Phillips Curve Revisited: How Demand-Pull Forces and Supply Shocks Rewrite Economic Expectations

Phillips Curve Revisited: How Demand-Pull Forces and Supply Shocks Rewrite Economic Expectations

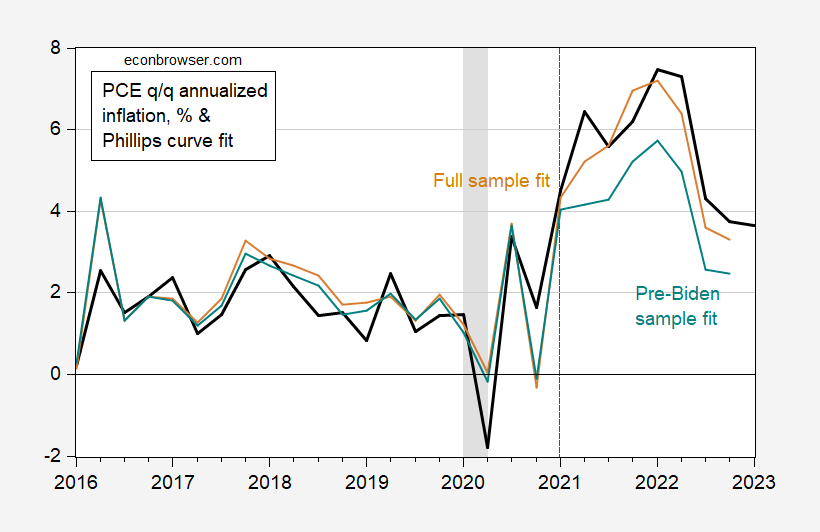

The Phillips Curve, once the cornerstone of macroeconomic theory, remains a vital lens through which economists analyze inflation and unemployment. Originally illustrating an inverse relationship between wage growth and joblessness, it has evolved—strained by real-world shocks that challenge its simplicity. Central to modern interpretation is the interplay between demand-pull pressures and supply-side disruptions, both capable of distorting the curve’s traditional predictions.

In times of dynamic demand surges and sudden supply collapses, the Phillips Curve reveals not just steady trade-offs but complex, shifting equilibria that demand nuanced understanding.

Understanding Demand-Pull Inflation and Its Phillips Curve Implications

The Phillips Curve was classically seen as a guide for policymakers navigating inflation and unemployment: when demand outpaces supply, jobs rise, wages climb, and inflation follows. Yet demand-pull inflation—driven by surging consumer spending, fiscal stimulus, or rapid monetary expansion—presses this equilibrium. “Excess aggregate demand chases limited output, pushing prices higher while pulling labor markets toward full utilization,” explains economist Alan Blinder.This creates a short-term spike in employment and output, but at the cost of rising prices. As workers demand higher wages to keep pace, inflation expectations anchor, steepening the Phillips Curve’s slope and widening the gap between actual and desired inflation.

- Mechanism: Demand-pull inflation emerges when GDP growth outstrips productive capacity, commonly during economic recoveries or policy-driven booms.

- Phillips Curve Signal: A steeper curve reflects heightened inflation responses to small upticks in demand, amplifying volatility.

- Real-World Example: The post-pandemic rebound in 2021–2022 saw demand-pull forces surge as stimulus checks and pent-up consumer spending overwhelmed constrained supply chains, pushing inflation to multi-decade highs in many advanced economies.

While demand-side factors dominate headlines, supply shocks—sudden disruptions that reduce output—introduce equally profound distortions. The Phillips Curve, built on assumptions of stable resource availability, often falters when shocks like energy crises or natural disasters batter production.

These disturbances reduce output capacity regardless of demand levels, generating inflation without the corresponding employment gains characteristic of demand-pull patterns.

Supply Shocks That Break the Phillips Curve’s Traditional Narrative

Supplier-side crises manifest as sharp, asymmetric disruptions: oil price spikes, semiconductor shortages, or extreme weather events. Unlike the gradual demand surge, supply shocks tighten production channels abruptly, pushing prices upward while constraining job growth—直接导致 inflation without strong labor market tightness. This divergence was stark during the 2021–2023 energy crunch, where soaring fuel and gas prices triggered cost-push inflation yet failed to generate widespread wage pressures.As Nobel laureate Paul Krugman noted, “When supply fails, inflation hits supply—a pattern with little room for trade-offs.”

The 2022 global energy crisis offers a textbook instance of supply-side volatility colliding with the Phillips Curve framework. Rising fossil fuel costs—not just higher prices, but reduced economic activity in energy-intensive sectors—created inflationary spikes. Yet unemployment rose only mildly in many energy-exporting nations, while service sectors avoided major labor shortages.

This divergence signaled a structural limitation: the Phillips Curve’s traditional inverse link weakens when supply shocks dominate, as inflation persists without strong demand-pull feedback.

Modern unemployment-inflation dynamics thus demand a dual lens: demand-pull forces that fuel classic trade-offs, and supply shocks that weaken equity across the curve. Policymakers now grapple with the challenge of disentangling these drivers—choosing between tightening policy to curb demand inflation or targeted support to counter supply bottlenecks. “One size fits none anymore,” warns David Dorn, a labor market economist at the Council on Foreign Relations.

Implications for Monetary Policy and Forecasting

Central banks rely on the Phillips Curve to forecast inflationary pressures and guide interest rate decisions.However, persistent supply shocks and complex wage-price spirals have eroded predictability. Traditional models struggle to separate demand from supply influences

Related Post

What Is Pseudo Autism? Decoding the Term and Unraveling Its Misconceptions

MyRock: Redefining Secure Digital Transactions with Unmatched Innovation

From Inches to Centimeters: The Simple, Essential Guide to Convert 411 to Centimeters

Florida Man Strikes Again: June 3 Becomes a Mind-Blowing Benchmark of Chaos