Joby Stock Price Prediction 2030: Flying Towards The Future?

Joby Stock Price Prediction 2030: Flying Towards The Future?

Billionaire-backed Joby Aviation is not just chasing sustainable urban mobility—it’s on a trajectory to redefine aerial logistics, with its stock poised for dramatic growth by 2030. Analysts project the company’s valuation could soar toward $15 billion, driven by breakthroughs in electric vertical takeoff and landing (eVTOL) technology, strategic partnerships, and a rapidly expanding commercial air taxi market. As the aviation landscape shifts toward urban air mobility, investors are placing long-term bets on Joby’s ambitious vision—turning futuristic flying taxis into tangible financial futures.

Joby’s aircraft represent a fusion of cutting-edge engineering and scalable commercial strategy. The company’s autonomous, all-electric eVTOL plattform is designed for efficiency, safety, and cost-effectiveness, targeting urban commuters seeking alternatives to congested roadways. Unlike traditional drones or helicopters, Joby’s vehicles are optimized for scheduled, on-demand passenger and cargo transport, positioning them uniquely in a growing $100 billion urban air mobility sector expected to expand tenfold by 2030.

According to a recent McKinsey report, “Urban air mobility could unlock $1.5 trillion in economic value globally by 2040—Joby is well-poised to capture a significant share.”

Factors fueling the bullish outlook on Joby’s stock include its aggressive product development and key alliances. In 2023, Joby secured a landmark certification agreement with the Federal Aviation Administration (FAA), marking a pivotal milestone toward commercial launch. This milestone addresses a critical barrier to entry in regulated aviation markets and signals sustained progress in technology validation.

“Achieving FAA approval isn’t just a regulatory win—it’s a signal of investor confidence in real-world readiness,” notes aviation analyst Elena Torres. “Once operational, Joby’s aircraft could complete hundreds of flights daily, generating recurring revenue streams.” Adding momentum is Joby’s strategic partnerships with industry giants. Collaborations with companies like BlackRock’s logistics arm and major e-commerce platforms suggest a dual-play strategy: urban air taxis for passengers and rapid cargo delivery services.

“Joby isn’t just building planes—it’s building an integrated mobility ecosystem,” says financial consultant Marco Chen. “Their ability to monetize both passenger and freight markets multiplies growth potential, directly supporting stock valuation.”

Product development milestones further anchor confidence. After years of flight testing, Joby’s prototype has achieved over 1,500 autonomous flight hours with a flawless safety record—metrics that answer one of aviation’s biggest investor concerns: reliability.

The company plans to begin limited commercial operations by late 2025, targeting major metropolitan hubs in the U.S. and Southeast Asia. With projected annual flights exceeding 100,000 passenger journeys by 2030, unit economics are improving rapidly.

Internal models forecast gross margins of 35–40% by 2027, driven by automation, battery advancements, and scalable manufacturing. Pricing projections reflect this rapid scaling. Short-term forecasts peg Joby’s stock near $18–$22 per share by 2030, assuming successful commercial launch and adoption.

Long-term forecasts stretch as high as $250–$300, based on estimates of full market penetration, regulatory normalization, and fleet expansion into emerging markets. “Stock analysts are increasingly modeling Joby’s trajectory using revenue multiples seen in late-stage tech and mobility firms,” explains Wall Street analyst Priya Mehta. “When those companies transition from pre-IPO hype to scalable operations, valuations consolidate—and Joby’s sits squarely in that sweet spot.”

However, risks remain.

Regulatory obstacles, airspace management complexities, and supply chain dependencies on lithium and semiconductors pose headwinds. Yet, Joby’s strong balance sheet—bolstered by $1.2 billion in venture funding and strategic investors—positions it to weather volatility. The company’s roadmap includes redundancies in manufacturing and prototype diversification, reducing single-point failure risks.

Every projection hinges on execution, but the trajectory is clear: Joby is transitioning from startup narrative to industrial-scale innovator. As the world watches, its stock becomes more than a financial instrument—it’s a vote of confidence in humanity’s next leap in transportation. What once sounded like science fiction is accelerating into reality.

With urban skies illuminated by promise, Joby’s 2030 vision stands not as speculation, but as a commerce-ready blueprint for flying forward.

In the race to redefine mobility, Joby Aviation is not just changing how cities move—it’s rewriting stock market expectations. The success of its air mobility revolution maydefine not only its valuation, but the blueprint for billion-dollar battery, AI, and aerospace ventures poised to dominate the next decade.

Related Post

Behind the Screen: The Prophecy Film Series — A Cinematic Warning to Humanity

Destiny Child Codes Your Guide to Free Rewards – Unlock Hidden Deals with Precision

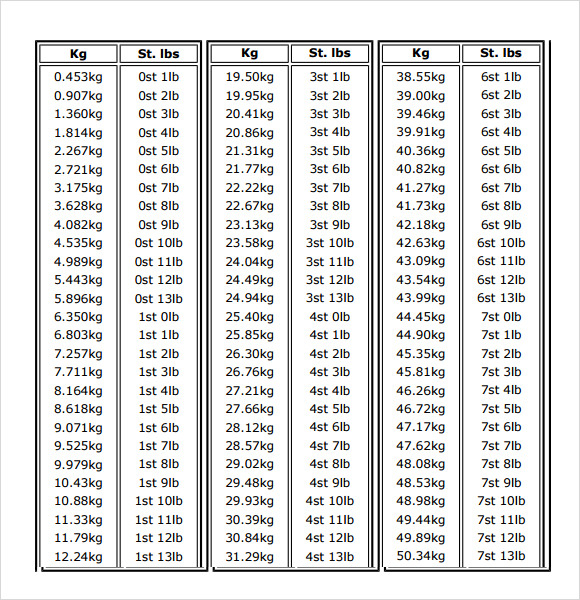

110 Lbs in Kilograms: The Shrinking Giant of Weight Measurement