Netflix Cost: Decoding the True Price Behind Your Streaming Subscription

Netflix Cost: Decoding the True Price Behind Your Streaming Subscription

The monthly price tag of Netflix belied a far more nuanced reality—one shaped by global pricing, tiered plans, shared access, and evolving promises. Understanding Netflix cost today requires peeling back the surface to reveal not just the monthly fee, but the infrastructure, content investment, and consumer choices that collectively drive what viewers pay. Netflix’s Basic, Standard, and Premium tiers reflect deliberate segmentation—each designed to deliver distinct entertainment experiences at carefully calibrated price points.

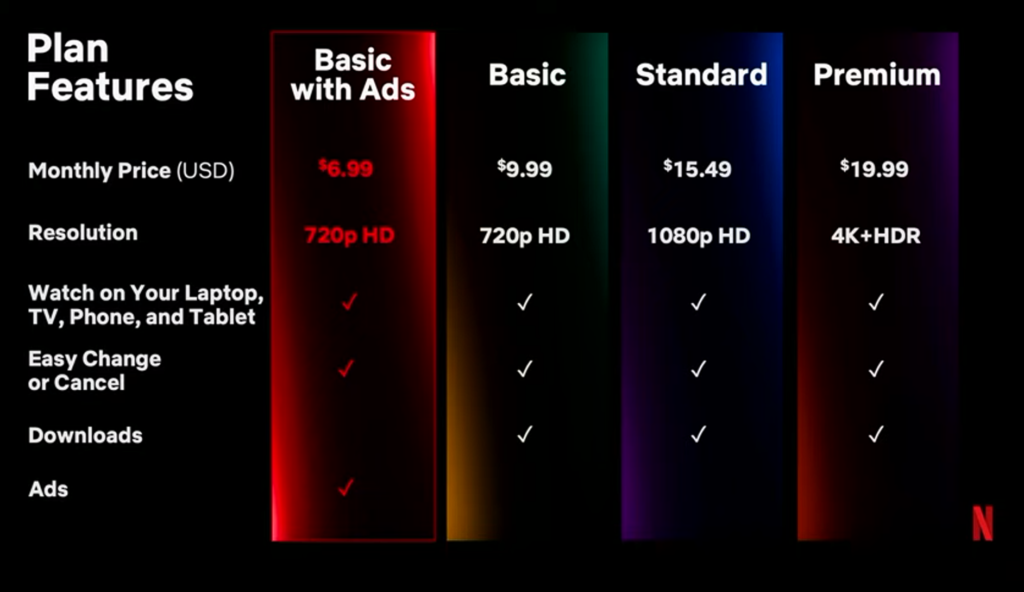

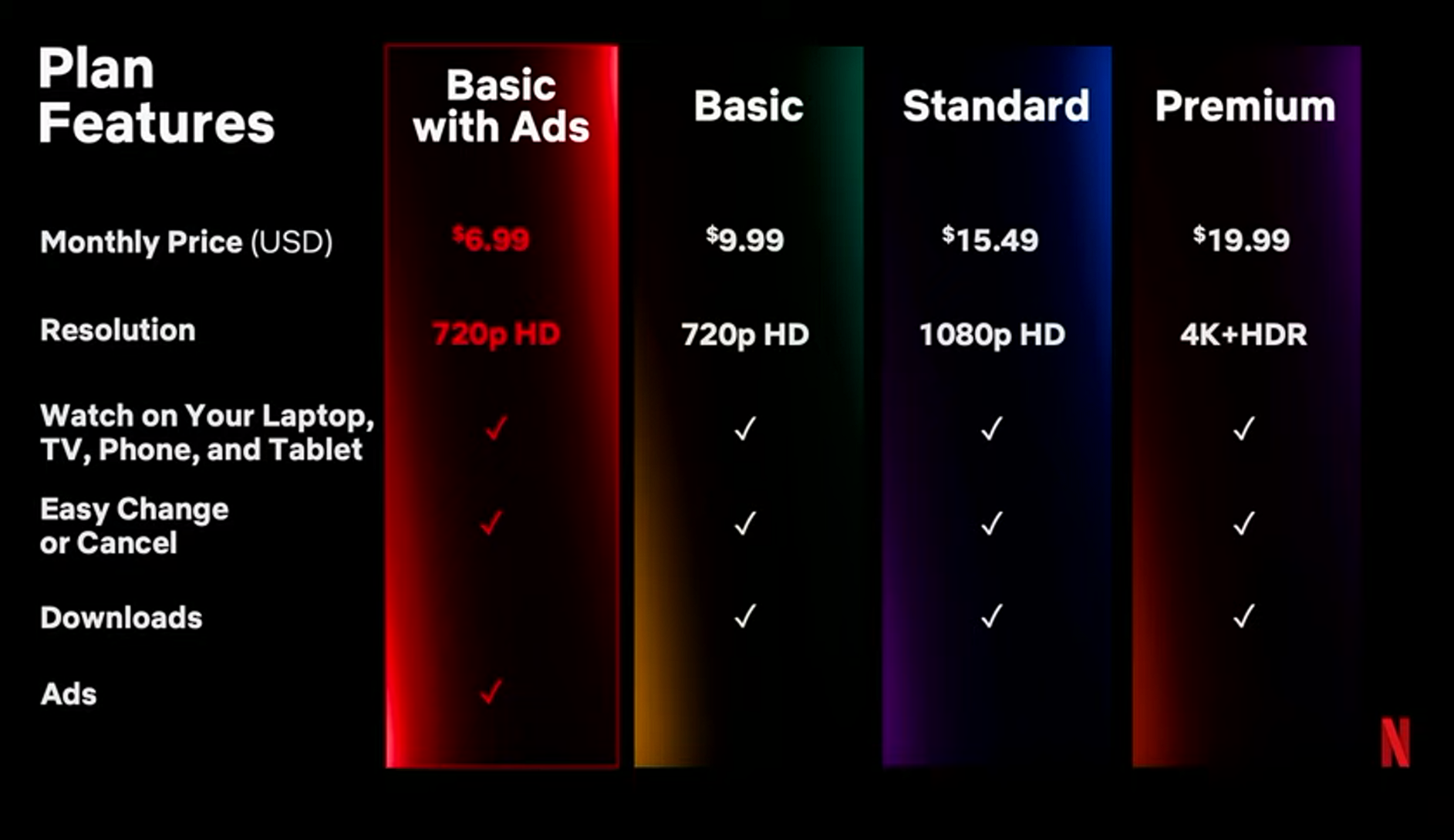

As of 2024, the Basic plan starts at $6.99, offering HD streaming on one device; the Standard plan at $10.99 enables smoother 4K video and multi-device use; and the Premium tier, the most expensive at $22.99, combines ultra-high definition, up to four simultaneous streams, and premium audio quality. These tiers signal Netflix’s strategy: segmenting audiences by desire for video fidelity and simultaneous viewing, rather than a one-size-fits-all model.

Beyond tier selection, the true cost of Netflix hinges on content economic realities.

The streaming giant spends over $17 billion annually on original programming and licensed content—a figure that underscores why high prices are justified by the need to retain and grow subscribers. As Farah Katerji, a senior analyst at StreamWatch Research, notes, “Streaming services now invest more in content than ever before, and those costs are inevitably reflected in your monthly subscription.” The feature-heavy Premium plan, for example, enables quality leadership in a competitive market—justifying its premium price through access to exclusive, high-production-value films and series that remain widely absent on rival platforms.

Shared streaming presents both an opportunity and a challenge.

In many households, multiple users subscribe under a single household plan—often at a reduced per-person cost—allowing households to maximize value. Despite Netflix’s formal restrictions against shared accounts, the social and economic drivers behind split subscriptions reveal a broader shift: consumers increasingly demand flexibility and affordability. In emerging markets, where average household income constrains spending, shared access becomes a necessity, not a loophole.

By 2023, Netflix introduced new subscription tiers aimed at households in high-sharing regions, effectively monetizing what was once a gray area.

The rise of ad-supported plans further reshapes cost dynamics. Introduced globally in phases starting late 2022, these tiered options—starting at $6.99/month—allow viewers to access Netflix with commercial breaks, splitting revenue between advertisers and the service.

Many analysts view this as a strategic pivot: reducing the upfront price while stabilizing long-term profitability in markets where price sensitivity is high. For viewers, it’s a trade-off—lower cost for interruption and data usage limits—but for Netflix, it represents a critical hedge against subscriber churn in price-conscious regions.

Regional pricing disparities illustrate Netflix’s localized cost strategy.

In the United States, where disposable income supports higher tolerance for premium pricing, the Standard and Premium tiers command top-tier fees. Conversely, in markets such as India, Nigeria, or Mexico, Netflix offers budget and regional-tier plans starting as low as $3.99 or $4.99, adjusting for local purchasing power and infrastructure costs. Extended geographically, the service adapts its pricing not just to income levels, but to local competition, internet speeds, and cultural viewing habits—proving that Netflix cost is not static, but dynamically calibrated.

Subscriber growth and retention depend heavily on perceived value relative to price. While initial low pricing helped build Netflix’s global audience, rising costs in saturated markets have spurred a reevaluation of what subscribers expect. Content remains central: binge-worthy originals, global hits like *Squid Game* or *Stranger Things*, and diverse localized stories justify premium tiers.

Yet the threat of cord-cutting and rising alternatives pushes Netflix to monitor price elasticity closely—balancing revenue needs with viewer retention. As David H-modell, digital economy editor at The Streamboard, elaborates, “Every dollar charged carries consumer sentiment. Netflix walks a tightrope: too cheap risks profitability; too expensive risks losing users to lower-cost or free alternatives.”

Shared access, though officially discouraged, persists as a culturally embedded behavior.

In countries like Brazil and Indonesia, families routinely share accounts, with users often switching devices or schedules within households. While Netflix’s account-sharing crackdowns in 2023 aimed to recoup lost revenue—reportedly recovering over $1 billion annually—reported usage of password-sharing apps suggests ongoing demand. The company’s response—introducing official “member add-on” subscriptions with flexible sharing licenses—reflects recognition of user needs while aligning cost capture with usage patterns.

This hybrid evolution reveals that true Netflix cost isn’t merely a monthly fee, but a function of how audiences engage, share, and prioritize streaming time.

Bundling continues to be a powerful leverage in Netflix’s pricing ecosystem. By bundling with mobile carriers, broadband providers, or device makers, Netflix expands access without raising base prices—effectively subsidizing entry through partner ecosystems.

In markets like South Africa and Thailand, such deals allow deeper penetration among price-sensitive consumers, increasing long-term subscriber potential. These bundled arrangements not only reduce churn but position Netflix as more than a streaming service: a gateway bundled into daily digital life.

Looking forward, Netflix’s cost structure faces both headwinds and opportunities.

The ongoing shift toward ad-supported models, AI-driven personalization, and expansive mobile-first content strategies demands continuous pricing agility. Yet with over 214 million subscribers worldwide and $33 billion in annual revenue, Netflix’s ability to maintain a compelling value proposition—even amid market fragmentation—remains clear. The platform’s cost narrative, once simple, now reflects a complex balancing act: sustaining high-quality content investment while delivering accessible, flexible pricing that resonates across cultures and economies.

Ultimately, Netflix’s cost embodies more than a dollar figure—it encapsulates a global entertainment paradigm shaped by innovation, economics, and human behavior. From tiered plans designed for diverse needs, to regional pricing tuned to local realities, and evolving models that balance ads with premium value, every element converges to answer a fundamental question: what do viewers truly pay for when they press play? The answer reveals a streaming leader adapting not just its pricing, but its very relationship with audiences worldwide.

Related Post

Discover Wyoming’s Wild Soul with Jackson Wyoming Tours: A Journey Through Natural and Cultural Wonders

Your Guide To The New York Times Subscription

Is Brianna Kielar Pregnant? CNN’s Missed Anchor Rumor and the Truth Behind the Speculation