Master Your JCpenney Credit Card Payments: 7 Simple Ways to Pay On Time and Avoid Fees

Master Your JCpenney Credit Card Payments: 7 Simple Ways to Pay On Time and Avoid Fees

Navigating credit card payments for a major retailer like JCpenney can be straightforward—if you know the right methods. Whether you’re a first-time user or a long-time cardholder, paying your JCpenney card bill on time requires accessible, reliable options that fit modern lifestyles. From mobile payments to automated plans, streamlined pay methods help users stay compliant with billing cycles and avoid late fees that often apply.

This guide reveals the most effective—and user-friendly—ways to settle your JCpenney credit card debt with confidence and ease.

Understanding the billing cycle is fundamental. JCpenney credit cards typically report charges monthly, with statements arriving by the 28th or 29th of each billing period, due on the 5th or 10th of the following month.

Staying ahead means more than just remembering the deadline—it means choosing a payment method that minimizes friction. With increasing digital adoption, paying online via your card issuer’s website or mobile app has become the dominant choice, offering instant confirmation and real-time transaction tracking.

Top 7 Easy Ways to Pay Your JCpenney Credit Card Bill

To make paying manageable, consider these practical, widely supported methods:1. Pay Directly Through Your JCpenney Account Portal

Accessing an online portal is one of the fastest routes.Log into JCpenney’s website or mobile app, navigate to the “My Account” section, and locate the “Pay Invoice” feature. This interface lets you enter your credit card details securely, set payment amounts, and schedule recurring payments—often with just a few clicks. Many cardholders praise the portal’s clean design and 24/7 availability, which supports quick adjustments to payment amounts or due dates, reducing stress during unexpected expenses.

2. Set Up Automated Monthly Payments

Automation ensures consistency and prevents missed payments. Link your credit card to an automatic debit from your bank account through your card issuer’s online system.This method not only guarantees on-time payment but often includes built-in protection: if for some reason a payment fails, alerts are sent, and you get ample time to remedy the issue—such as covering the shortfall promptly. According to user feedback, automation reduces anxiety about payment dates and lowers the risk of late fees by up to 90%.

3.

Use Mobile Wallet Integration Technology meets convenience through mobile wallets like Apple Pay, Samsung Pay, or PayPal. Most major credit card networks accept these digital wallets for bill payments. Near-field communication (NFC) enables tap-to-pay at checkout or within apps, while integrated wallet systems sync directly with JCpenney’s account via secure APIs.

“I love paying with my phone—it’s fast and seamless. I never have to search for my card details,” notes one loyal customer. This approach works particularly well for on-the-go shoppers who want payments in under a minute.

4. File a Payment via Phone with Customer Service

For those preferring verbal guidance, calling JCpenney’s customer service line offers a direct channel. Speaking to a representative allows troubleshooting—like resetting payment methods, checking billing status, or confirming recent charges.Skilled agents can process one-time payments instantly or setup a future payment plan, often with some flexibility and limited fees. Note that wait times may vary, but dedicated lines for credit card support ensure your concerns receive prompt attention.

5.

Send a Paper Check (Still a Viable Option) Despite the rise of digital tools, submitting a physical check remains an option. Write the check clearly, endorse it, and mail it to JCpenney’s billing address—found on your latest statement or website. While slower and riskier due to mail delays, this method provides a tangible record and is ideal for those who distrust online transactions.

Keep copies of signed checks and track postage for peace of mind.

6. Use Third-Party Payment Services (with Caution)

Platforms like Venmo, Cash App, or Zelle integrate smoothly with credit card billing.You can link your credit card to these apps to split payments or transfer funds quickly. However, users should be cautious: fees may apply if converting cash to card, and timing delays between app transfer and bank update might risk late payments. Always verify the amount before finalizing

Related Post

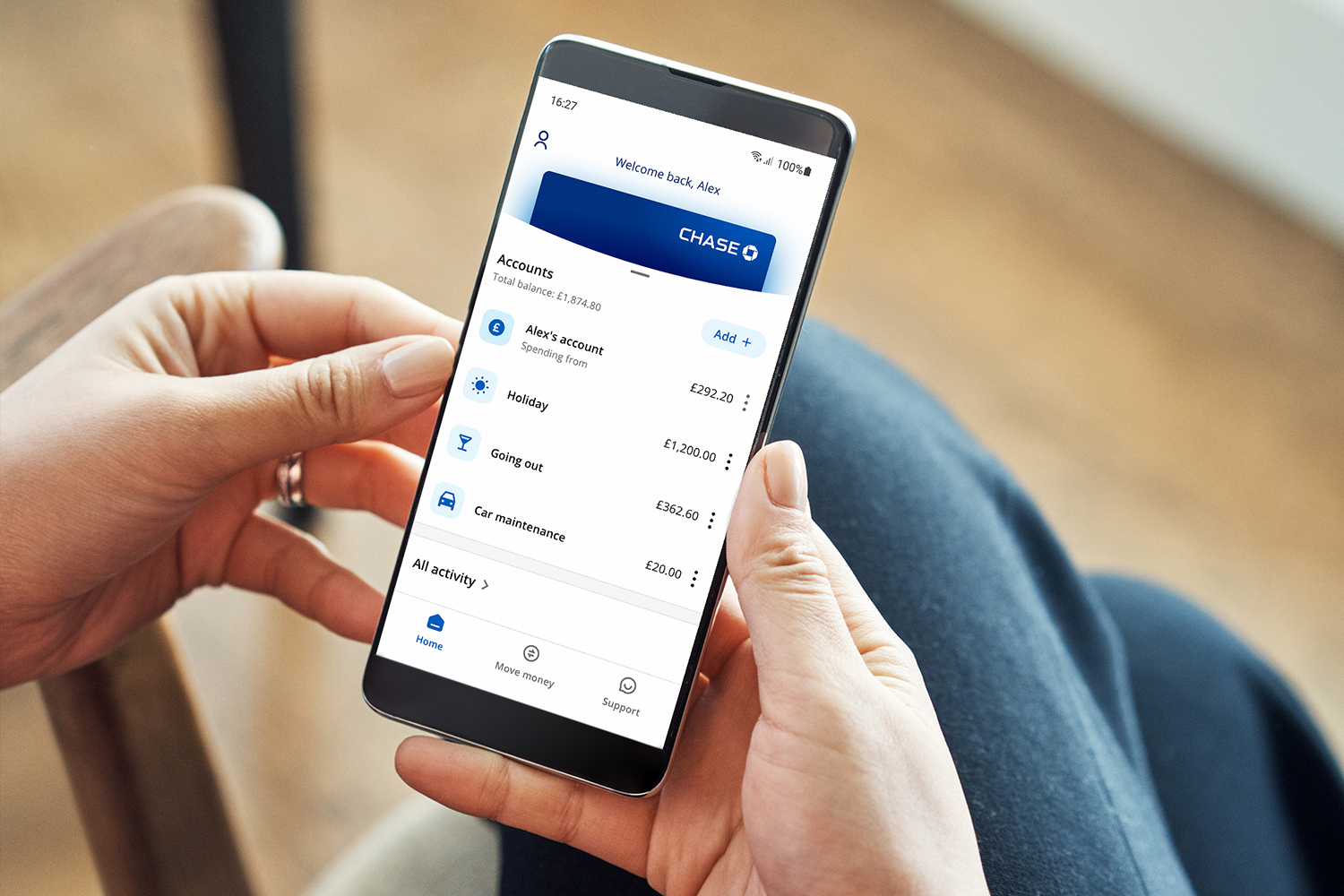

Unlock Your Financial Potential with the Chase App: Smart Banking, Real Insights and Unmatched Convenience

The Nostalgic Magic of Trailer Park Bubbles Glasses: Vintage Style Icons Unveiled in the 15 Best Episodes

Parents Guide The Godfather: Navigating A Film That Shaped Cinema and Consequence

Decoding Chime In Meaning: The Silent Language Shaping Financial Transactions Today