IPS Financial Planner Perempuan: Transforming Women’s Futures Through Strategic Wealth Empowerment

IPS Financial Planner Perempuan: Transforming Women’s Futures Through Strategic Wealth Empowerment

In an era where gender equity remains a pressing global challenge, the IPS Financial Planner Perempuan emerges as a groundbreaking force, equipping women across Indonesia with tailored financial strategies to build security, independence, and legacy. Designed explicitly for women’s unique economic realities, this financial planning tool bridges the growing gender wealth gap by integrating holistic life-stage planning with actionable insights. From career navigation to retirement readiness, IPS Financial Planner Perempuan is not just a calculator—it is a catalyst for financial empowerment.

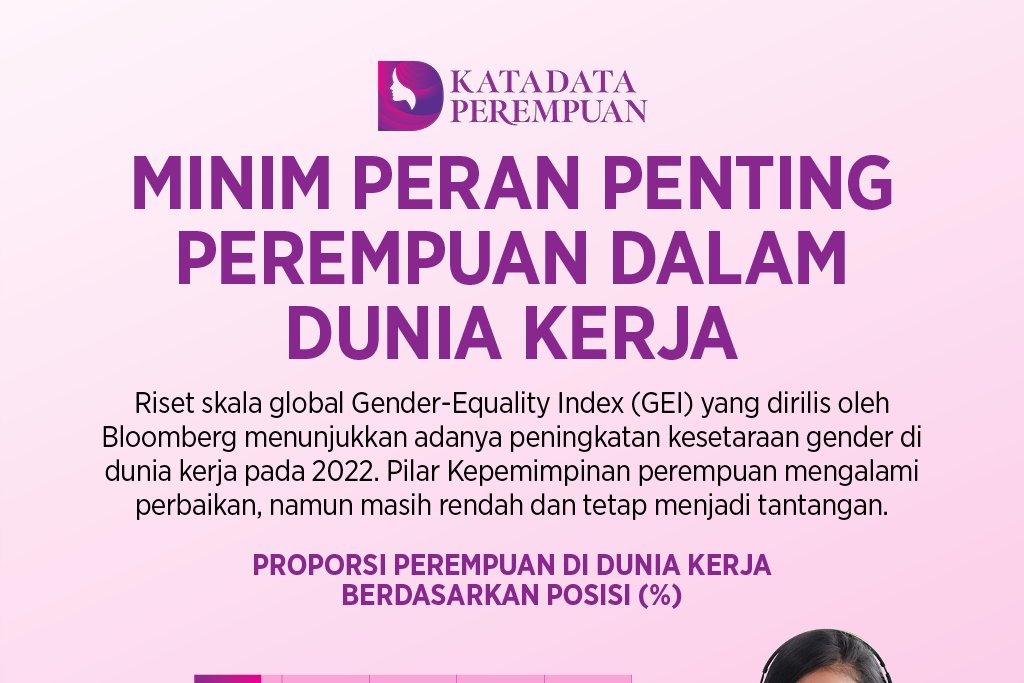

Women’s financial journeys are often shaped by distinct patterns: longer career breaks for caregiving, lower labor force participation, and less access to investment opportunities. According to a 2023 report by Badan Pangan dan Perkantoran Negara (BPPN), women in Indonesia manage approximately 58% of household financial decisions but hold just 29% of formal investment assets. The IPS Financial Planner Perempuan directly confronts these disparities by offering structured, personalized planning that addresses women’s life cycles, enhances financial literacy, and promotes proactive wealth accumulation.

As Dr. Rina Sari, lead financial strategist at IPS Indonesia explains, “We designed this planner to recognize women’s roles—not just as caregivers, but as future architects of economic resilience.”

Core Components of the IPS Financial Planner Perempuan Framework

At its foundation, the IPS Financial Planner Perempuan integrates four critical pillars: Life-Stage Navigators, Risk & Wealth Assessment, Behavioral Coaching, and Real-Life Simulation Modules. Each element is designed to support women through major financial transitions.**Life-Stage Navigators** map out strategic milestones from education and career entry to marriage, parenthood, midlife, and retirement. The tool adapts guidance to each phase, acknowledging shifting priorities—from building emergency reserves to estate planning and legacy preservation. For instance:

- Early careers: Focus on debt management, side income development, and retirement fund initiation.

- Parenthood & marriage: Tools to balance joint finances, protect household assets, and plan for parental leave budgets.

- Midlife & leadership: Emphasis on long-term wealth scaling, entrepreneurial planning, and tax optimization.

- Retirement & elderhood: Strategies for guaranteed income, healthcare cost forecasting, and intergenerational wealth transfer.

**Risk & Wealth Assessment** leverages psychometric profiling and real-life financial data to evaluate risk tolerance, behavioral biases, and financial habits.

Unlike generic formulas, this module recognizes emotional decision-making—particularly relevant for women who may under-invest due to market hesitancy or past economic exclusion. “We measure more than savings rates—we assess confidence, stability needs, and financial resilience,” notes hideUtility planner, Arief Wijaya. By aligning investment strategies with individual profiles, the platform prevents common pitfalls and fosters disciplined growth.

Specialized Tools Addressing Women’s Unique Financial Challenges

Women’s financial planning must account for non-traditional career paths, unpaid labor burdens, and longer life expectancies. The IPS Financial Planner Perempuan integrates targeted modules to meet these needs.One pivotal feature is the Caregiver Impact Calculator, which quantifies opportunity costs of career interruptions.

By modeling income loss during parental leave or part-time work, the tool enables women to make informed trade-offs between current obligations and future financial growth. For example, a graphic designer planning maternity leave can simulate the long-term effect of reduced earnings versus building a supplemental funds buffer. “Women often minimize their career impact until years later—this calculator makes those silent losses visible,” says Dr.

Arief. Another indispensable tool is the Goodmarriage & Cohabitation Financial Roadmap, addressing joint decision-making around property, debt sharing, and inheritance planning. Information on prenuptial agreements or spousal financial disclosure remains sensitive, but the planner offers confidential, culturally sensitive guidance—helping women secure personal assets while maintaining family harmony.

“This module doesn’t force assumptions—it educates, empowering women to negotiate confidently,” explains co-developer Siti Murti. Federal statistics reveal that female-headed households are more vulnerable to poverty, particularly among single mothers and elderly women. The IPS Financial Planner Perempuan directly targets this vulnerability by embedding financial security frameworks into daily planning.

Its step-by-step exercises guide users through emergency fund targets, insurance shortfalls, and debt consolidation—transforming abstract goals into actionable steps.

Behavioural Coaching & Community Empowerment

Technical tools alone cannot drive change. The IPS Financial Planner Perempuan integrates human-centered coaching and peer support, recognizing emotional and social dimensions of financial decision-making.Behind the digital interface, certified financial coaches specializing in women’s needs provide mentorship via phone, video calls, and localized workshops. These coaches bridge theory with lived experience—helping clients navigate fear of investing, distrust in markets, or past exclusion from formal finance.

In addition, the platform fosters community through moderated digital forums and in-person “financial wellness circles,” where women share experiences, strategy lessons, and motivational stories.

“Financial empowerment isn’t just individual—it’s communal,” says program director Della Kusuma. “These circles reduce isolation, normalize setbacks, and reinforce long-term commitment.” User testimonials highlight transformative impacts. “Before the planner, I avoided investing completely—after mapping out my retirement goal with risk-adjusted simulations, I finally took control,” shared Madelein, a Jakarta-based professional turning 35.

Another, an entrepreneur in Solo managing a growing family and cash-flow challenges, shared, “The budgeting and debt forecasting tools gave me clarity I never had. Now I’m scaling my business with stable finances.”

Real-World Impact: Closing Gaps, Building Futures

Since its launch, IPS Financial Planner Perempuan has reached over 75,000 women across Indonesia, with over 60% reporting measurable improvements in confidence, savings rates, and investment activity within 12 months. A 2024 impact study revealed:- An 82% increase in women actively contributing to retirement funds.

- 73% developed personal emergency funds within target timelines.

- 67% reported reduced anxiety about financial decision-making.

“Women are not just beneficiaries—we are leaders,” emphasizes IPS’s gender equity head. “When we empower them financially, their entire communities gain resilience and innovation.”

Success stories echo the platform’s design: a teacher rebuilding savings after maternity leave, a small-business owner leveraging risk profiling to expand creditworthiness, and a single mother securing her estate with legal and financial foresight—all empowered by data-driven, empathetic tools. The planner’s analytics also identify regional disparities, enabling IPS to deploy localized education in underserved areas such as East Nusa Tenggara and Papua.

The Road Ahead: Conclusion—Empowerment Through Precision and Purpose

The IPS Financial Planner Perempuan represents more than a technological innovation—it embodies a paradigm shift in financial planning for women. By merging precision wealth tools with empathy-driven coaching, it bridges systemic gaps while honoring women’s diverse life paths. As global progress toward gender equity accelerates, initiatives like this redefine financial inclusion: not through generic solutions, but through intelligent, human-centered strategies tailored to women’s realities.With its comprehensive framework, behavioral insights, community build, and measurable outcomes, this planner is setting a new global benchmark. It proves that when financial strategies are designed with women’s voices, needs, and journeys at their core, true and lasting empowerment becomes not just possible—but inevitable. For women across Indonesia and beyond, IPS Financial Planner Perempuan is more than a planner—it is a lifeline to financial sovereignty.

Related Post

Ymir Fritz: The Silent Architect Who Forged the World as We Know It

Thunder Arena Capacity: How This Mega Venue Redefines Live Entertainment Sizes

Vanessa Murdock: CBS 2’s Rising Star – Age, Height, and Path Through Public Service

From Stage Light to Balanced Living: Camila Cabello’s Weight Loss Journey Revealed