Saturday Banking: What You Need To Know

In a world where financial systems evolve at breakneck speed, understanding Saturday Banking isn’t just smart—it’s essential. This growing movement reflects how banks are adapting to modern lifestyles, offering critical services on traditionally quiet weekday afternoons. For millions, Saturday banking bridges gaps in availability, financial access, and urgent operational needs.

This article reveals everything you must know: how these services work, who benefits, the risks involved, and what the future holds.

Understanding Saturday Banking: A Lifeline for Modern Financial Needs

Saturday banking refers to financial services offered by banks, credit unions, and financial institutions on Saturdays—traditionally off-peak hours when branches are closed or operating with constrained hours. Once a niche offering, Saturday banking has become a cornerstone of customer-centric innovation, driven by changing workplace patterns, digital inclusivity goals, and rising demand for financial flexibility. Unlike physical teller services available only Monday through Friday, Saturday banking enables customers to access ATMs, conduct transactions, and receive key support when work schedules or personal commitments prevent weekday visits.For many, this flexibility means the difference between securing urgent funds or missing a critical bill payment deadline. In countries with strong banking penetration like the U.S., U.K., Canada, and Australia, Saturday banking now supports essential activities such as pre-authorized debits, stop-payment requests, account inquiries, and cash withdrawals—services historically tied exclusively to weekday business hours. This shift reflects a deeper transformation: banks no longer just open at nine a.m.—they now meet customers wherever and whenever they need them.

How Saturday Banking Works: Access, Tools, and Operational Windows

To understand Saturday banking, it’s important to unpack how it functions on a practical level. Most regulated institutions integrate digital platforms as the primary access point: mobile apps and online banking portals remain fully active on Saturdays, allowing fund transfers, balance checks, and transaction scheduling before opening hours. This digital-first model ensures safety, immediacy, and convenience without requiring physical presence.In physical branches, operating hours on Saturdays vary but typically run from 8:00 a.m. to 12:00 p.m., and sometimes extend closer to noon in select locations. These reduced hours allow staff to handle time-sensitive requests—such as emergency fund access or document verification—without weekend crowds.

ATMs located in malls, retail centers, and high-traffic urban areas also see increased utilization, empowered by real-time network connectivity and 24/7 card functionality even outside core business hours. A critical feature of Saturday banking is its integration with fraud prevention and security protocols. Biometric login, transaction limits, and real-time notification systems are heightened to protect users engaging services when they might be less vigilant—such as midday errands or post-work leisure.

Banks routinely deploy AI-driven monitoring to detect unusual activity, ensuring customer safety despite non-traditional access times.

Who Benefits Most from Saturday Banking? Real-World Users Speak

The value of Saturday banking is most deeply felt by employees with inflexible schedules, single-parent households, remote workers, and professionals in sectors like healthcare, education, and retail.For Sarah, a night shift nurse in Toronto, Saturday banking allowed her to transfer emergency funds to a family member’s account after weeks of missed pay periods—transactions completed seamlessly through her mobile app before a midday coffee run. “I used to stress about missing bill due dates because I couldn’t walk into a branch,” she shared. “Now, Saturday banking keeps me in control, even on unpredictable nights.” Student Loan borrowers represent another major user group.

With tuition payments often processed on fixed deadlines, Saturday banking bridges gaps when campus jobs are unavailable or tax refund timing doesn’t align with monthly billing cycles. A 2023 survey by the National Association of Student Financial Officers found that 41% of borrowers using Saturday banking services cited splitting payments across weekdays and weekends as a key factor in improved financial stability. Remote and gig economy workers also benefit significantly.

Freelancers, deliverers, and taxi drivers depend on reliable access to funds during irregular hours. In Sydney, a ride-hailing driver reported saving over $30 weekly by shifting appointment scheduling and payment drop-offs to Saturday windows, avoiding weekend service dips. As one rider stated, “With Saturday banking, I finally close the gap between shifts—no more dreading Sunday buys because I ran out of cash.”

Key Services Available During Saturday Banking Hours

While Saturday banking may not replicate the full breadth of weekday operations, a core set of essential services remain consistently available, meeting the most urgent customer needs.These include: - 🏦 **ATM Withdrawals**: Bank cards function seamlessly on Saturdays; ATMs operate during standard Saturday hours with real-time CB with all major payment networks. - 💳 **Fund Transfers**: Initiate transfers to other accounts, pay bills, or settle dues—all via mobile app or web portal, processed instantly after authorization. - 📞 **Stop-Payment Requests**: Block checks, debit cards, or electronic payments in real time to prevent fraud or unintended transactions.

- 📊 **Account Information Access**: Check balances, transaction histories, and credit scores through digital platforms anytime. - 📝 **Basic Financial Assistance**: Many institutions offer priority support via secure chat or phone, especially for time-sensitive requests tied to payroll or essential services. Interest-bearing accounts and deposits typically pause or cap interest on Saturdays due to overnight processing delays, but banks clearly communicate these operational boundaries in advance.

For urgent loans or credit adjustments, dedicated Saturday frontline teams are often staffed on-site to guide applicants through emergency financing options.

Risks and Precautions in Using Saturday Banking Services

While Saturday banking delivers unmatched convenience, users should remain aware of inherent risks. The reduced staffing levels mean longer wait times and limited physical support, increasing vulnerability to cartel scams or technical glitches when in-person oversight is sparse.Cybersecurity remains a top concern: mobile transactions on saturated networks may expose accounts if not protected by robust encryption and two-factor authentication. The FTC highlighted a spike in SMS phishing attempts targeting Saturday transaction windows last year, urging users to verify communications through official banking channels. To mitigate risk, experts recommend: - Enabling biometric authentication and transaction alerts on all banking apps.

- Limiting cash withdrawals to trusted ATMs within secure locations. - Avoiding large, one-time transfers just before closure unless confirmed. - Reviewing account activity immediately after using Saturday services.

Banks continue to enhance safeguards—many now deploy AI fraud alerts triggered specifically at Saturday windows to protect users exploiting lower visibility. Yet, the burden also rests on customers to maintain vigilant habits during off-peak access.

The Future of Saturday Banking: Innovation, Inclusion, and Accessibility

The rise of Saturday banking reflects a broader industry shift toward 24/7, accessible financial solutions tailored for an evolving world.Fintech pioneers are expanding Saturday offerings beyond basic transactions to include peer-to-peer payment confirmations, instant micro-loan pre-approvals, and real-time budgeting tools. Emerging markets, where formal banking infrastructure remains sparse, stand to gain the most. Mobile banking platforms already leverage satellite connectivity and localized ATMs to deliver Saturday-like access in rural and remote areas.

In Kenya, for example, fully operational Saturday digital banking windows have reduced account inactivity by 27% among informal sector workers. Looking ahead, satellite institutions and credit unions are testing hybrid models—such as automated teller kiosks open exclusively on Saturdays with human oversight during peak hours—blending self-service efficiency with trusted guidance. Regulators increasingly recognize Saturday banking as a vital component of financial inclusion, setting clearer standards for transparency, consumer protection, and operational continuity.

As banking continues to shed its rigid, weekday persona, Saturday banking stands not just as a convenience, but as a mechanism for economic resilience. It empowers individuals to manage their finances on their own terms—without sacrificing security or oversight. More than a fleeting convenience, Saturday banking is redefining what it means to be truly accessible.

For millions, it’s not just banking—it’s growing into a smarter, safer part of daily life.

Related Post

The Tuesday Work Meme: Why Blaming Mondays Paralyzes Productivity

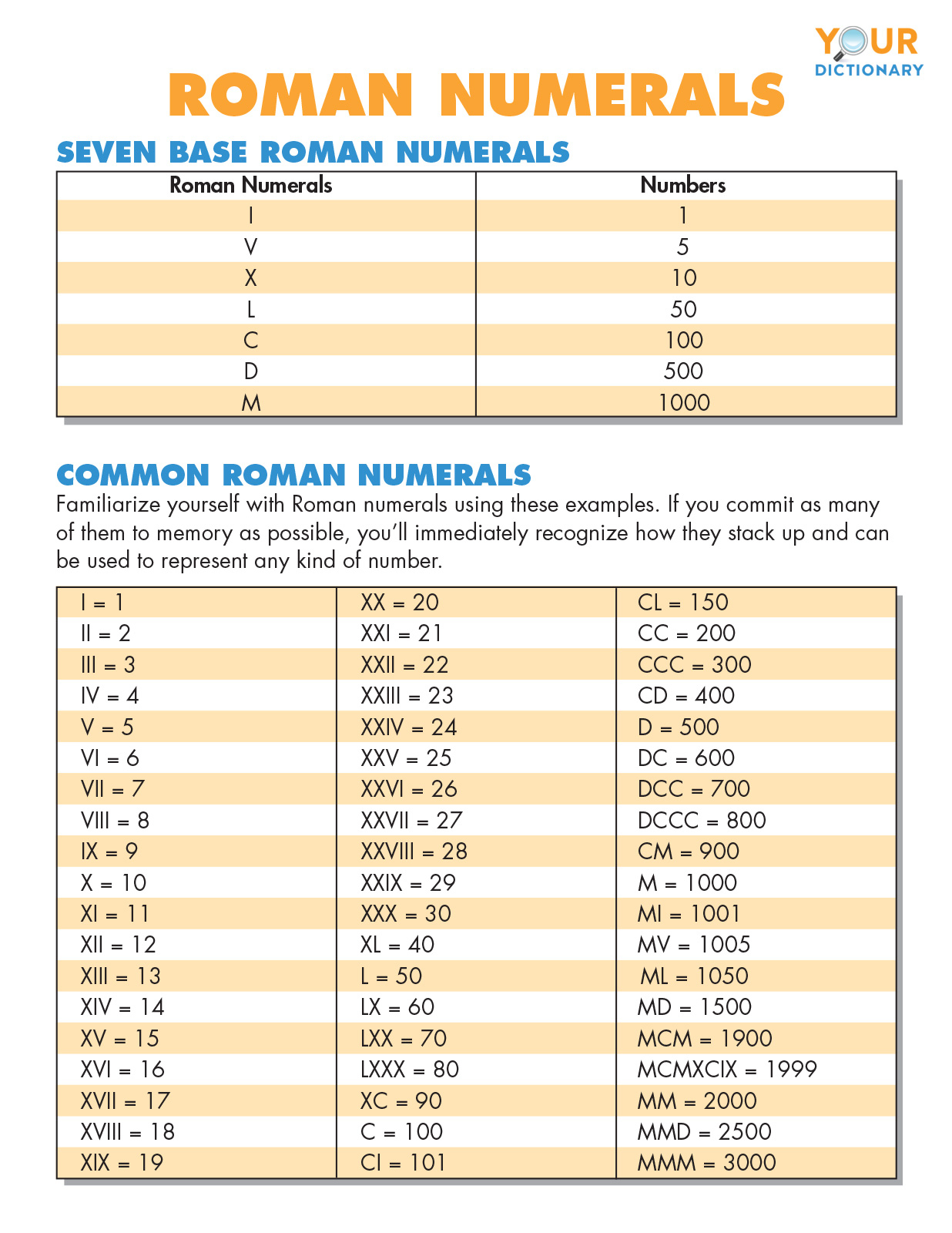

XXV In Numbers: Your Roman Numeral Guide – From I to XXV

Unveiling the Jackerman Mother Warmth: A Timeless Symbol of Nurturing Comfort and Emotional Safety

Kickstarting Your Amazon FBA Journey: The Ultimate Beginner’s Guide