Santander Consumer USA: Driving Retail Credit Access Across America with Innovation and Reach

Santander Consumer USA: Driving Retail Credit Access Across America with Innovation and Reach

Santander Consumer USA, a key division of the global Santander Group, stands at the forefront of consumer credit in the United States, blending financial innovation with broad accessibility to serve millions. Operating as one of the nation's largest providers of auto loans, personal loans, and credit card financing, the company plays a vital role in helping everyday Americans fund major purchases—whether buying their first car or managing daily expenses—through tailored financial solutions. With a network spanning thousands of branches and digital platforms, Santander Consumer USA combines institutional strength with personalized service, offering customers across urban and rural communities a reliable path to credit.

At the heart of Santander Consumer USA’s success is its commitment to inclusive finance. The company has long prioritized underserved markets, leveraging data-driven underwriting to expand access without compromising responsible lending. “Our mission is to empower all customers, regardless of their credit history,” says a corporate spokesperson.

“By integrating technology with a human touch, we deliver fair and flexible financing options that meet real-life financial needs.” This philosophy translates into products like the Santander Easy Auto Loan, designed with low down payments and transparent terms, appealing especially to first-time drivers and mid-income households.

One of the most compelling aspects of Santander Consumer USA’s operations is its diverse product portfolio, tailored to match the evolving demands of American consumers. The company offers:

- Auto Financing: Short to long-term loans for vehicle purchases, with flexible repayment terms and competitive rates based on individual credit profiles.

- Personal Loans: Unsecured and secured loan options allowing customers to consolidate debt, fund home improvements, or cover unexpected expenses with clear financing paths.

- Credit Cards: Products designed with rewards and rewards-only tiers, supporting both mainstream shoppers and those focused on building credit responsibly.

- Banking Integration: Through its banking subsidiary, Santander Consumer USA enables seamless service—account access, loan management, and financial education—all within one unified platform.

This data-centric approach not only accelerates customer walkthroughs but also reduces default risks, ensuring sustainability in a competitive market. In 2023 alone, Santander Consumer USA reported over 2.1 million loan originations—primarily in the auto category—highlighting both robust demand and operational efficiency.

The company’s digital evolution has further cemented its leadership in the evolving fintech landscape.

Its mobile app, revised multiple times since launch, now offers end-to-end loan processing, real-time status tracking, and push notifications on loan terms and repayment due dates. “We’re building a customer experience where convenience meets transparency,” explains a key product lead. “Clients no longer need to visit a branch; they can complete major financing decisions from their phone in under 10 minutes.” This digital fluency, combined with decades of regulatory compliance and community engagement, positions Santander Consumer USA as a trusted partner in financial inclusion.

Beyond product innovation, Santander Consumer USA invests heavily in community impact and financial literacy. The company regularly sponsors neighborhood workshops covering credit management, budgeting, and responsible borrowing—efforts that deepen customer trust and financial resilience. Partnerships with local institutions amplify these initiatives, ensuring tailored support for populations facing economic challenges.

As one regional manager emphasized, “We’re not just a lender—we’re a financial ally helping families grow and grow stronger.”

Facing increased regulatory scrutiny and shifting consumer expectations, Santander Consumer USA remains agile, adapting quickly to changes in lending laws and emerging trends like buy-now-pay-later (BNPL) features and embedded finance. While traditionally rooted in installment loans, the company explores innovations that balance agility with sound credit practices. This forward-thinking stewardship underscores Santander Consumer USA’s enduring relevance: a bridge between legacy banking and next-generation financial empowerment.

In an era where financial services demand both speed and trust, Santander Consumer USA continues to redefine access. From empowering first-time car buyers to supporting long-term credit health, the company exemplifies how a major financial institution can combine scale with sensitivity. With a clear vision, customer-first strategy, and unwavering commitment to responsible lending, Santander Consumer USA not only meets today’s consumer needs—it shapes the future of retail credit in America.

Related Post

Santander Consumer USA’s Go-To Guide: Your Complete Handbook for Smart Financial Choices

The Enigmatic Beauty of the Squirrel Flower: A Tiny Wonder of Ecological Alchemy

Where Is She Now? Channel 13’s Latest Update Reveals Faith King’s Quiet Return After Years Away

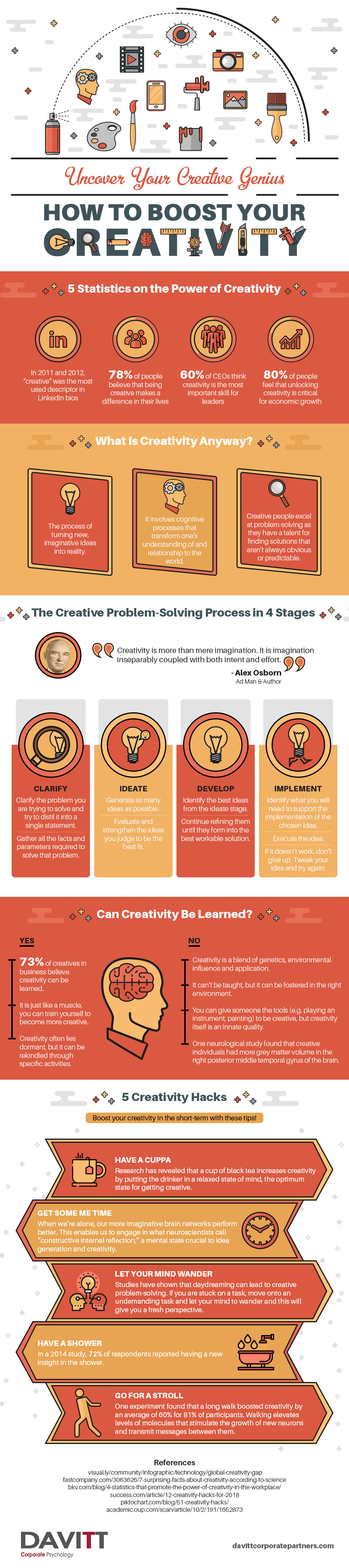

Uncover The Creative Genius of Gia Garison and Alexander Wang: Innovation and Style Redefined