The XRP Spot ETF Proposal: Key Amendments Reshaping Crypto Investment Futures

The XRP Spot ETF Proposal: Key Amendments Reshaping Crypto Investment Futures

The Financial Industry Regulatory Authority (FINRA) is advancing a pivotal refinement to the proposed XRP Spot Exchange-Traded Fund (ETF) structure, gaining critical momentum in late 2024. These amendments aim to address longstanding concerns from regulators, exchanges, and investors by tightening custody requirements, enhancing transparency protocols, and clarifying reporting obligations—steps that could significantly accelerate the ETF’s approval timeline. With XRP’s volatility and growing institutional interest, these adjustments mark a turning point in the mainstream acceptance of digital assets through regulated investment vehicles.

<> The XRP spot ETF proposal has evolved through intense scrutiny, driven by both technological innovation and market demand. Initially floated as a vehicle enabling retail and institutional investors direct exposure to XRP via traditional brokerage accounts, the proposal faced skepticism primarily over custody and liquidity safeguards. The new amendments respond directly to these challenges, reshaping core components without altering XRP’s fundamental appeal.

The most substantial changes focus on custody infrastructure. To mitigate counterparty risk, the updated framework mandates that approved custodians employ segregated, bank safeguarded vaults compliant with Segregated Accounts Rule standards. This ensures XRP holdings are legally isolated from operators’ general assets—a prerequisite for budget-conscious SEC and CFTC review.

As Kaveh Hassani, chief compliance officer at a leading digital asset firm, noted: “Segregated custody is no longer optional. It’s the cornerstone of investor trust and regulatory compliance in a space historically plagued by opacity.” The amendments also require third-party audits of custody processes every 12 months, with results publicly disclosed, reinforcing accountability.

Another critical amendment strengthens market integrity through real-time reporting enhancements.

Exchanges and brokers must now deliver granular trade data—price discovery, volume breakdowns, and transaction timestamps—directly to SEC-registered monitors within seconds of execution. This moves beyond current partial reporting models, addressing regulators’ calls for full visibility to prevent manipulation and ensure fair pricing. Blockchain analytics firms are already aligning systems with the required feed specifications, indicating operational readiness to support higher transparency.

Closely tied to market confidence are provisions tightening the ETF’s structure around derivatives exposure. The proposal now limits synthetic XRP exposures to 10% of total holdings, eliminating complex forward contracts that previously raised systemic risk concerns. This constraint narrows the ETF’s output to physical XRP, simplifying risk assessment and reducing regulatory friction.

Additionally, the amended rules clarify investor eligibility and anti-money laundering (AML) verification. Brokers must implement robust identity verification protocols aligned with FinCEN’s Virtual Currency Rules, coupled with enhanced transaction monitoring for suspicious activity. These safeguards align XRP ETFs with conventional securities standards, lowering barriers to entry for U.S.

institutional players.

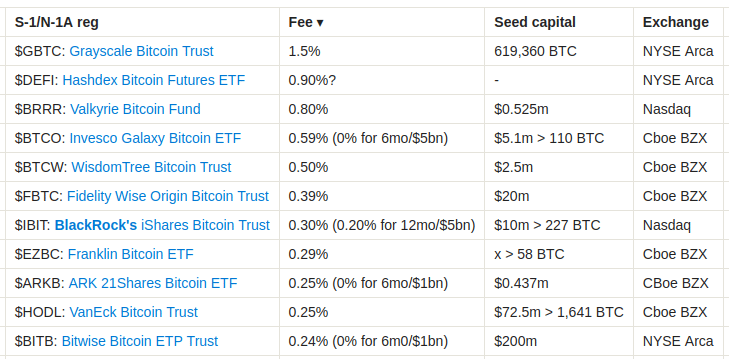

Patterned after successful models from Bitcoin and Ethereum ETF pathways, the refinements prioritize risk containment without sacrificing market access. They directly respond to the SEC’s iterative feedback, particularly on custody segregation and audit trails.

While the proposal remains under active review, the depth of these amendments signals strong momentum—IF approved, the XRP Spot ETF could set a precedent for future digital asset fund structures. ## What These Amendments Mean for Institutional and Retail Investors The structural improvements in the XRP spot ETF amendments create a safer, more predictable investment path. Retail investors gain access to XRP through regulated custody-backed ETFs, eliminating direct-bek'Indica access risks.

Institutions benefit from clear compliance pathways, encouraging broader allocation to XRP’s volatile but high-growth market. Sci arbitration of XRP as asset class legitimacy accelerates. The amendments reflect a maturing digital asset ecosystem—one where innovation aligns with investor protection.

XRP, once marginalized by regulatory uncertainty, now sits at the forefront of a new frontier in regulated crypto investment. As the proposal advances, these refinements may not only pave the way for the first XRP Spot ETF but redefine how commoditized digital assets integrate into mainstream financial architecture. In a landscape once defined by skepticism, the focus on custody, transparency, and real-time reporting suggests more than procedural tweaks—they signal FINRA and the broader financial ecosystem embracing XRP not as a speculative novelty, but as a core, protected component of diversified portfolios.

Related Post

Grab $15 Off Your Order with DoorDash’s Latest Promo Code

Get Microsoft Word 365 Free Your Ultimate Guide

Bobby Flay’s Wife: Behind the Celebrity Chef’s Private Love Life

Unlocking Hydration Science: How Sarah Dugdale Revolutionizes Water’s Role in Health