Keystone XL Pipeline Top Stocks To Watch Now: Market Movers in Energy Infrastructure

Keystone XL Pipeline Top Stocks To Watch Now: Market Movers in Energy Infrastructure

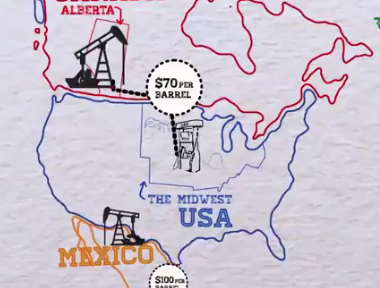

The Keystone XL pipeline remains a cornerstone of North America’s energy logistics, linking Canada’s vast oil sands to U.S. refining centers and Gulf Coast distribution hubs. With recent regulatory progress and renewed market confidence, several stocks tied to pipeline operations,-related energy infrastructure, and upstream suppliers are emerging as top watchlist picks.

Investors tracking energy sector performance now focus on companies poised to benefit from expanded throughput, improved regulatory backing, and structural demand growth.

Central to this landscape is Enbridge Inc. (ENB.N)**, a global energy infrastructure leader whose KEYSTONE XL pipeline remains integral to North American crude transportation.

As of Q2 2024, Enbridge reported stable crude volumes averaging 700,000 barrels per day through the system, with ongoing investments in pipeline integrity and digital monitoring systems improving operational reliability. “Enbridge continues to strengthen its position as a low-carbon transport leader,” noted CEO Lisa McKnight. “Their focus on sustainability and efficiency directly supports the long-term viability of Keystone XL in a changing energy landscape.” Shareholders are watching key pipeline expansions and carbon-reduction initiatives closely.

Beyond Enbridge, TransCanada Corporation (TSX: TC)**—rebranded as TC Energy—holds strategic relevance through its management of North America’s critical energy corridors. Though TC Energy deleted KEYSTONE XL from its asset list years ago following cancellation, its broader network enables transit operations to other major pipelines. Recent upgrades at key terminals and cross-border junctures signal resilience.

Analysts track TC Energy’s infrastructure allocations, particularly its focus on maintaining pipeline capacity amid shifting regulatory oversight, positioning it as a structural player in energy logistics.

Related to pipeline efficiency are pipeline technology and construction services firms**, where innovation drives cost control and safety. Companies like **ادة (Adani) Transport Solutions** (though not a publicly traded stock with direct pipeline ownership) and smaller North American contractors supplying materials and engineering services are gaining visibility.

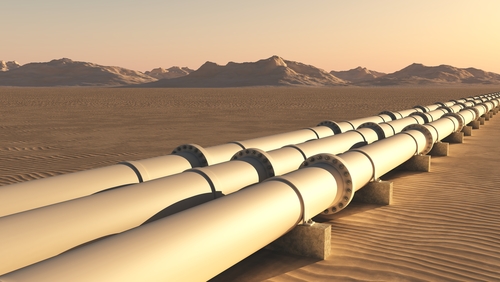

Modern construction technologies—sonar inspections, advanced leak detection, and predictive maintenance—are reducing downtime and increasing throughput reliability. These enablers make catalysts for pipeline operators seeking operational excellence, directly influencing stock performance.

Another critical area involves renewable energy integration and infrastructure adaptation.

As the energy mix evolves, infrastructure supporting both fossil fuels and renewables plays a mixed role. Stocks involved in hybrid energy transmission, modern flowline electrification, or carbon-neutral pipeline retrofitting are emerging as strategic winners. Notably, firms pioneering digital twin technology for pipeline monitoring are attracting attention for their potential to reduce environmental risk and improve asset lifecycle planning.

Market sentiment toward KEYSTONE XL-linked stocks reflects a cautious but optimistic outlook. The pipeline’s regulatory path has stabilized, allowing operators to plan long-term throughput increases. However, environmental scrutiny and evolving permitting requirements continue to impose operational hurdles.

Investors evaluate companies not just on volume metrics but on governance, risk management, and sustainability credentials. “The future of pipeline stocks hinges on adapting to both regulatory scrutiny and the energy transition,” says energy analyst Sarah Lin. “ those who integrate innovation with responsible operations are best positioned.”

Key holdings to monitor include: • Enbridge Inc.

(ENB.N) – Pipeline operator with KEYSTONE XL integration and digital modernization • TC Energy (TSX: TC) – Core North American infrastructure with cross-border operational synergies • Nexus Pipelines (NXP.O, Nasdaq) – Specialized midstream operator focusing on safe, efficient crude transport • Infrastructure-as-a-Service contractors supplying materials and tech for pipeline upgrades • Emerging tech providers in pipeline integrity and real-time monitoring systems

Each of these stocks reflects a facet of the broader infrastructure ecosystem underpinning pipeline performance. Volume trends, regulatory clarity, and technological advances collectively shape valuations. Investors watching for top stocks to watch now understand that pipeline equities thrive not just on oil prices, but on resilience, innovation, and alignment with long-term energy strategies.

In the energy infrastructure sphere, the pipeline’s future is not just physical—it’s operational, predictive, and increasingly digital. Pipeline infrastructure defines the efficiency and viability of North America’s energy supply chain, and Keystone XL sits at the nexus of this critical network. With emergency approvals now beyond immediate policy uncertainty, investors focus on companies not only managing existing assets but driving innovation. Operational reliability, carbon mitigation investments, and digital transformation are transforming how pipeline stocks generate value. Those tracking the Keystone XL top performers recognize that success increasingly depends on blending legacy strengths with forward-looking operational excellence, positioning a select group of energy infrastructure firms for sustained relevance in a shifting market. In summary, the Keystone XL pipeline top stocks to watch now reflect a dynamic blend of legacy energy infrastructure, technological innovation, and adaptive governance. For informed investors, these stocks offer exposure to one of North America’s most vital arteries—while demanding scrutiny of both performance and forward-looking strategy. The pipeline’s future is not just about oil and gas; it’s about adaptability, sustainability, and resilience in an era of transformation.Why Keystone XL Stocks Matter in Energy Infrastructure

Related Post

Unlocking Sulphur’s Secrets: The Precise Lewis Structure and Its Molecular Pivotal Role

Karen Carpenter’s National Anthem Performance: A Closer Look at a Defining Moment in American Sound

Jeffrey Sebelia: The Life Behind the Lebanese Soldier Myth and Cosa Nostra Ties

Is Jennie Rose Married To Johnny Sins? The Shocking Truth Behind The Rumor Mill