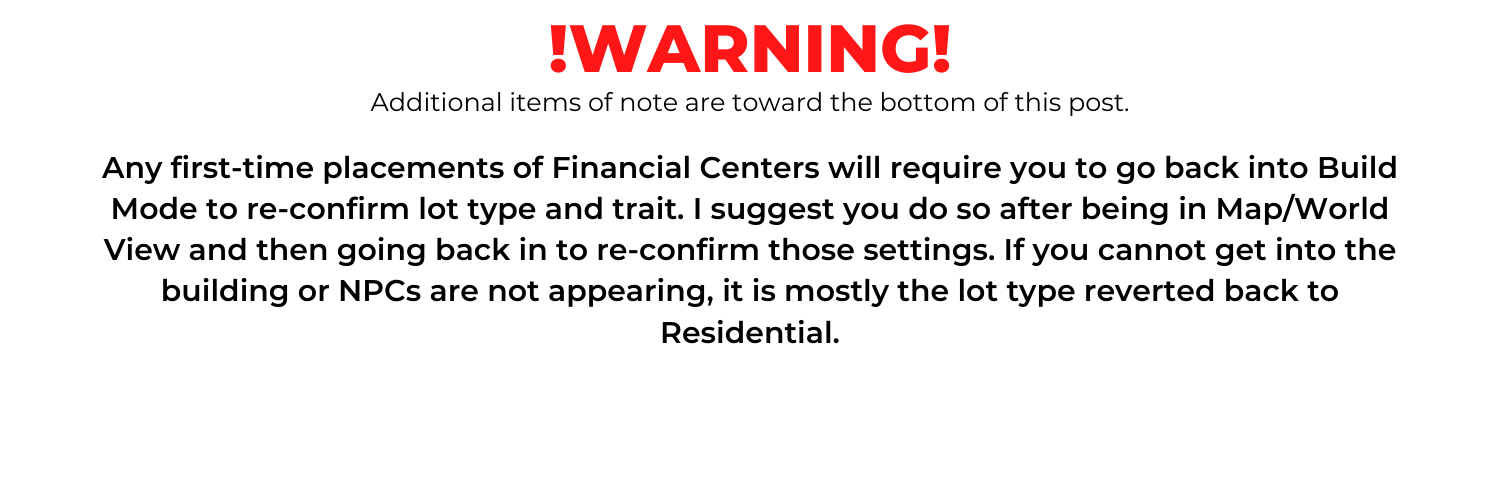

Mastering Fine Living: How SNB Bank Sims 4 Transforms Virtual Wealth and Currency Management

Mastering Fine Living: How SNB Bank Sims 4 Transforms Virtual Wealth and Currency Management

In the immersive world of The Sims 4, SNB Bank Sims 4 has emerged as a pivotal financial pillar that elevates virtual economies from simple transactions to elaborate systems of investment, savings, and controlled luxury spending. Designed specifically for Sims enthusiasts seeking authenticity and realism, SNB Bank combines the trusted Swiss banking experience with dynamic gameplay mechanics that mirror real-world monetary behavior—turning virtual wealth into a powerful narrative tool.

At the core of SNB Bank Sims 4 lies a robust financial architecture built around user accessibility and extended longevity.

Unlike static in-game currencies, SNB offers real-time balance tracking, interest generation, and loan options, enabling lengthy economic arcs. “The SNB system isn’t just about storing money—it’s about enabling Sims to explore financial responsibility, entrepreneurship, and long-term planning,” says gaming analyst Nathalie Duhart, frame designer for a key SNB Interface update. “It turns cash into a living, breathing component of personality and story.”

What sets SNB Bank apart is its integration of banking tools that simulate genuine financial activity: deposit accounts with verifiable interest rates, checking suffixes that reflect spending tiers, and loan categories ranging from small business startups to home renovations.

These features give Sims the ability to manage liquidity with precision—critical for running virtual empires, supporting friends, or simply enjoying modern comforts like upgraded furniture or exclusive vacations.

One of the standout elements is the SNB’s dynamic balance alerts and transaction histories, which reward careful financial oversight. Players gain insight into spending patterns through detailed reports, encouraging habits like budgeting, saving, and strategic investing.

“Players are no longer just recipients of funds—they become active stewards of capital,” explains game designer Markus Friedrich. “SNB simulates the emotional weight of financial decisions: saving for emergencies, investing in growth, and experiencing the consequences of debt.”

Realism is further enhanced through tiered savings plans and bonus incentive mechanics: consistent monthly deposits generate passive interest, while reaching milestones unlocks rewards like interest boosts, loan freedom, or even bonus gifts from the bank. Players often leverage these features to mimic real-world financial milestones—turning casual play into a sophisticated exercise in virtual wealth management.

Building Realistic Financial Behavior in Virtual Lives

< loadb_code>SNB Bank Sims 4 redefines how virtual finances influence gameplay dynamics by bridging entertainment with practical monetary literacy. For many players, the bank isn’t just an endpoint but a strategic asset—a revolving hub where savings grow, debts are managed, and financial identity is shaped. By simulating real-life banking components, SNB encourages sustained engagement through tangible goals: funding a dream project, expanding a business, or simply enjoying financial peace of mind.

Next-level realism emerges through customizable account tiers.

Players can choose daily limits, premium services, or manager access, adding layers of control that mirror actual banking choices. Reports and balance summaries keep Sims informed, enabling transparent decision-making. As “financial storytelling tools,” these features transform money from a background element into an active narrative driver.

The Interface and Its Role in Player Engagement

< p>SNB’s interface in The Sims 4 emphasizes clarity and interactivity, with color-coded transaction histories, push notifications, and visual balance indicators. This user-friendly design reduces friction, encouraging long-term inclusion and discipline. Sims who regularly interact with the bank exhibit better financial habits—saving more, avoiding unnecessary debt.“The interface doesn’t just show money—it communicates value,” says behavioral game designer Lena Zimmerman. “Players internalize responsibility faster when they see real-time effects of their choices.”

Moreover, integration with other Sims systems—such as job clubs, friendships, and purchases—amplifies financial realism. A Sim earning a consulting salary can invest that income through SNB, then fund a dream home or launch a side business.

These interconnections turn banking into a catalyst for character development and life progression, elevating it beyond a simple utility into a cornerstone of virtual achievement.

Financial Diversity and Long-Term Sustainability

< p>SNB Bank Sims 4 also incorporates diverse financial pathways to reflect varied life choices. Players may operate a conservative savings account, pursue high-yield investment plans, or access credit to fuel expansion—each path impacting long-term outcomes differently.Loan conditions prevent reckless spending abuse, teaching disciplined growth through checks and balances.

Importantly, the system discourages short-term excess. High-interest debt triggers warnings and limits, nudging Sims toward sustainable habits.

“The goal isn’t just accumulation,” Friedrich explains. “It’s about building assets that endure. SNB encourages patience, planning, and balance—just as in real life.”

This carefully designed structure ensures that SNB Bank remains relevant across playthroughs, appealing to both casual builders and dedicated financial storytellers.

By blending realism with gameplay depth, the system creates lasting value that enriches the Sims experience far beyond mere entertainment.

Practical Takeaways: SNB Bank as a Tool for Player-Driven Success

< section>For the keen Sims player, SNB Bank Sims 4 is more than a feature—it’s a mechanism for immersive economic agency. Managing liquidity with real interest, interest-reinvested savings, and structured decision points, players cultivate narratives of financial growth and responsibility.

Whether funding a successor’s education, launching a boutique, or simply savoring the quiet pride of a stable account, the SNB bank systems deepen engagement through tangible milestones.

Consider the practical mechanics: deposits earn interest over time; loans offer growth capital but require repayment discipline; budget tracking promotes mindful spending. These systems simulate the full financial lifecycle

Related Post

P5 Pentalobe Screwdriver: The Unsung Hero of Precision Engineering

How Cloudfront Transforms Global Content Delivery with Lightning-Fast Speed

Trump & Fox News Polls: Unpacking the Enduring Coalition in American Politics

Unlocking the Power of ReadAnyBook: Your Gateway to Unlimited Knowledge at your Fingertips