Top 10 Crypto Giants Shaping the Digital Future: A Complete U.S.-Focused List of Us Crypto Companies Impacting Innovation

Top 10 Crypto Giants Shaping the Digital Future: A Complete U.S.-Focused List of Us Crypto Companies Impacting Innovation

In an era defined by decentralized finance, blockchain disruption, and rapid technological advancement, U.S.-based cryptocurrency companies have emerged as pivotal players in reshaping global finance, payments, and digital asset infrastructure. From evolving fintech giants to pioneering decentralized exchanges and institutional-grade wallet services, these firms are not only driving crypto adoption in North America but also setting benchmarks for security, transparency, and innovation. Their influence spans trading platforms, blockchain networks, payment processors, venture capital backers, and regulatory compliance experts—each playing a critical role in institutionalizing the crypto economy.

This comprehensive list identifies the leading U.S. cryptocurrency companies that are steering the industry forward, offering services and technologies that meet both retail demand and enterprise-grade requirements. With heavy focus on U.S.

regulatory alignment, these firms exemplify how crypto evolution is being shaped within one of the world’s most scrutinized financial markets.

Leading Crypto Platforms Fueling U.S. Market Growth

The U.S. crypto ecosystem thrives on a constellation of companies that combine technological agility with compliance rigor.Among them, standardized leadership has emerged from firms that balance accessibility and robust security. These companies collectively represent thousands of millions in market capitalization and serve millions of users across fiat-crypto on-ramps, trading, custody, and development tools.

Top U.S.

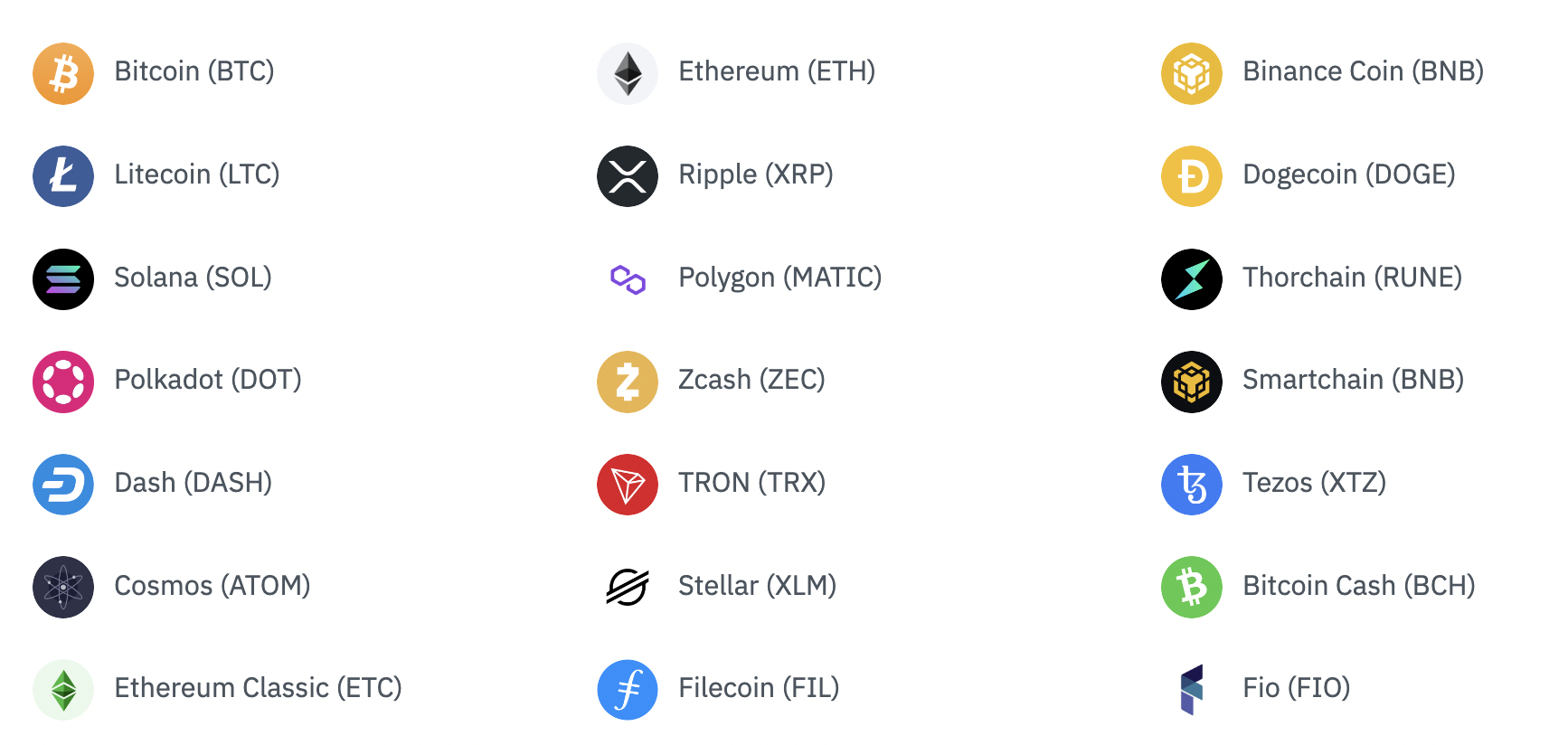

Crypto Exchanges: Where Millions Trade Every Day At the core of crypto liquidity in the United States lie major cryptocurrency exchanges, which enable users to buy, sell, and trade digital assets with fiat currencies and stablecoins. Three dominant platforms dominate the landscape:

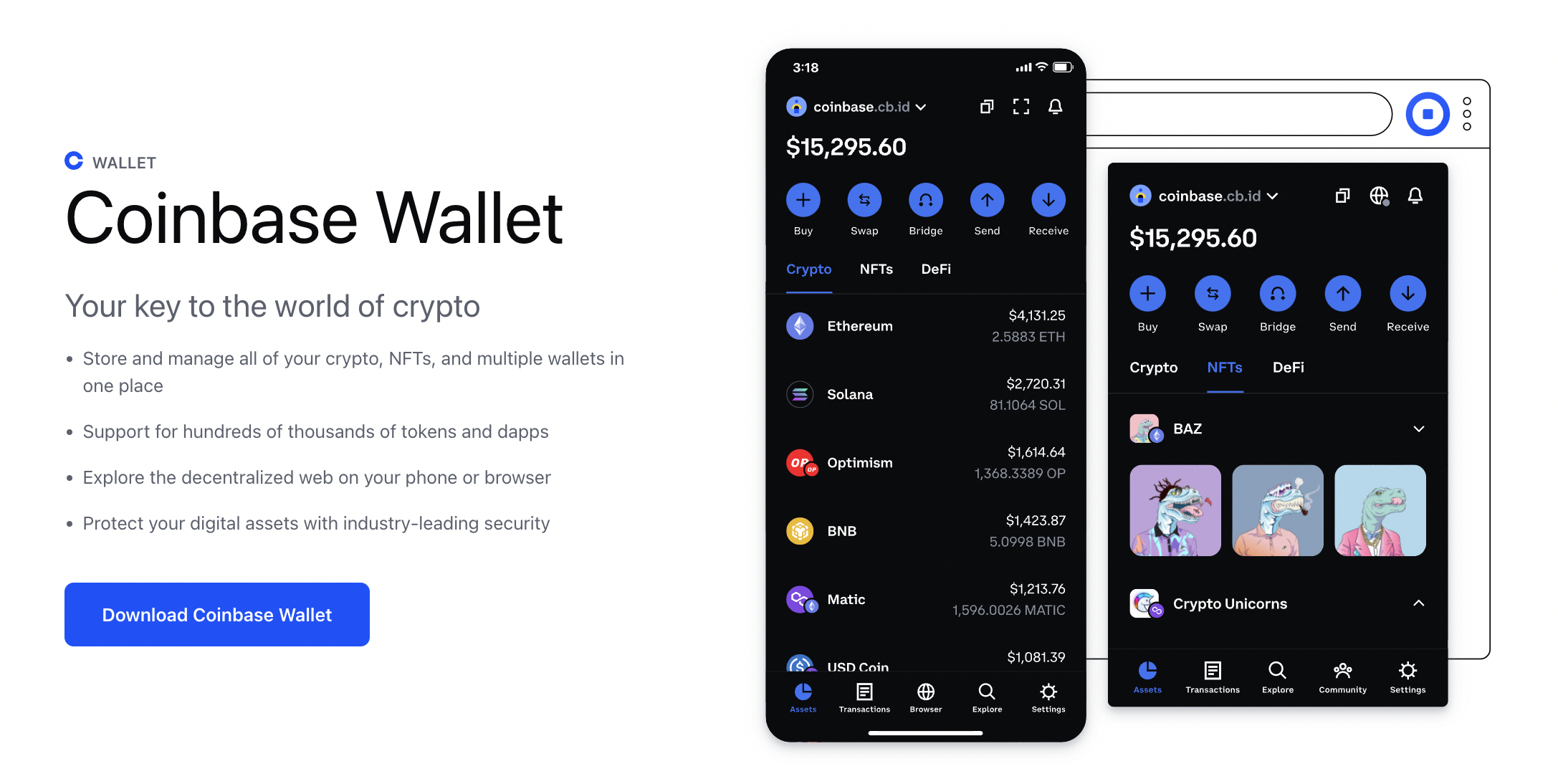

- Coinbase: Often hailed as the "Intellectual Bank of Crypto," Coinbase leads in regulatory compliance and institutional trust. With over 100 million linked users and a publicly traded presence, it provides secure custody, trading, investment products, and API access for developers.

“We were built with compliance in mind,” says Coinbase CEO Brian Armstrong, “ensuring that crypto’s potential can be harnessed safely within the U.S. financial framework.”

- Kraken: Renowned for its early adoption of institutional services, Kraken combines deep liquidity with advanced trading tools. The platform offers custody, derivatives, and spot trading while maintaining strict adherence to U.S.

financial regulations, attracting professional traders and hedge funds.

- KuCoin U.S. (branded entity following U.S. operations focus): Though global, its U.S.

subsidiary delivers localized compliance, enhanced security features, and curated market access—bridging international innovation with American regulatory precision.

Payment Innovators Redefining Real-World Adoption

Beyond trading, U.S. crypto firms are pioneering seamless integration of digital assets into everyday transactions.Companies like PayPal and Circle are transforming how businesses and individuals use crypto by embedding it into existing payment rails:

- PayPal Crypto Services: By enabling credit card users to buy, hold, and spend cryptocurrencies like Bitcoin and Ethereum through its digital wallet, PayPal eliminates friction for mass adoption. Over 14 million checkouts for crypto payments underscore its growing role in mainstream finance.

- Circle (parent of USDC): Operating the world’s largest regulated stablecoin, USDC, Circle provides dollar-pegged digital money trusted by banks and enterprises. Its issuance complies with U.S.

regulatory standards, cementing USDC as a cornerstone for stable, fast, and secure cross-border and real-time payments.

Institutional Infrastructure and Blockchain Innovation

Behind the public face of crypto lies a robust infrastructure grown by U.S. firms specializing in blockchain infrastructure, smart contract development, and institutional-grade tools.These companies ensure scalability, security, and interoperability for the broader ecosystem:

- Chainalysis: As a leading blockchain analytics firm, Chainalysis powers compliance and crime prevention solutions used by over half the Fortune 500 companies. Its tools help governments and financial institutions trace transactions, mitigate fraud, and enforce KYC/AML regulations.

- Coinbase Infrastructure (e.g., Coinbase Cloud): Providing cloud-native infrastructure and API-driven blockchain services, Coinbase supports developers and enterprises building decentralized applications on scalable, secure networks.

- Infura (Amazon-backed, active U.S. presence): By offering developer-friendly blockchain API access to Ethereum and other major chains, Infura enables apps to deploy dApps without managing complex node infrastructure—crucial for decentralized finance platforms and NFT marketplaces.

Venture Capital and Ecosystem Enablers

Funding and innovation in the U.S. crypto space are fueled by forward-thinking venture capital firms and incubators that identify and nurture breakthrough technologies. These backers drive early-stage projects toward commercial viability:Among the most influential:

- Andreessen Horowitz (a16z Crypto): With over $6 billion allocated specifically to blockchain and Web3, a16z Crypto invests in protocol builders, privacy tech, and decentralized identity, shaping next-generation infrastructure beyond speculative trading.

- Parametric: Focused exclusively on decentralized finance, this fund backs yield optimizers, insurtech protocols, and liquidity solutions—strengthening the resilience and accessibility of DeFi ecosystems.

- Dragon Capital: Known for deep technical expertise, Dragon supports protocol upgrades, mainnet migrations, and privacy-enhancing tools, reinforcing long-term sustainability over short-term hype.

These investors don’t just fund startups—they architect the future of decentralized finance and digital ownership.

Regulatory Navigation: The Unifying Challenge for U.S. Crypto Leaders Unlike many global counterparts, U.S.

crypto firms operate within a complex, evolving regulatory framework overseen by the SEC, CFTC, FinCEN, and state authorities. Compliance is not optional—it defines market trust, investor protection, and long-term viability. Top companies distinguish themselves by rigorously aligning product development with regulatory expectations, often engaging regulators proactively.

Key compliance pillars include:- AML/KYC enforcement: Platforms like Kraken and Coinbase deploy sophisticated identity verification and transaction monitoring to prevent illicit use.

- Secure custody solutions: Firms such as Fireblocks and Copper Crypto offer cold storage, insurance-backed custody, and multi-signature wallets to protect user funds.

- Transparent reporting: Leading exchanges submit regular data to authorities, including 1099-K forms and suspicious activity reports, reinforcing market integrity.

companies as trusted stewards in a landscape where regulatory uncertainty remains high, ensuring continued growth and institutional inflow.

The Broader Impact: U.S. Crypto Firms as Catalysts for Economic Innovation The U.S.-based crypto ecosystem is more than a financial curiosity—it is a transformative force.

By enabling borderless transactions, lowering barriers to investment, and fostering decentralized innovation, these companies are redefining financial sovereignty and technological empowerment. Their commitment to security, compliance, and scalability accelerates adoption beyond speculative trading into productive use cases: supply chain transparency, micropayments, decentralized identity, and inclusive fintech. “The future of money is decentralized, but trust is built locally,” states Coinbase’s Armstrong.

As institutional adoption deepens and regulatory clarity advances, U.S. crypto firms will continue to shape not just markets, but the fundamental mechanisms of economic interaction globally. Their leadership proves that innovation in crypto thrives at the intersection of bold vision and rigorous governance—paving the way for a more open, secure, and equitable digital economy.

Related Post

Nick Stellino’s Net Worth: Behind the Headlines of His Rapid Rise to Wealth

What Does the “Drop” Mean on a Bat? The Hidden Science Behind a Key Performance Metric

Karli Ritter Divorced: The Public Journey of a Star Shaped by Personal Turmoil

Fidelity 500 Index Fund: How Dividends Power Long-Term Wealth in One Simple Vehicle