Navigating Taxes in Washington: The Washington State Department of Revenue’s Essential Guide

Navigating Taxes in Washington: The Washington State Department of Revenue’s Essential Guide

The Washington State Department of Revenue (WSDR) serves as the authoritative guide for individuals, businesses, and organizations navigating the complexities of state taxation. From income and sales taxes to corporate levies and specialized fees, WSRD provides a comprehensive, transparent framework that empowers taxpayers to meet their obligations with confidence. With a commitment to fairness, clarity, and accessibility, the agency’s published guide distills intricate tax laws into practical, actionable insights—making compliance not only manageable but intelligible.

At the core of WSDR’s mission is the goal of educating Washington residents and businesses through clear, up-to-date information. “We recognize that tax rules can feel overwhelming, especially with frequent changes and regional nuances,” says a WSRD spokesperson. “Our comprehensive guide aims to cut through the confusion by combining authoritative policy with real-world application—ensuring every taxpayer knows exactly what’s expected of them.”

Key Tax Programs Managed by Washington State Department of Revenue

The WSDR oversees several critical tax systems that fund state operations, public services, and infrastructure.Understanding these domains is essential for accurate compliance.

Income Tax: Who Pays, and How Much?

Washington state levies a progressive income tax across multiple brackets, designed to reflect earning capacity. The 2024 tax year features seven rate tiers, ranging from 1% to a top marginal rate of 9%.Residents must file annual income tax returns regardless of filing status—whether single, married, or head of household. - **State Income Tax Rates:** | Filing Status | 1st $11,700 | 2nd $18,600 | 3rd $32,900 | 4th $54,900 | 5th $76,900 | 6th $109,800 | Up to $169,450 | Above $169,450 | - **Dividends & Capital Gains:** Both taxable at ordinary rates, with no preferential treatment under Washington state law. - **Withholding Requirements:** Employers withhold taxes based on employee status, but overlook refunds or credits can trigger year-end adjustments.

PIKE Placeholder: Taxpayers often benefit from WSDR’s interactive withholding calculators, which help estimate quarterly payments and avoid penalties.

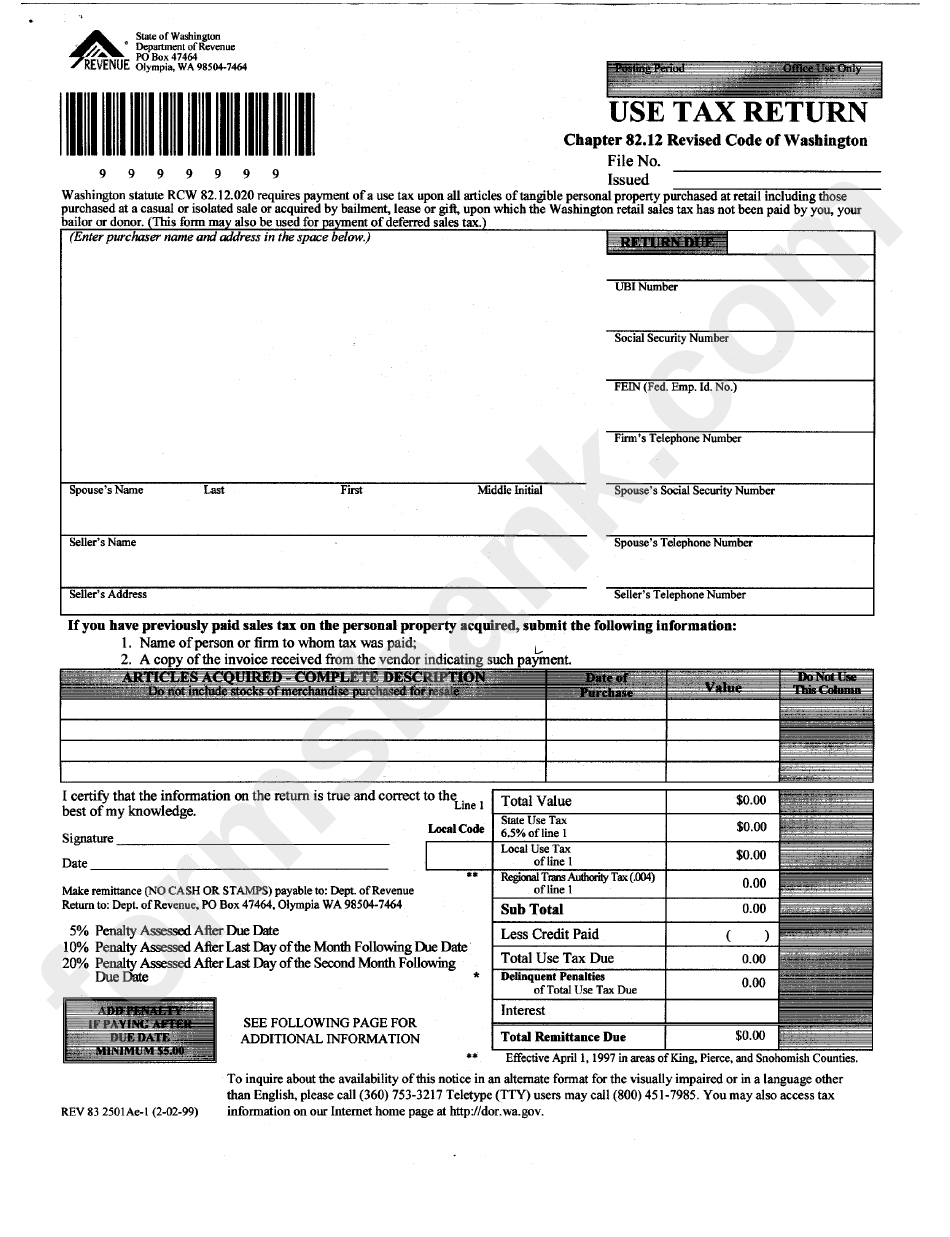

Sales and Use Tax: What You Pay at Checkout

Washington applies a base sales tax of 10%, plus local levies that vary by city and county—ranging from 0% in some rural jurisdictions to over 2.75% in urban centers like Seattle or Spokane. The tax applies to most goods and services, but crucial exclusions include groceries, prescription medications, and certain medical devices.- **Remote Sellers & Nexus Requirements:** Since 2016, out-of-state sellers must collect sales tax if they exceed $100,000 in annual revenue or 200 transactions in the state—a threshold deliberately set to capture digital marketplace activity. - **Use Tax Liability:** Buyers remain responsible for tax on taxable purchases made from outside WA without collection, making records vital during audits.

Corporate & Business Taxes: Navigating Complexity

For businesses—from startups to multinationals—the WSDR’s guidance on corporate income tax, franchise tax, and employment taxes shapes operational strategy.Unlike many states, Washington levies no general corporate income tax based on profit, instead relying on a $250 annual franchise tax per active entity, aligned with corporate revenue and assets. Key obligations include: - Quarterly filings (Form 100 for C-Corporations, Form 44 for S-Corporations) reporting financial activities. - Total Employee Tax Withholding (TEWA) reporting, ensuring accurate wage and tax deposited to the state.

- Navigating nexus rules for multi-jurisdictional operations, especially in e-commerce and remote service provision.

Specialized Levies and Fees

Beyond core taxes, Washington enforces unique charges: - **Lottery Tax:** A 2% levy on gross winnings from state-sponsored games. - **Unemployment Insurance (UI):** Premiums tied directly to employer payroll, assessing risk profiles annually.- **Sinal Health & Environmental Taxes:** Dedicated to public health initiatives and pollution prevention, requiring specialized reporting beyond general tax filings. These fees underscore Washington’s model of using taxation not only for revenue but as a tool for societal investment.

Statewide Tax Administration: Tools, Resources, and Compliance Strategies

The WSDR provides a robust digital infrastructure to assist every taxpayer.Its website offers downloadable forms, interactive calculators, and real-time status checks—features highlighted in a 2023 audit as reducing processing times by over 30%.

Digital Access and Self-Service Platforms

Taxpayers can file returns online via WA4EST, the state’s user-friendly portal accepting Windows-Based and Mac-based systems. The platform supports direct upload of W-2s, 1099s, and payroll data—streamlining submission and minimizing errors.“Our digital transition reflects a commitment to accessibility and efficiency,” notes the WSDR’s communications director. “Web-based tools eliminate the need for physical franchises or paper filings, leveling the playing field.”

Education and Outreach Initiatives

Definition of tax terms, deadlines, and compliance nuances remains a top priority. WSDR produces quarterly webinars, fact sheets in 12 languages, and targeted outreach to underserved communities.For example, the “Tax Markets initiative” hosts free sessions in rural counties, addressing unique challenges faced by seasonal workers and small farmers. - **Identity Theft Protection:** WSDR warns taxpayers to safeguard personal information, offering free credit monitoring services for those impacted by breaches. - **Refund Advching:** Automated email alerts for refund status help taxpayers plan cash flow in line with official timelines (typically 6–10 weeks post-filing).

Common Pitfalls and How to Avoid Them

Missteps in tax compliance are often avoidable with attention to detail. Key errors include: - Failing to update withholding flags when employment status churns. - Neglecting remote seller nexus thresholds, exposing unknowing sellers to audits.- Misapplying exclusion limits on sales tax, such as improper grocery reporting. WSRD emphasizes proactive reconciliation: reconcile bank records monthly, verify third-party reporting (e.g., 1099s), and retain supporting documents at least three years.

Next-Level Compliance: Working with WSDR and Professional Support

While WSDR’s resources are comprehensive, complexity demands expert guidance for high-risk or high-value scenarios.Businesses generating significant revenue or operating across multiple tax jurisdictions benefit from certified public accountants (CPAs) and tax attorneys familiar with state-specific codes. Partnerships between taxpayers and the WSDR continue to evolve, with emerging tools like AI-driven eligibility checkers and personalized compliance dashboards enhancing transparency. Additionally, the agency collaborates with municipalities to clarify local sales tax obligations—especially critical as urban growth redefines tax geography.

The Washington State Department of Revenue’s comprehensive guide transcends mere regulation—it empowers informed civic participation through clarity, consistency, and continuous innovation. By demystifying tax obligations and equipping taxpayers with reliable tools, WSRD ensures the state’s fiscal health and public service delivery remain grounded in accountability and trust. In an era of rapid economic change, this proactive, taxpayer-centric approach sets a national benchmark for effective state revenue administration.

Related Post

You’re Still In My Heart: A Deep Dive into the Enduring Emotional Legacy of Love That Never Fades

Jeremy Allen White Height: The Architect’s Tower Height Reveal That Elevates His Legacy

Who’s Behind Bars in Volusia County? A Deep Dive Into Jail Inmates

Unraveling the Social Media Phenomenon: The Instagram Viral Girl Sex Video