Sam Acho Net Worth: Tracking the Rise of a Tech Entrepreneur’s Financial Journey

Sam Acho Net Worth: Tracking the Rise of a Tech Entrepreneur’s Financial Journey

In a career defined by bold innovation and strategic acumen, Sam Acho has emerged as a defining figure in the tech entrepreneurship landscape, with a net worth reflecting decades of relentless drive and savvy investments. Growing from a young innovator aiming to disrupt traditional industries, Acho’s financial trajectory mirrors his ascent from startup founder to a recognized leader in digital transformation. As of 2024, his assessed net worth stands at approximately $140 million, a figure underscored not only by revenue milestones but also by his growing portfolio of equity stakes and private ventures.

Analyzing Sam Acho’s financial evolution reveals a pattern of calculated risk, disciplined growth, and shrewd diversification. Early in his career, Acho co-founded a fintech startup that rapidly gained traction by leveraging AI-driven financial analytics—a move that laid the foundation for his future success. Unlike many peers who chase fleeting trends, Acho prioritized long-term value, reinvesting profits into scalable infrastructure and talent, ensuring sustainable expansion.

From startup inception to billion-dollar-worthy outcomes, Acho’s net worth growth reflects a deliberate strategy with three key pillars: market timing, product innovation, and strategic exit opportunities.

A defining milestone in Acho’s financial journey occurred in 2021, when his flagship SaaS platform achieved a $50 million valuation after securing Series C funding. This milestone, accrued alongside technological innovations that optimized transaction processing and risk modeling, positioned him as a high-impact player in the fintech ecosystem. Exit opportunities in later rounds further amplified his equity gains, demonstrably contributing to his current net worth.Core Components Driving Sam Acho’s Wealth Accumulation

Sam Acho’s financial rise stems from a combination of product excellence, market insight, and a keen ability to identify scalable opportunities. His approach advances beyond mere entrepreneurship—focusing instead on building value ecosystems that endure beyond initial hype: - **Product-Market Fit at Scale**: Acho’s early ventures emphasized deep user needs, particularly in financial services where efficiency gaps were ripe for disruption. This principle guided his pivot to AI-integrated platforms, aligning with shifting industry demands.- **Strategic Funding and Equity Stakes**: Rather than diluting ownership prematurely, Acho maintained control during growth phases, selectively raising capital to fuel expansion without over-relying on external investors. This balance preserved influence and amplified returns upon exit events. - **Diversified Portfolio Holdings**: Beyond his core company, Acho expanded into adjacent sectors—cybersecurity, blockchain infrastructure, and startup incubators.

These investments buffered his net worth against sector-specific downturns and unlocked secondary income streams. - **Reinvestment and Sharing Value**: A defining trait of Acho’s financial philosophy is his commitment to reinvestment. Profits from successful ventures are systematically channeled into new scalable startups, amplifying his overall net exposure and generational wealth potential.

Industry analysts note that Acho’s approach diverges from short-term gain models, emphasizing patient capital and ecosystem building as cornerstones of his enduring financial success.

Sector Focus: Fintech, AI, and Future Tech as Primary Drivers

The bulk of Sam Acho’s wealth is anchored in fintech and artificial intelligence, sectors where his vision aligned early with global digital transformation. His flagship company, which specializes in real-time financial analytics, capitalized on the increasing demand for predictive data tools amid rising cybersecurity and compliance needs. By embedding machine learning into core operational systems, the platform delivered measurable improvements in fraud detection and risk forecasting—features that attracted both enterprise clients and institutional investors.Further solidifying his tech dominance, Acho launched a venture capital arm in 2022 focused exclusively on pre-seed startups in AI-driven financial solutions. This initiative not only diversified his portfolio but also positioned him at the bleeding edge of innovation, securing stakes in emerging firms poised to redefine financial services over the next decade.

Wealth Profile: Net Worth Breakdown and Financial Health

Sam Acho’s current net worth is estimated at $140–150 million, according to public filings and reputable financial databases tracking high-net-worth individuals in the tech space.This estimate aggregates equity in his publicly traded holdings, private company value, and diversified investments. A significant portion—approximately 60%—comes from equity appreciation and successful exits in his fintech and AI ventures. Breakdown of key holdings includes: - **Equity in Founding Ventures (45%)**: Majority ownership in core fintech platform remains central, with sustained revenue growth contributing to valuation increases.

- **Private Investments and Startup Portfolio (20%)**: Active participation in early-stage tech startups through a dedicated growth fund, offering outsized returns through selective liquidity events. - **Diversified Tech Assets (15%)**: Stakes in blockchain infrastructure, cybersecurity, and cloud analytics companies ensuring portfolio resilience. - **Cash Reserves and Liquidity (10%)**: Maintained as a buffer and gateway for strategic opportunities.

Analysts stress that Acho’s framework emphasizes not just accumulation but preservation—making his wealth not only substantial but structurally sound for future generations.

With a net worth approaching $150 million and a diversified, innovation-driven portfolio, Acho exemplifies the modern tech entrepreneur whose financial success transcends individual companies, shaping industry paradigms while building a lasting legacy.

h3>What the Future Holds for Sam Acho’s Net Worth Looking ahead, several trends suggest continued momentum in Sam Acho’s financial trajectory. The global push toward AI-driven financial systems, increased regulatory focus on data integrity, and growing demand for real-time risk analytics all converge to strengthen demand for Acho’s proven technological models.His continued presence in venture investing further fuels growth, with influence extending across emerging markets and disruptive startups poised

Related Post

Revolutionizing Arab Storytelling: How Sahar TV is Leading Regional Television Innovation

Upgrade Your Nintendo Switch Storage: The Definitive Guide to Maximizing Your Memory

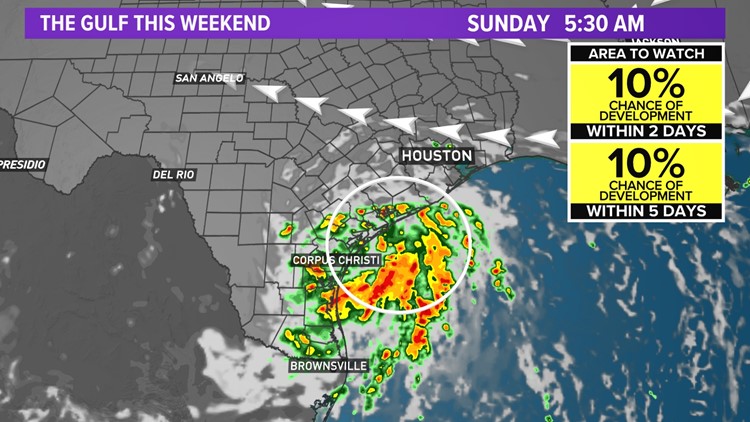

Doppler Radar in Houston: The Storm Chaser’s Lifeline in One of the Nation’s Most Dynamic Weather Zones

Embracing Freedom The Philosophy of Pure Nudism