Market of Loanable Funds Unveiled: How Supply, Demand, and Interest Rates Shape Economic Growth

Market of Loanable Funds Unveiled: How Supply, Demand, and Interest Rates Shape Economic Growth

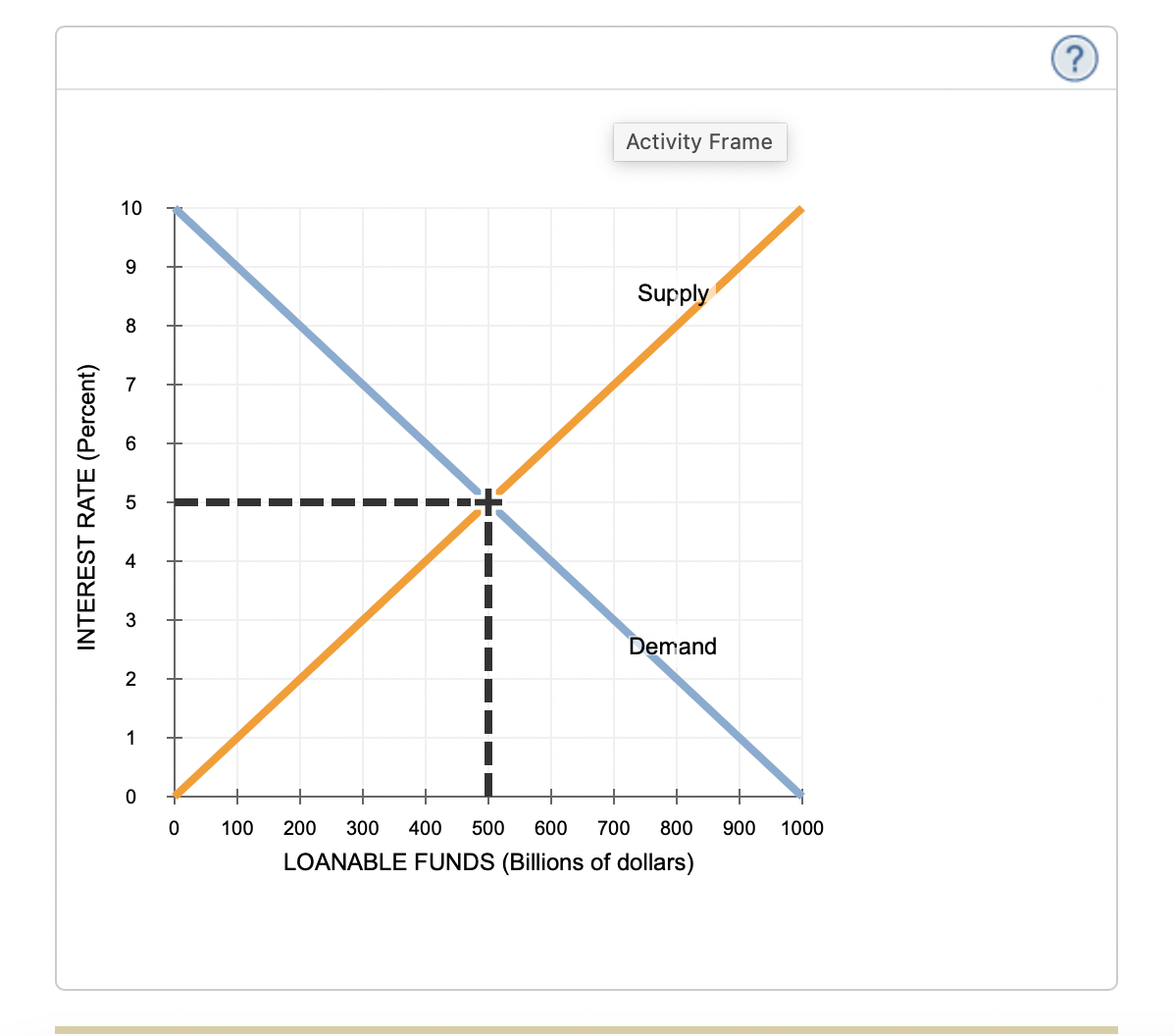

The Market of Loanable Funds, visualized through a dynamic supply-and-demand graph, offers a powerful lens into how savings and investment interact in an economy. This model explains the determination of equilibrium interest rates and levels of loanable funds—critical drivers of business expansion, housing markets, and long-term economic growth. By tracing shifts in demand for borrowing and supply of savings, the graph reveals the invisible forces that shape financial conditions, reflecting broader macroeconomic trends visible across regions and time.

The Dynamics Behind the Loanable Funds Curve

At its core, the loanable funds market balances the total supply of savings—aws individuals, firms, and governments setting aside income—and the total demand for loans issued by businesses financing projects and households financing major purchases.

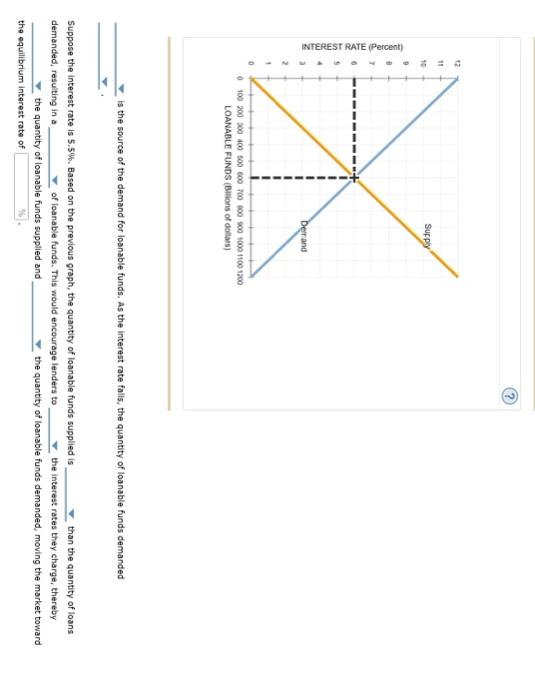

The equilibrium occurs where these two curves intersect, setting a clear equilibrium interest rate. When demand outpaces supply, interest rates rise, incentivizing greater saving and discouraging borrowing; conversely, ample supply pushes rates down, encouraging investment and spending.

Understanding this model requires unpacking three fundamental components:

This self-correcting process ensures resources flow efficiently from savers to productive uses.

Graph Anatomy: Demand and Supply Curves in Action

The market is conventionally represented with loanable funds on the vertical axis and quantity on the horizontal, featuring two distinct curves:

- Demand Curve (Downward Sloping): As interest rates decline, borrowing becomes cheaper, increasing venture capital for startups, home construction, and business equipment purchases. Higher rates discourage loans, reducing investment.

- Supply Curve (Upward Sloping): Higher interest rates motivate greater saving—more funds are put into the market, whether through household deposits or corporate bond issuance. This reflects the incentive effect: “the higher the reward, the more people save.”

The intersection defines equilibrium—where loanable funds supplied precisely match demand.

This point anchors the interest rate at which financial markets clear.

A shift in either curve alters outcomes dramatically.

- A surge in business confidence shifts the demand curve right, sparking investment booms and upward pressure on rates. - A national surge in savings shifts the supply curve right, lowering rates and stimulating borrowing. These shifts underlie economic fluctuations visible across cycles.Real-World Impacts: From Policy Changes to Housing Markets

Market forces described by loanable funds do not operate in isolation—monetary policy, tax reforms, and global capital flows profoundly impact the curve positions. Central banks, through interest rate targets, directly influence borrowing costs. For example, when the Federal Reserve cuts rates, it effectively flattens the demand curve, lowering the cost of borrowing and encouraging spending.

Supply-side innovations, such as new financial instruments or pension fund reforms, can boost savings, shifting supply upward.

Conversely, demographic shifts—aging populations reducing national savings—shift supply left, constraining loans and pressuring rates upward even with stable demand. Recent studies highlight how prolonged low rates post-2008 led to prolonged supply surpluses in many advanced economies, compressing lending margins and altering capital allocation.

Policy Lessons and Structural Challenges

Understanding the loanable funds graph equips policymakers to anticipate transmission lines of monetary decisions. A rate hike to curb inflation may stifle investment if demand for loans weakens sharply, while stimulus via low rates risks inflation if supply fails to keep pace.

Structural factors—such as underdeveloped capital markets or rigid fiscal policies—limit supply elasticity, weakening the market’s responsiveness.

| Key Driver | Market Impact | Example |

|---|---|---|

| Monetary Policy | Shifts demand or affects cost of borrowing | Fed rate cuts post-2020 increased business loans |

| Savings Incentives | Left supply curve shifts | Tax-advantaged retirement accounts boost national saving |

| Demographics | Left supply curve weakly effective | Aging populations reduce national loanable funds in parts of Europe |

| Regulatory Environment | Restricts or enables lending | Capital requirements limit bank lending in unstable periods |

The market of loanable funds thus serves as both a trigger and a barometer—its equilibrium rate remaining a pivotal indicator of economic health and policy effectiveness.

Why This Model Matters for Every Stakeholder

For investors, observing supply and demand shifts explains interest rate risk and asset valuations. For businesses, borrowing costs determined by the intersection shape investment horizons. For households, mortgage rates reflect macroeconomic forces structured by savings behavior and liquidity.

Central banks rely on this model to calibrate stimulus, ensuring financial conditions support sustainable growth without overheating.

In a world of volatile markets and evolving financial systems, the loanable funds graph remains a foundational framework—inviting scrutiny, prediction, and informed action. It reveals how the quiet exchange of loans underpins economic momentum, turning individual savings into national progress and private capital into public prosperity.

Related Post

Robert De Niro: The Silent Architect of Cinematic Mastery

Papi Papi Papi Chulo: Decoding the Vibrant Language of Means and Meaning in Urban Culture

Tesla Model X Plaid 2019: Find Yours Now — The Performance Machine Defined

From Bloodstains to Bags of Steak: What the Killer’s Shopping List Reveals About Preparation and Parlysi—Cast of The Killer’s Shopping List Unveiled