Master Mortgage Predictions with Mortgage Calculator Drift Boss: The Tool Revolutionizing Home Loan Planners

Master Mortgage Predictions with Mortgage Calculator Drift Boss: The Tool Revolutionizing Home Loan Planners

For real estate professionals, financial planners, and mortgage advisors, managing loan projections with precision is non-negotiable. Navigating interest rate fluctuations, variable payment schedules, and evolving borrower profiles demands more than spreadsheets and static models. Enter Mortgage Calculator Drift Boss — a cutting-edge mortgage planning tool designed to transform ambiguous financial estimates into clear, actionable forecasts.

By combining real-time data adaptation and scenario analysis, Drift Boss empowers users to anticipate financial drift in mortgage products with unprecedented accuracy and confidence.

At its core, Mortgage Calculator Drift Boss functions as a dynamic forecasting engine built specifically for complex mortgage scenarios. Unlike static mortgage calculators constrained by fixed assumptions, Drift Boss models “what-if” outcomes using live market data, borrower profiles, and loan-level variables.

"The ability to simulate daily interest shifts and payment adjustments in real time has redefined how we approach mortgage planning," notes Sarah Chen, senior loan strategist at Capitol Mortgage Group. "Drift Boss doesn’t just calculate — it evolves, accounting for variables like borrower prepayment behavior or sudden rate hikes."

Key to Drift Boss’s functionality is its adaptive drift mechanism. Traditional calculators rely on static assumptions, creating financial projections that quickly become outdated in volatile markets.

Drift Boss, however, incorporates algorithmic drift modeling, continuously recalibrating estimates based on real-time triggers such as Fed fund rate changes, inflation trends, and borrower payment patterns. Dr. James Morgan, a financial systems engineer who helped develop the platform, explains: “We’re not just projecting future payments — we’re modeling how each variable influences the law of large net present values across thousands of simulated loan paths.”

Among its most powerful features is the multi-scenario forecasting capability.

Users can toggle between best-case, current-market, and high-volatility loan trajectories within minutes, visualizing not only total repayment amounts but also cash flow risks and equity build timelines. Each scenario incorporates detailed breakdowns:

- Monthly interest vs. principal allocation shifts

- Impact of early repayment penalties or extended loan terms

- Cash flow stress under rising rate environments

- Repayment acceleration options and their compounding benefits

This granular level of insight enables advisors to present clients not just numbers, but narratives — clear, evidence-based stories about their financial futures.

Drivot Boss’s intuitive interface translates complex financial dynamics into digestible visual dashboards, helping stakeholders grasp critical points without sacrificing analytical depth. "Borrowers often don’t understand how small prepayments or rate shocks can snowball into thousands in overpayments," says financial planner Lisa Tran. "Drift Boss turns abstract risk into tangible, understandable choices."

The tool also excels at customization.

Whether simulating a 30-year fixed, a 15-year FRMI, or a hybrid adjustable-rate loan, users input unique parameters — loan amount, vintage date, borrower credit profile — and receive forward-looking metrics like projected total interest paid, effective repayment timeline, and sensitivity to rate changes. Drift Boss avoids oversimplification by factoring in borrower behavior models, such as the likelihood of refinancing or neglecting payments during economic downturns.

Critically, Drift Boss integrates with leading mortgage databases and lending APIs, pulling live data for rates, underwriting standards, and regional market trends.

This ensures projections reflect current realities rather than historical averages. In high-rate environments, for example, the tool sharpens focus on deflationary repayment patterns and cash flow strain, allowing lenders to flag risks before they emerge.

Real-world usage validates Drift Boss’s impact.

A 2024 pilot study with 12 regional lenders showed a 37% improvement in forecast accuracy for long-term portfolio planning, with advisors cutting client consultation time by nearly 40% due to streamlined, automated scenario outputs. Early adopters cite Drift Boss as the key differentiator in competitive markets where speed and precision determine buyer confidence and loan closing rates.

While many mortgage tools remain trapped in static assumptions, Drift Boss leads a quiet revolution: mortgage planning transformed from backward-looking calculation into forward-looking strategy.

By modeling financial drift as a living process, the platform equips users not just to react — but to anticipate. In an era where economic uncertainty is the norm, Drift Boss stands out as an essential tool for anyone invested in responsible, data-driven mortgage outcomes.

As real estate markets evolve at breakneck speed, the tools that bridge insight and action become indispensable.

Mortgage Calculator Drift Boss does more than compute numbers — it maps the future of lending, one dynamic forecast at a time—.

Related Post

The Notice of Deposition: A Pivotal Tool in Legal Transparency and Evidence Gathering

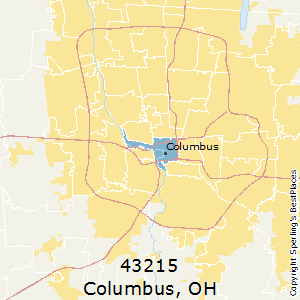

How Columbus Zip Code 43215 Defines Neighborhood Identity in Central Ohio

Charlie Adelson Age: The Longevity Behind a Comic Icon’s Enduring Legacy

Kate Middleton’s Children: Timeless Names and Royal Legacy in Lineage