Investing In Hololive: What You Need to Know in 2024

Investing In Hololive: What You Need to Know in 2024

Hololive has evolved far beyond a mere virtual idol group—it’s now a dynamic, multi-billion-dollar entertainment brand with a growing footprint in the investment space, drawing interest from fans and financially savvy investors alike. For those tracking emerging digital economies, understanding how to engage with Hololive through investment opportunities requires insight into its structure, revenue streams, buying models, and long-term sustainability. With a blend of fandom loyalty, innovative monetization, and structured digital collectibles, Hololive offers a unique intersection of entertainment and investment—one that demands scrutiny, strategy, and smart insight.

At its core, Hololive operates as a talent agency under Hololive Agency, a subsidiary of Ha chapter One Holdings, which manages a global roster of 43 virtual youtubers known collectively as droids. Unlike traditional entertainment ventures, Hololive leverages the global popularity of anime, streaming culture, and digital media to generate recurring, scalable revenue. Its business model combines subscription-based content platforms, merchandise sales, licensing deals, and most notably, a novel fan-driven investment ecosystem centered on digital memorabilia and tokenized assets.

The Building Blocks of Hololive Investment

Investing in Hololive isn’t yet offered through standard stock exchanges, but a sophisticated ecosystem of digital assets and tokenized investment instruments has emerged, opening pathways for both retail and institutional participants.Key components include:

- Virtual Merchandise & Collectibles—Hololive droid Fan Army members regularly purchase official merchandise, limited-edition prints, and digital wearables, fueling recurring sales that directly support artist income and platform growth.

- Hololive Tokens —The agency has introduced Hololive-branded utility and governance tokens, enabling fans to stake, trade, or claim exclusive digital content and voting rights in community-driven projects. These tokens represent a new frontier in fan-owned digital economies.

- Streaming Platform Partnerships—Revenue is amplified through platforms like YouTube, Twitch, and dedicated platforms such as NICO, which host live streams monetized via ads, donations, and subscriptions—parts of which flow back into talent support and Hololive’s broader ecosystem.

- Licensing and Brand Expansion—From fashion collaborations to mobile games and theme park integrations, Hololive’s expanding IP portfolio diversifies income beyond digital media, creating multiple revenue streams resistant to market fluctuation.

Unlike traditional asset classes, Hololive investments are deeply tied to cultural momentum and digital engagement. The platform’s value derives not just from tangible revenue but from intangible, network-driven loyalty—an evolving asset class in its own right.

Understanding Fan-Driven Investment Models What distinguishes Hololive’s investment appeal is its fusion of fandom and finance.

Fans are no longer passive viewers; they become stakeholders through digital memorabilia purchases and token ownership. This participation model mirrors early-stage cryptocurrency investment but with community and entertainment at its heart. For example, purchasing a high-tier Hololive collectible or token grants access to exclusive content, such as personalized greeting videos or early access to streams—benefits that reinforce emotional attachment while offering tangible value.

As Hololive tokens gain utility in governance (e.g., voting on brand activations or charity initiatives), their intrinsic worth may appreciate based on community engagement levels, not just speculative market demand. Investors must recognize two key dynamics: community-driven liquidity and brand resilience through digital immersion. While volatility exists, the depth of user passion creates a sticky economic model rarely seen in conventional media ventures.

Revenue Mechanisms Fueling Sustainable Growth

Hololive’s financial engine thrives on diversified, recurring revenue flows. The primary contributors include: - Subscription Services:Platforms like YouTube Premium and Hololive-exclusive streaming apps provide consistent income from millions of active viewers, representing a predictable revenue base. - Merchandising and Digital Goods:Merch sales, often tied to new droid debuts or seasonal events, generate millions monthly, supported by high emotional brand loyalty.- Tokenized Assets:Hololive tokens enable fan ownership, drive platform engagement, and unlock premium benefits—creating a self-reinforcing cycle of investment and content creation. - Brand Partnerships:Collaborations with global brands inject capital, expand reach, and validate Hololive’s commercial clout beyond niche audiences. - Live Events and Experiential Content:Virtual concerts, meet-and-greets, and themed experiences generate live ticket sales and sponsorships, enriching the monetization landscape.

These streams collectively form a robust financial foundation, insulating Hololive from reliance on a single income source.

Risks and Considerations for Prospective Investors While the growth trajectory is compelling, investing in Hololive carries distinct risks that demand careful evaluation. Unlike publicly traded equities, Hololive’s digital assets lack standard regulatory oversight, transparency, and historical performance benchmarks.

Key concerns include:

- Market Volatility:Hololive tokens and fan-driven assets can experience sharp price swings influenced more by social sentiment than earnings reports.

- Talent Dependency:Halving or the emergence of new droid talent could shift audience focus, impacting engagement and revenue stability.

- Regulatory Uncertainty:As digital collectibles and utility tokens evolve, legal frameworks may tighten, especially in regions prioritizing investor protection and anti-money laundering compliance.

- Platform Concentration:Dependence on YouTube and third-party streaming services exposes revenue streams to algorithmic changes, demonetization risks, or platform policy shifts.

The Future of Investing in Virtual Entertainment Ecosystems Hololive represents more than a novel investment vehicle; it exemplifies the convergence of digital fandom, intellectual property, and decentralized finance. For emerging virtual entertainment brands, Hololive offers a blueprint: a platform built on authentic community engagement, diversified monetization, and scalable digital assets creates durable value.

Early adopters stand to benefit from both emotional connection and financial upside, but success hinges on recognizing that holistic investment in digital ecosystems requires fluency in culture, technology, and market dynamics. As more fans and investors embrace virtual personalities as both creators and stakeholders, Hololive’s model may inspire a new generation of hybrid entertainment ventures—residing at the intersection of fandom, finance, and innovation.

In the evolving landscape of digital investment, Hololive is not just entertainment—it’s an emerging asset class worth understanding, monitoring, and engaging with strategically.

For those tracking the future of fan-driven economies, the question is no longer *if* Hololive matters, but *how deeply* its model will shape where capital flows next.

Related Post

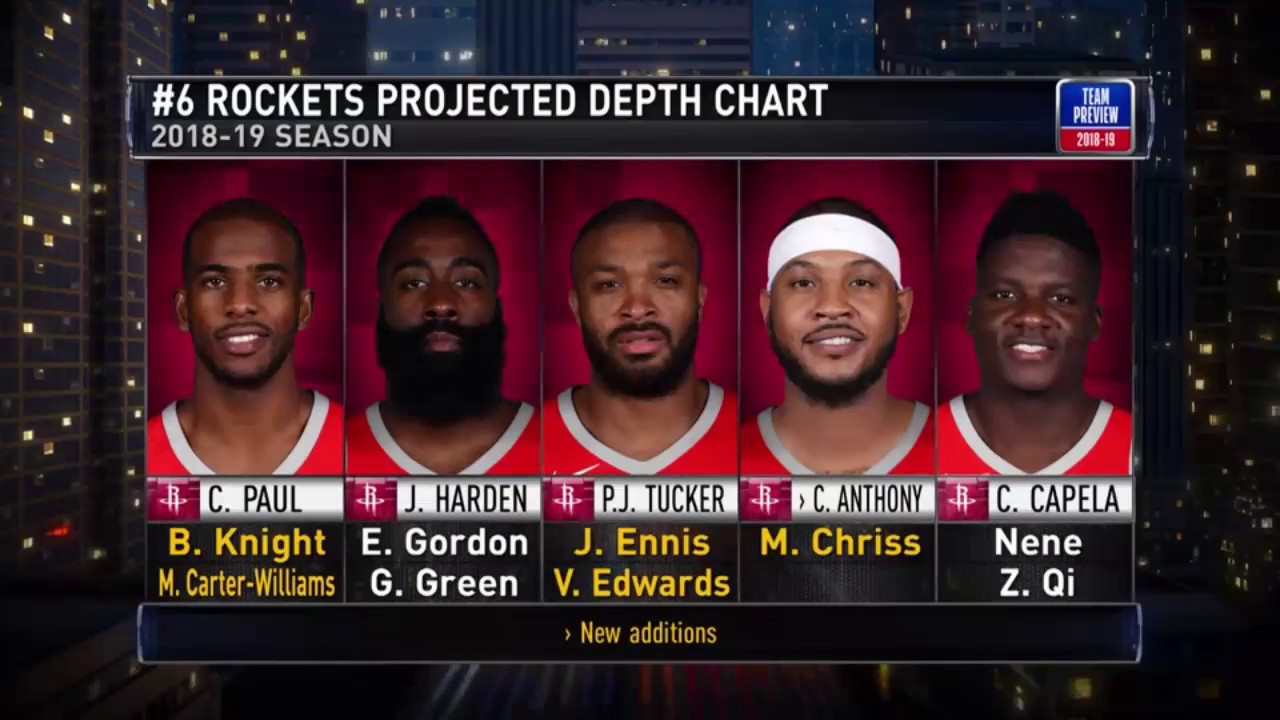

The 2018 Houston Rockets Roster: Architects of a Defensive Revolution

Master Math Skills with Hooda Math Block Blast: Fun Gamified Learning in Action

Riverside Cafe Unveiled: A Deep Dive Into Flavors, Prices, and Pairings at the Heart of the City

Decoding the Iconic Mtv Cribs Intro Line That Redefined Home Staging Narratives