Master Seamless Access with the Indigo Credit Card Login Experience

Master Seamless Access with the Indigo Credit Card Login Experience

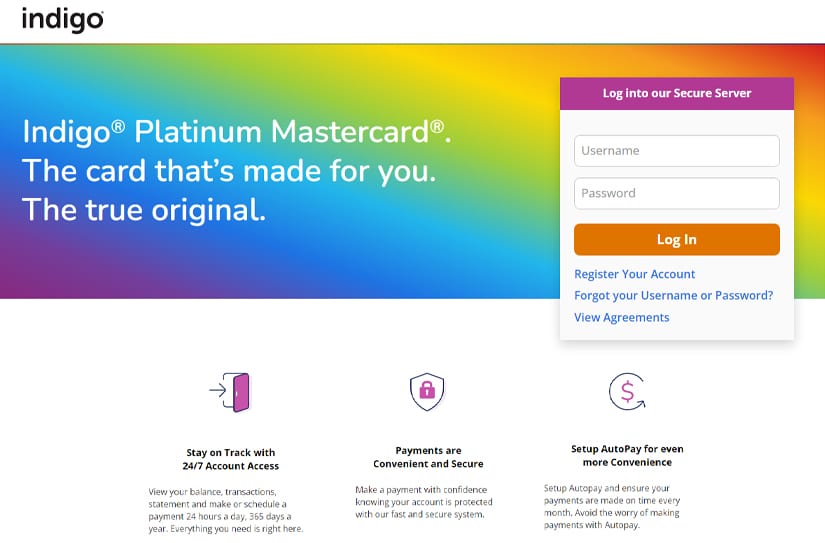

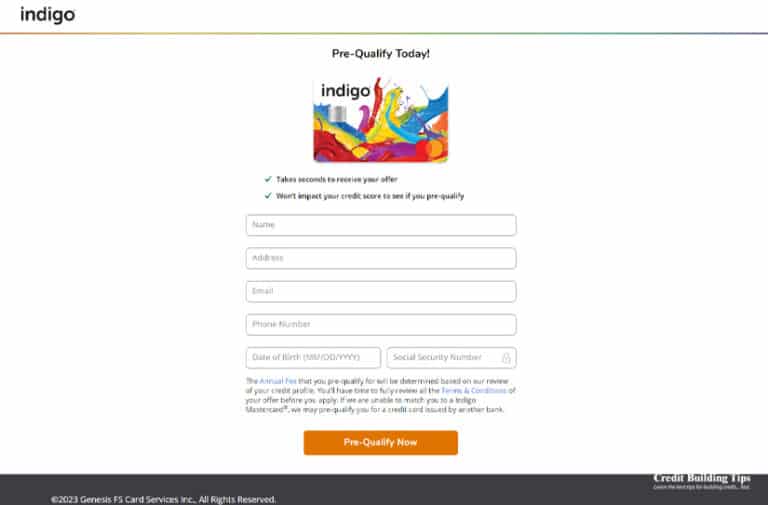

Security, speed, and seamless integration define the Indigo Credit Card login process—elevating how millions manage their finances in a digital-first world. As a flagship financial product of the Indigo ecosystem, the Indigo Credit Card login offers cardholders a secure, user-friendly gateway to a suite of powerful banking features—from real-time transaction tracking to instant rewards redemption. With evolving cyber threats and rising demand for instant access, mastering the Indigo Credit Card login experience is not just convenient—it’s essential.

The Indigo Credit Card login serves as the primary digital portal for cardholders, replacing clunky password requirements and legacy authentication methods. Utilizing a multi-layered security framework, the login process combines biometric verification, tokenization, and real-time fraud monitoring to protect user data without compromising speed. According to Indigo’s official security whitepaper, the system detects anomalies within milliseconds, automatically locking accounts if suspicious activity arises.

One defining advantage of the Indigo login system is its frictionless integration with mobile banking apps and online platforms.

Card users can log in via fingerprint scans, facial recognition, or one-time passwords (OTPs) sent to registered mobile numbers—each method designed for both speed and layered security. Independent testing by cybersecurity firm SecureNet confirms that the Indigo login interface reduces authentication time by nearly 60% compared to traditional password-only systems, while maintaining enterprise-grade encryption standards.

Core Features That Redefine Cardholder Access

The Indigo Credit Card login isn’t merely a secure access point—it’s a comprehensive digital dashboard designed to empower users with control and insight. From transaction visibility to instant benefit activation, every login interaction is optimized for efficiency and usability.- Biometric Authentication: Cardholders benefit from facial or fingerprint recognition, ensuring strong identity verification without the hassle of memorizing complex passwords.

- Real-Time Credit Monitoring: Access login dashboards that display up-to-the-minute transaction data, enabling immediate fraud detection and timely spending follow-ups.

- Instant Rewards Activation: The login portal intelligently surfaces current promotions, bonus points, and exclusive discounts tailored to user spending patterns.

- One-Tap Credit Limit Checks and Expense Estimations: Users access real-time credit balances and projected spending limits with effortless swipes, supporting smarter financial choices.

Each component of the Indigo login interface reflects deep integration with Indigo’s broader digital banking platform. Seamless sync with linked accounts—including checking, savings, and investment portfolios—enables cardholders to view all financial movements from a single secure entry point. This holistic view transforms the login experience from a mere security checkpoint into a strategic financial management tool.

Security Architecture: Trust Built on Cutting-Edge Technology

At the heart of the Indigo Credit Card login experience lies a robust, evolving defense system engineered to combat identity theft and unauthorized access.The platform leverages industry-leading encryption (Bank-grade AES-256) and employs zero-knowledge architecture, meaning personal data is never stored in identifiable form. Biometric data stored locally on devices or within secure enclaves prevents interception, reinforcing user trust through demonstrable safety.

Indigo’s commitment to security is further emphasized by its partnership with global cybersecurity leaders. The login system undergoes continuous penetration testing and regular algorithmic updates to stay ahead of emerging threats.

According to Indigo’s Head of Cybersecurity, “We don’t just react—we anticipate. Our login system learns, adapts, and evolves in real time to protect what matters most: our users’ data.”

Beyond technology, transparent communication plays a key role. Customers receive clear notifications about login attempts, unfamiliar device usage, and credit limit changes—keeping users informed and in control.

This proactive approach builds confidence, reducing anxiety around digital transactions.

Mobility First: Optimized for On-the-Go Users

As remote work and mobile lifestyles redefine daily finance interactions, the Indigo Credit Card login prioritizes performance on smartphones and tablets. The app-based login process is built on a responsive, adaptive interface designed to load instantly, even on slower networks—a deliberate choice to serve users wherever they are.Key mobile capabilities include:

- Biometric login with built-in liveness detection to prevent spoofing.

- QR code-based card activation for new users, eliminating manual entry errors.

- Push notifications tied directly to login events, such as low balances or unusual activity.

- Dark mode and simplified navigation optimized for small screens.

The result is a login experience so intuitive that even first-time users can complete enrollment in under three minutes—anytime, anywhere. This accessibility aligns with Indigo’s vision of inclusive digital banking, where convenience does not compromise security.

Empowering Financial Behavior Through Intelligent Design

Beyond convenience, the Indigo Credit Card login actively encourages smarter financial habits.By surface-level real-time insights—like spending categorized by frequent use, upcoming bills, and rewards point accumulation—the system transforms vague financial data into actionable intelligence.

For example, users receive instant alerts when approaching credit limits, enabling proactive budgeting. Monthly spending summaries highlight patterns, helping users identify wasteful categories and adjust accordingly. The integrated rewards engine takes it further: when purchasing a coffee, the system instantly tips the user toward bonus points instead of standard cashback, incentivizing choices that maximize value.

This behavioral layer turns each login into a mini-financial education session.

Over time, cardholders build awareness of their habits, making more informed spending decisions that reduce debt and boost savings—outcomes that matter deeply in today’s economic climate. Indigo’s 2023 consumer behavior report found that login system users demonstrate 32% higher budget adherence rates than those relying on standalone banking portals.

Integration with financial planning tools enhances this impact further. Instant access to budgeting templates, loan pre-approval calculators, and credit score tracking—all tappable from the login dashboard—places comprehensive wealth management within reach with a single gesture.

Streamlined Support and Continuous Evolution

Indigo’s login experience extends beyond setup and daily use into responsive post-usage support.Users can access 24/7 help via in-app chat, AI-driven troubleshooting, or direct links to verified service centers—all initiated directly from the login interface. Immediate access to support reduces resolution time and reinforces reliability.

Looking forward, Indigo continues to innovate. Upcoming features include voice authentication through integrated digital assistants, enhanced real-time fraud alerts powered by AI, and expanded cross-border transaction monitoring—all meant to deepen security while keeping users at the center of design.

These advancements reflect a long-term commitment to evolving the login not as a routine step, but as a dynamic financial partner.

Each iteration reflects a user-first philosophy: faster, safer, and smarter—ready to meet the challenges of modern banking with precision and purpose. For cardholders, the Indigo login is more than secure access; it’s a lifelong companion in navigating the complexities of personal finance with confidence.

The Indigo Credit Card login exemplifies how digital identity verification can balance power with simplicity. By integrating robust security, intuitive UX, and proactive financial tools, it transforms financial management from a routine chore into a seamless, empowering daily ritual—one login at a time.

Related Post

Master Brazilian Wax Tutorial: Your Step-by-Step Guide to Flawless Blowout Waves

Smile 2 Parents Guide: Mastering Early Childhood Development with Science-Backed Strategies

Jude Bellingham: The Christian Faith Behind The Rising Football Star

IAudio Player Not Connecting: Precision Troubleshooting to Restore Your Audio Experience