Quantity Economics vs. Price Economics: Unraveling the Forces That Shape Markets

Quantity Economics vs. Price Economics: Unraveling the Forces That Shape Markets

In the dance between supply and demand, two powerful but often misunderstood forces drive market behavior: the quantity effect and the price effect. While both influence how consumers and producers respond to change, they operate through fundamentally different mechanisms—one rooted in volume, the other in value. Understanding the tension between quantity effect and price effect is essential for businesses, investors, and policymakers aiming to interpret economic signals accurately.

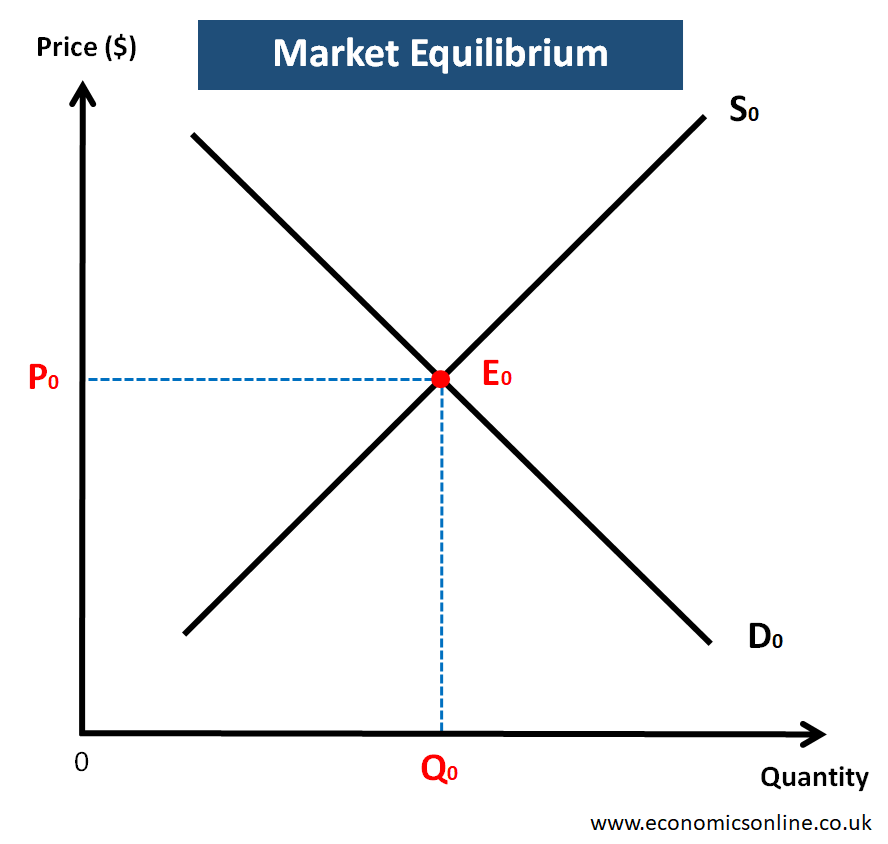

At its core, the quantity effect describes how changes in the amount of a good or service available—its supply—directly impact consumer demand and market equilibrium. When supply increases—say, during a harvest surplus or a manufacturing boost—prices typically fall due to greater availability, stimulating higher demand. Conversely, reduced supply pushes prices upward, tempering consumption.

Economists emphasize this effect as a key driver of short-term market adjustments. Official data supports this: the U.S. Energy Information Administration reports that a 10% rise in oil production historically correlates with a 5–7% drop in global crude prices, demonstrating the potent quantity-side influence.

Unlike the downward pressure of increased supply, the price effect emerges from shifts in perceived value—how buyers evaluate a product’s worth relative to cost. A well-priced item may command higher sales even with static supply, especially if demand remains stable or rises. This effect reflects psychological and economic thresholds: a $100 laptop may deter some buyers, but a $700 price tag for a flagship model might signal superior quality, sustaining demand.

As financial economist Dr. Elena Marquez notes, “Price is not just a number—it’s a signpost of value. Consumers weigh price against utility, brand, and alternatives, making price effect a nonlinear force.” This nonlinearity is critical; small price changes can trigger large demand shifts when combined with strong perceived value, particularly in branded or differentiated markets.

While quantity effect leans on improved availability to reshape supply-demand balance, price effect operates through behavioral economics—how consumers cognitively process cost. Consider consumer electronics: when Samsung introduces a new Galaxy model, pricing strategy often precedes supply scaling. Initial high pricing targets early adopters willing to pay for innovation, reducing immediate supply pressure.

Over time, supply ramps up and prices drop, enabling broader adoption—a classic “price effect unlocked by quantity expansion.” This sequential interplay reveals a deeper truth: markets rarely move on supply or price alone, but on their synergistic push and pull.

Quantitative studies underscore this duality. Research published in the Journal of Economic Perspectives finds that during inflationary periods, supply constraints reduce quantity availability, raising prices.

Yet, price sensitivity varies: essential goods maintain demand even under high prices, highlighting the stabilizing role of quantity in dampening extreme price spikes. In contrast, non-essential luxuries exhibit pronounced price elasticity—small percentage price increases cause large drops in demand, amplifying the significance of price effect management in marketing.

Businesses strategically exploit both dynamics.

Manufacturers adjust production (quantity effect) to stabilize prices during demand surges, while retailers use discounting (swinging price effect) to boost volume. Smarter pricing strategies, informed by real-time supply chain data, balance inventory turnover with margin optimization. For instance, fashion brands often hold limited stock (limiting quantity) to drive urgency, capitalizing on the psychological premium created by scarcity—a subtle manipulation of price effect backed by controlled supply.

From a policy lens, the quantity vs. price dilemma shapes regulation and intervention. Antitrust agencies monitor excessive supply redistribution that distorts prices, while central banks influence aggregate quantity through monetary supply to manage inflation.

The “quantity effect” gains urgency in crises: during the COVID-19 pandemic, global chip shortages reduced automotive production, triggering price surges, while government stimulus aimed to restore supply volume and restore price equilibrium.

Advanced econometric models now track the marginal contributions of quantity versus price in market shifts, revealing nuanced patterns across sectors. In agriculture, supply elasticity dominates seasonal price variations.

In real estate, limited land supply amplifies price escalation, often overriding income growth. Even digital platforms feel this tug-of-war—streaming services adjust content quantity via licensing while pricing models adapt to user retention rates, balancing exclusivity with accessibility.

Ultimately, quantity effect and price effect are not opposing forces but complementary variables in economic architecture.

While quantity effect speaks to physical availability and market saturation, price effect captures subjective value and behavioral response. Their interaction determines everything from daily consumer choices to macroeconomic stability. As market complexity grows, grasping their distinct roles—and their convergence—remains vital for informed decision-making across every discipline.

In the end, the market’s rhythm is dictated by this profound interplay: the more of something exists, the cheaper it tends to become, yet how much buyers are willing to pay hinges on the perceived worth—proof that value is both volume-weighted and price-reflective. Understanding this balance empowers actors across the economic spectrum to anticipate change, shape outcomes, and navigate uncertainty with clarity.

Related Post

Jadiann Thompson Height

Master Unit 3 Progress Check MCQs in AP Chemistry: Unlocking the Secrets to Top Marks

Municipal Vs. Xelajú Mc: The Clash Between Formal Governance and Grassroots Power in Guatemala’s Cultural Heartbeat

A Father’s Silent Language: How Hangman Phrases Shape Language, Culture, and Mind