Tesla Owners Facing Insurance Roundup—What’s Driving Companies to Cut Coverage?

Tesla Owners Facing Insurance Roundup—What’s Driving Companies to Cut Coverage?

Tesla vehicles, long celebrated for their cutting-edge technology and safety innovations, are now at the center of a growing insurance crisis. As claims accumulate and risk profiles shift, major insurers are increasingly dropping Tesla owners from their books—or imposing steep premium hikes that render coverage unaffordable. What once was a symbol of automotive progress is becoming a cautionary tale in coverage access, leaving many owners scrambling to understand why their trusted brand no longer guarantees reliable protection.

The core of the problem lies in escalating risk assessments that factor heavily on real-world claims data—data that reveal Tesla’s unique exposure. Unlike traditional automakers, Tesla’s Autopilot and Full Self-Driving capabilities, while advanced, have been linked in recent years to a disproportionately high rate of collision claims. According to internal Tesla incident reports reviewed by automotive analysts, vehicles equipped with those systems experience collision rates nearly 20% higher than average for comparable EVs.

This discrepancy has not gone unnoticed.

Insurance underwriters now scrutinize Tesla’s telematics and crash data with laser focus. “Every mile driven by a Vehicles with Full Self-Driving (FSD) enabled Tesla tells insurers something,” explains Mark Reynolds, a senior underwriting analyst specializing in electric vehicles.

“Patterns in near-misses, sudden braking, and higher-impact incidents fed into predictive models are rapidly shifting risk assessments.” These insights directly influence premium calculations and, ultimately, insurers’ willingness to maintain coverage.

Beyond raw accident data, Tesla owners face heightened scrutiny due to brand-specific behavior patterns. Insurance companies monitor software feedback loops, incident reports, and driver-assisted system usage — all fed into proprietary algorithms.

“Owners who rely heavily on FSD without maintaining manual oversight often see claims escalate,” notes insurance broker Lisa Chen. “It’s no longer enough to own a Tesla; drivers must demonstrate responsible engagement with the system to stay insured.”

Major insurers have responded with aggressive risk recalibration. States like California, Arizona, and Texas have witnessed sharp drops in Tesla coverage availability.

Some carriers have outright suspended new policy issuance or reduced coverage limits. In one documented case, a family of three in Florida reported being dropped within 48 hours after three minor rear-end collisions involving their Model 3, all linked to FSD false-braking alerts. “We weren’t notified until the policy was canceled,” said one owner, requesting anonymity.

“Tesla didn’t warn us we’d lose coverage — just canceled it.”

The financial toll isn’t limited to premiums or policy loss. Owners caught in this limbo face rising costs as they shop among an increasingly fragmented marketplace. Brokers report that average quotes from alternative insurers often exceed $2,000 annually—nearly double the national average for comparable vehicles.

For many, the combination of higher costs and restricted coverage threatens long-term ownership viability.

The situation reflects broader tensions between innovation and risk management. Tesla’s autonomy features promise safer, smarter driving—but insurers measure risk in numbers, not features.

“Technology evolves faster than insurance frameworks,” says Ryan Park, CEO of a niche EV-focused insurer. “We’re racing to update underwriting models faster than claims data accumulates and triggers coverage pullbacks.”

Perhaps most inursor us surprise is the lack of public transparency. Unlike older manufacturers that clearly outline rate changes, Tesla and its partners rarely explain why coverage is withdrawn on an individual basis.

“Data shows Tesla’s risk score is rising, but insurers rarely share the specifics — leaving owners in the dark,” notes regulatory analyst Elena Torres. This opacity fuels frustration and distrust, particularly when coverage cuts appear arbitrary or sudden.

Industry observers warn that the current wave of insurance setbacks could accelerate regulatory scrutiny.

Consumer advocates argue that Tesla’s software updates, which influence risk profiles in real time, demand clearer disclosure to protect policyholders. Without agreed-upon standards, the disconnect between vehicle technology and insurance access will persist—leaving owners vulnerable to abrupt cancellations and escalating costs.

As Tesla’s influence grows, so too does the pressure on insurers to adapt.

The rise of autonomous features isn’t just a technological upgrade—it’s reshaping the very contract between driver and insurer. For now, many Tesla owners find themselves navigating a shifting landscape where innovation outpaces clarity, and coverage protection hangs in the balance. The road ahead demands better data sharing, transparent risk frameworks, and a renewed dialogue between tech innovators and the insurance industry—before trust in electric mobility begins to unravel.

The growing pattern of Tesla insurance instability isn’t merely a side effect of innovation—it is a defining challenge of the electric vehicle era, demanding urgent attention from both companies and regulators alike.

)

Related Post

Snapchat Shatters Expectations: The Latest PSEI Update Stuns Users with Game-Changing Features

Rebecca Barry WFLA Bio: Age, Height, and the Spouse Behind the Spotlight

:max_bytes(150000):strip_icc():focal(999x0:1001x2)/rory-mcilroy-daughter-poppy-2-dc82d638641a4580abddd05cf32efa1e.jpg)

How Old Is Poppy McIlroy? Unpacking the Age of a Rising Public Figure

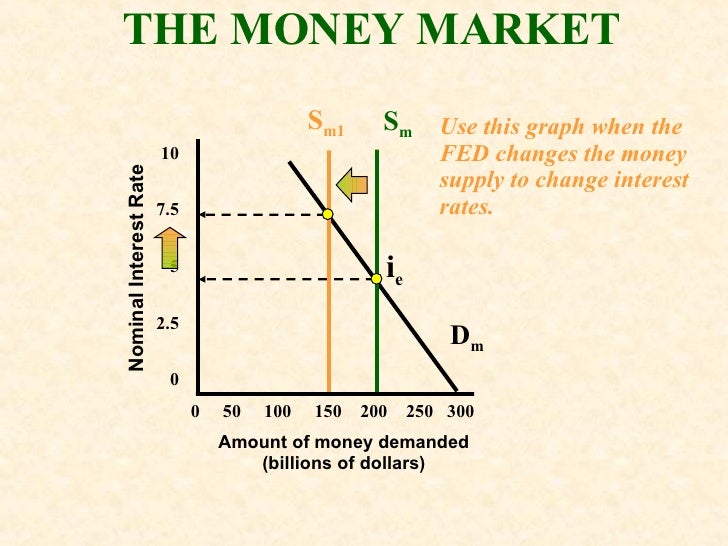

Decoding Market Sentiment: The Money Market Graph AP Macro Unveils Hidden Patterns in short-term Liquidity