Cryptocurrencies By Market Cap: A Quick Guide to the Giants of Digital Finance

The world of cryptocurrency continues to evolve at breakneck speed, with market cap rankings shifting rapidly as new projects emerge and established players adapt. For investors, enthusiasts, and financial observers alike, understanding the top 10 cryptocurrencies by market capitalization is essential—not just for tracking wealth but for grasping the broader dynamics shaping the crypto ecosystem. These digital assets represent not only financial stakes but also technological innovation, adoption trends, and regulatory evolution.

This guide delivers a current, data-driven overview of the leading cryptocurrencies, combining market performance, use cases, and real-world impact into a clear, actionable reference.

As of April 2024, the top 10 cryptocurrencies by market cap reflect a blend of blue-chip stalwarts and agile innovators, each carving a distinct niche in the rapidly expanding digital economy. Market capitalization—calculated as total supply multiplied by current price—serves as a primary indicator of an asset’s dominance and investor confidence.

But beyond numbers, these currencies power real-world applications, from decentralized finance (DeFi) and blockchain infrastructure to cross-border payments and smart contract platforms. Delving into their key attributes reveals why some endure while others fade, offering insights critical to anyone navigating this volatile frontier.

The Pillars of Market Dominance: What Makes a Cryptocurrency Top 10?

Market capitalization defines a cryptocurrency’s scale and stability. It is determined by the formula: price per coin multiplied by circulating supply.The top 10 cryptocurrencies consistently exhibit strong liquidity, consistent development activity, real-world utility, and robust community engagement. These traits create a self-reinforcing cycle: widespread adoption boosts value, which attracts developers and investors, further entrenching market position. While speculative trading fuels short-term swings, long-term leaders exhibit resilience through market corrections.

Beyond market cap, deeper analysis reveals that successful cryptocurrencies often serve as foundational components of broader ecosystems. For example, Ethereum powers the majority of decentralized applications (dApps), while Bitcoin remains the gold standard for peer-to-peer digital cash. Similarly, stablecoins like USDC and USDT dominate transaction volume due to their price stability and integration across exchanges and payment platforms.

Understanding these roles helps contextualize each cryptocurrency’s unique contribution to the digital economy.

Bitcoin: The Immutable Foundation of Crypto Value

Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, remains the largest and most influential cryptocurrency by market cap, typically exceeding $1 trillion. Positioned as digital gold, Bitcoin’s capped supply of 21 million coins and decentralized protocol underpin its scarcity narrative. Its role extends beyond speculation: institutional investors hold it as a hedge against inflation, while it powers global settlements through Lightning Network and over-the-counter (OTC) trading desks.“Bitcoin isn’t just a currency—it’s a new asset class,” notes financial analyst Sarah Chen. “Its market dominance reflects its first-mover advantage and unmatched security.”

Ethereum: The Engine of Decentralized Innovation

Ethereum, launched in 2015 by Vitalik Buterin, ranks second with a market cap resonating across five figures. Unlike Bitcoin, Ethereum is a programmable blockchain enabling smart contracts—self-executing agreements that drive deployment of decentralized apps (dApps), NFTs, and DeFi protocols.The 2022 transition to proof-of-stake (The Merge) reduced energy consumption by 99% and boosted scalability, deepening investor confidence. Ethereum’s ecosystem, valued at over $40 billion, includes popular tools like Uniswap, Aave, and Chainlink, cementing its status as the backbone of Web3 innovation.

Tether (USDT): The Stablecoin Anchor of Crypto Markets

Tether, a stablecoin pegged 1:1 to the U.S. dollar, maintains the largest market cap among fiat-backed digital assets—often surpassing $100 billion.Its primary role is reducing volatility risk: traders use USDT to park value during market downturns without exiting liquidity entirely. Despite past controversies over reserve transparency, recent third-party audits have restored some credibility. USDT’s ubiquity—transactions through major exchanges routinely use millions in USDT daily—makes it indispensable to short-term trading strategies and cross-border settlements.

USD Coin (USDC): The Transparent Pillar of Market Trust

USDC, issued by Circle and Coinbase, ranks as the third-largest stablecoin with a market cap near $35 billion.Built on Ethereum and other blockchains, its “transparent reserves” model—verified monthly—has become an industry benchmark for stability. Backed 1:1 by cash and short-duration debt, USDC supports over 70% of stablecoin trading volume. Its integration with PayPal, Venmo, and DeFi platforms underscores its role in bridging traditional finance and crypto, offering fast, low-cost settlements with audit-backed trust.

Solana (SOL): The High-Throughput Blockchain Contender

Solana, launched in 2020, surged past $60 billion in market cap in 2023, competing on raw speed and throughput.With sub-second transaction finality and 65,000+ TPS, Solana’s architecture targets scalability constraints plaguing Bitcoin and Ethereum. Its ecosystem thrives on low fees and high performance, attracting developers building dApps, NFTs, and Layer 2

Related Post

Boyars’ AP World History Masterclass: How Boyars Revolutionized Understanding of the Russian Boyars and Global Feudal Elites

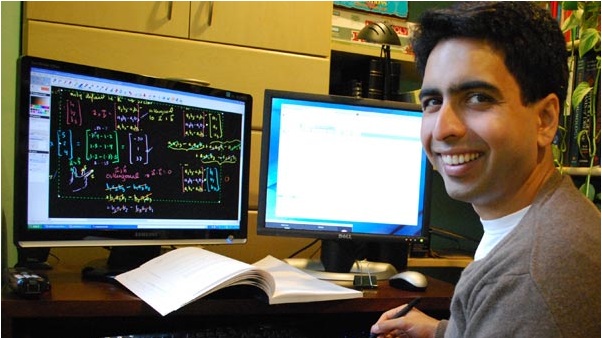

Master Accelerated Learning: How Helix Jump Khan Academy Is Redefining Skill Acquisition

Money Capital Defined: Unlocking Its Types, Applications, and Critical Role in Modern Finance

MathPlaygroundSkateboardHero: Where Math Meets the Ollie and the Infinity of Skate Physics