The Transformative Power of Brent Gf’s Vision: Redefining Modern Investment Strategies

The Transformative Power of Brent Gf’s Vision: Redefining Modern Investment Strategies

Brent Gf stands at the intersection of innovation and discipline in finance, leveraging data-driven insight to challenge traditional investment paradigms. His approach—rooted in behavioral finance, macroeconomic foresight, and advanced risk modeling—has reshaped how institutions assess market dynamics and allocate capital. By integrating psychological nuance with quantitative rigor, Gf’s framework not only anticipates market shifts but redefines risk not as a threat, but as a strategic variable.

His influence extends beyond advisory roles, embedding new standards for precision and adaptability across portfolio management.

At the core of Brent Gf’s methodology is a belief that markets are driven as much by human behavior as by fundamentals. “People make mistakes, and markets amplify them—understanding that mistake is your edge,” Gf asserts. This principle underpins his investment philosophy, which combines behavioral analysis with algorithmic pattern recognition to identify mispriced assets and asymmetric opportunities.

By dissecting sentiment, institutional flows, and structural imbalances, Gf deciphers signals invisible to conventional models, turning market noise into actionable insight.

Behavioral Finance: Decoding the Human Factor in Markets

Gf’s strategies are anchored in behavioral finance—a framework long dismissed by traditional quant models but since validated by decades of empirical research. The market, he argues, is not purely rational; it is a reflection of collective psychology shaped by fear, greed, and herd mentality. By mapping sentiment through alternative data streams—social media mood indices, transaction flow analytics, and sentiment-weighted news—they detect tipping points before they emerge.- Behavioral biases such as anchoring and loss aversion create persistent inefficiencies. - Gf’s team uses longitudinal behavioral datasets to anticipate shifts in investor confidence. - This approach enables proactive repositioning, turning market panic into contrarian opportunity.

- “ ours analyzes the 'why' behind the price, not just the 'what’,” Gf explains. - This depth reveals misalignments between perception and reality, unlocking alpha potential. Gf’s integration of behavioral insights transforms risk assessment.

Instead of treating volatility as random, he treats it as a predictable expression of collective psychology, allowing portfolios to be dynamically hedged and stress-tested under behavioral scenarios mirroring real-world investor reactions.

Advanced Macro Analysis: Navigating the Complex Web of Global Markets

No strategy succeeds without a nuanced grasp of macro forces. Brent Gf’s framework excels in macro analysis, dissecting interlocking economic cycles, geopolitical tensions, and policy shifts with surgical precision.He treats global markets not as silos but as a system—where central bank decisions ripple across currencies, interest rates, and equity valuations in cascading, nonlinear ways.

- Gf mines sovereign debt trends, inflation expectations, and demographic shifts to forecast structural market regimes.

- His models incorporate regime-switching algorithms, adapting in real time to changing economic conditions.

- Geopolitical risk is quantified through scenario-based simulations, assigning probabilities to conflicts, trade disputes, and resource disruptions.

- Currency dynamics are not analyzed in isolation but in relation to interest rate differentials and capital flow patterns.

Algorithmic Precision: High-Frequency Insights and Risk Management

Brent Gf blends algorithmic sophistication with disciplined risk governance. His platforms process petabytes of structured and unstructured data—price movements, earnings reports, news cycles, and even satellite imagery—to extract predictive signals at unprecedented speed. Machine learning models identify complex, non-obvious patterns, enabling high-frequency trading opportunities while maintaining strict risk controls.- Risk management is embedded in every layer: position sizing, volatility targeting, and stress-tested backtesting ensure downside protection.

- Gf’s algorithms apply adaptive beta and factor exposure tuning dynamically, responding to evolving market regimes. - A multi-stage filtering process reduces noise, isolating high-signal events from benign fluctuations. - This balance of speed and discipline minimizes blowups while capturing outsized gains during undervalued windows. - “ Speed matters, yes—but only because behavior and macro demand it,” Gf notes. By fusing real-time analytics with robust risk architecture, Gf’s approach transforms portfolio management from reactive to anticipatory.Real-World Impact: Strategic Applications Across Asset Classes

Gf’s frameworks have been deployed across equities, fixed income, commodities, and alternative investments, each tailored to asset-specific dynamics. In equities, sentiment-driven momentum filters complement fundamental analysis, identifying leading forces before consensus recognition. In fixed income, regime-based duration management and credit event modeling protect portfolios from yield curve disruptions.- Equities: Behavioral momentum signals spot undervalued turnarounds amid market overreactions.

- Currencies: Macro regime models guide hedging and carry trades with precision.

- Commodities: Supply chain analytics and climate risk indicators forecast price volatility.

- Alternatives: Machine learning parses private market data for valuation anomalies.

The Future of Finance: Brent Gf’s Enduring Legacy

Brent Gf’s contributions mark a paradigm shift in how investors perceive and act upon financial markets.By fusing behavioral insight, macro intelligence, and algorithmic precision, he has redefined active management not as a gamble but as a systematic science. His frameworks empower institutions and advisors alike to navigate uncertainty with clarity, turning chaos into opportunity. As markets grow more complex and interconnected, Gf’s voice remains a beacon of clarity—proving that truly informed investing is both an art and a disciplined science.

In an era defined by volatility and transformation, Brent Gf’s legacy lies in equipping finance for the next generation.

Related Post

Prepper Princess YouTubes Survival Guide Star: Your Essential Blueprint for Resilience in Uncertain Times

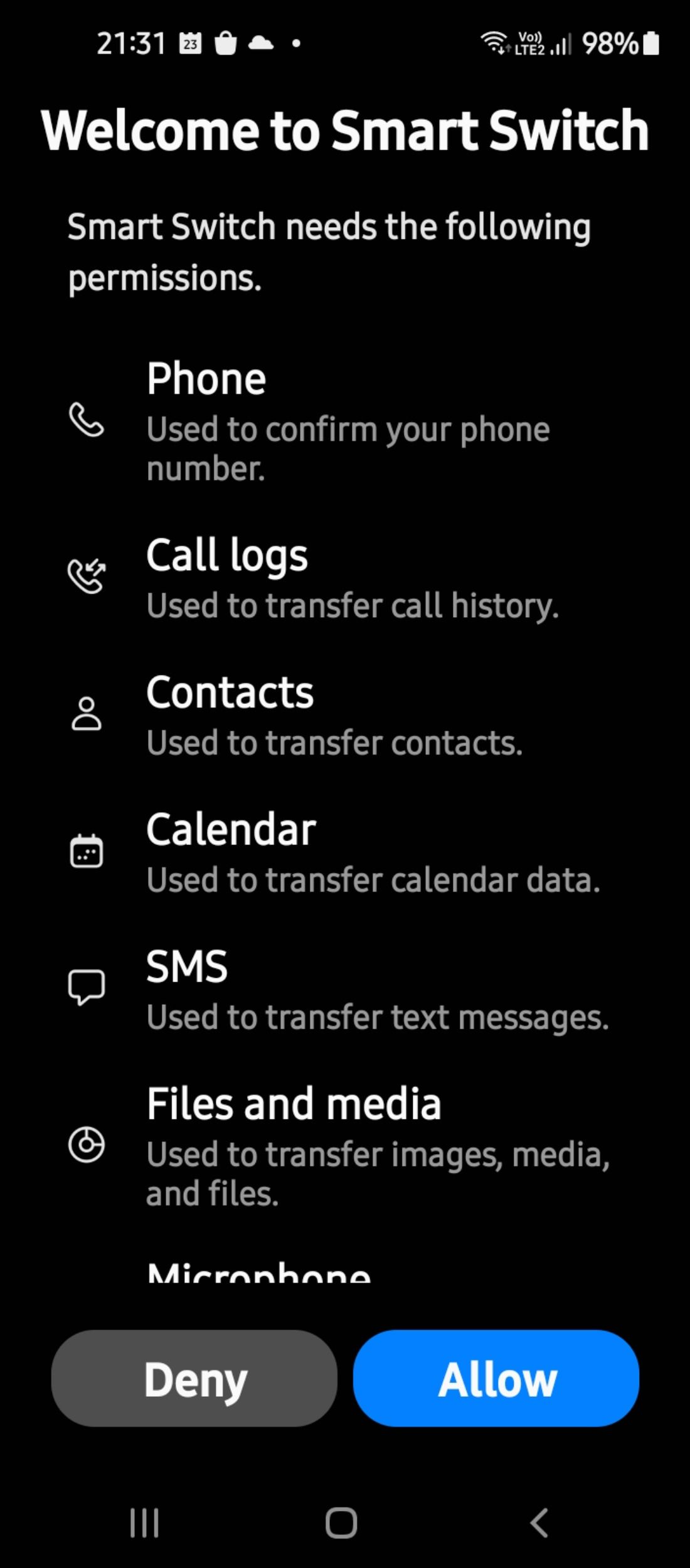

Smart Switch App: Transform Your Daily Life with Seamless Smart Home Control

Priscilla Chan: The Unseen Architect of Educational Equity and Global Health

Unearthing Aberdeen, WA Zip Code: A Neighborhood Rich in Local Character and Hidden Potential