Indonesia Stock Exchange: A Comprehensive Guide to India’s Gateway to Capital Markets

Indonesia Stock Exchange: A Comprehensive Guide to India’s Gateway to Capital Markets

As Indonesia’s flagship financial marketplace, the Indonesia Stock Exchange (via its current rebrand as Indonesia Stock Exchange under the Bursa Efek Indonesia or BEI legacy transition) stands as a critical engine for economic growth, attracting both domestic investors and global capital. With over two decades of evolution, the exchange has matured into a dynamic platform where companies list, trade, and grow—offering exposure to sectors ranging from traditional industries to cutting-edge technology and green energy. For emerging market investors and regional players alike, understanding the exchange’s structure, operations, and opportunities is essential for navigating Southeast Asia’s largest and most strategically important equity market.

First established in 1960 as the Jakarta Stock Exchange, the institution underwent significant transformation to meet global standards. Rebranded and modernized under Bursa Efek Indonesia, it now operates as a fully electronic, 24/7 digital marketplace connected to international liquidity networks. Today, it ranks among Asia’s most accessible exchanges, boasting over 700 listed companies and over IDR 600 trillion in market capitalization.

Transparency, regulatory rigor, and investor protection have become hallmarks—governed by OJK (Otoritas Jasa Keuangan), Indonesia’s financial regulator—ensuring compliance with international best practices.

Core Features and Market Structure

The Indonesia Stock Exchange is organized into distinct segments tailored to different investor profiles and company sizes:

- Main Listing Segment: Where blue-chip corporations, including banks, conglomerates, and resource companies, list their securities. Firms must meet stringent criteria—minimum net worth, earnings thresholds, and corporate governance standards—to ensure stability and credibility.

- Pequot Listing Segment: A lighter-touch segment designed for growth-oriented SMEs and evolving firms. Lower compliance burdens but still requiring minimum disclosure, enabling promising companies to access public markets while maintaining transparency.

- E-Listing Platform: A digital-first avenue for retail investors and fintech innovators, reducing entry barriers and supporting financial inclusion through mobile and web-based trading apps.

The exchange supports a variety of financial instruments—common equities, REITs (Real Estate Investment Trusts), infrastructure bonds, and derivatives—while offering structured products like ETFs and index funds.

Trading hours follow Indonesian time (Trafik Waktu Jakarta, UTC+7), with real-time updates accessible through multi-language platforms, including English, Mandarin, and Arabic to serve international clients.

Investment Opportunities and Sector Performance

The diversity of listed companies ensures investors can specialize in sectors aligned with Indonesia’s economic pillars and future growth directions:

- Resources & Energy: Dominating the heavyweight class with PLN (state utility), Pertamina (oil and gas), and free-port copper giant Freeport-McMoRan. These stocks offer steady dividends and cyclical exposure tied to commodity markets.

- Finance: The banking and financial services segment—led by Bank Central Asia (BCA), Mandiri, and BRI—is resilient and essential, especially during macroeconomic volatility.

- Consumption & Retail: Fast-growing firms like Tondegra, GoTo (digital superapp), and Duta Vita reflect the rise of a tech-savvy middle class, driving investor interest in modern commerce and digital services.

- Technology & Innovation: Emerging players in fintech, e-commerce, renewable energy, and biotech signal Indonesia’s shift toward a knowledge-based economy.

Market performance has shown strong resilience, with annual returns often outperforming regional peers in the past decade. Market volatility remains moderate, influenced by global commodity prices, monetary policy shifts from Bank Indonesia, and domestic political developments—making proactive risk management crucial.

Trading Mechanics and Accessibility

Trading on the Indonesia Stock Exchange leverages a fully automated, integrated system accessible via desktop, mobile, and remote access terminals.

Investors use digital accounts linked to verified brokers or direct platform access, with real-time quotes, order execution, and portfolio dashboards updated every few seconds. Margin trading, short-selling (subject to OJK regulations), and automated investment algorithms are supported, catering to both retail traders and institutional players.

Market hours: 7:30 AM to 4:00 PM Jakarta Time (UTC+7), open for continuous quotes even outside trading hours through after-hours trading awards. Market closure occurs only for Sahur (pre-dawn fasting hour in Ramadan), with no circuit breaker restrictions, ensuring liquidity during key sessions.

Brokerage services are competitive and widely available, with most major banks and independent brokers offering commission-free or low-commission trades, especially in the Pequot and E-Listing segments.

Investors benefit from seamless settlement via Clearing and Depositary System (CLS), minimizing counterparty risk and enhancing capital efficiency.

Challenges and Regulatory Environment

Despite its strengths, the exchange faces ongoing challenges: limited retail awareness compared to institutional participation, infrastructure gaps in financial literacy, and disparities in technological adoption across regions. Additionally, enforcement of corporate governance remains a focus area, with the OJK intensifying disclosure requirements and audit standards.

OJK oversight ensures the market remains transparent and fair, mandating mandatory reporting, insider trading prohibitions, and periodic compliance audits. Stress tests, liquidity monitoring, and investor education campaigns help reinforce market integrity.

The regulatory framework is increasingly aligned with ASEAN and international standards, boosting foreign institutional confidence.

Future Outlook and Strategic Direction

Looking ahead, the Indonesia Stock Exchange is positioned at the forefront of regional financial integration. Plans to deepen liquidity through electronic market innovation, expand ESG (Environmental, Social, Governance) reporting mandates, and attract more foreign portfolio investors underscore its ambition.

With Indonesia’s demographic dividend—over 65% under 40—and rising digital penetration, the exchange is primed to become a magnet for global capital seeking growth in Southeast Asia’s largest economy. Technological upgrades, enhanced investor protection, and sector-specific initiatives promise to transform its role from regional gateway to a model of sustainable, inclusive market development.

As global markets increasingly recognize Southeast Asia’s expansion potential, the Indonesia Stock Exchange stands not merely as a stock platform, but as a vital institution driving financial empowerment, corporate accountability, and long-term economic resilience—making it indispensable for any investor charting the future of emerging markets.

Related Post

How Ky Time Zone is Reshaping Global Connectivity: Bridging Hours Across Continents

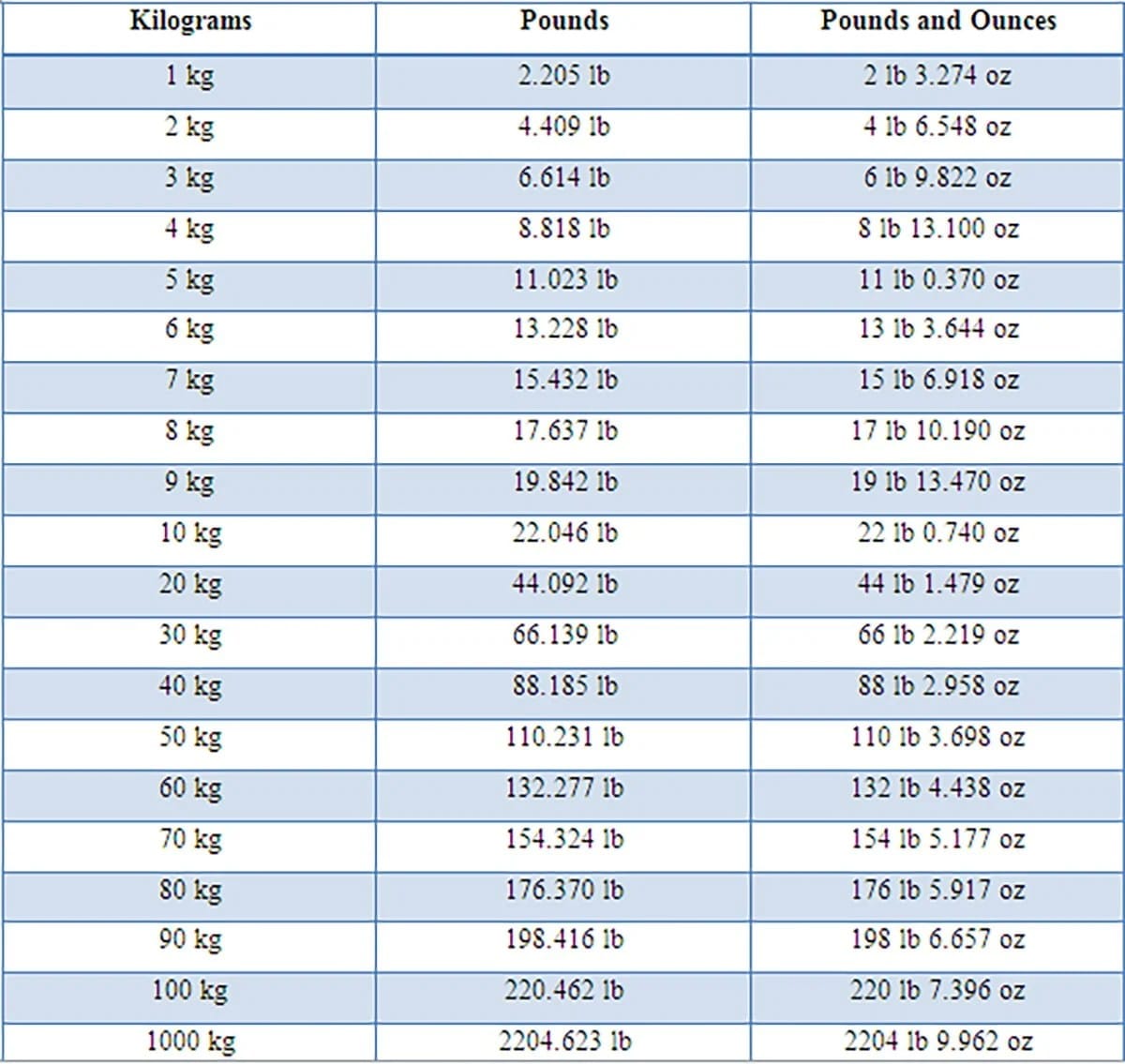

74.3 kg in Pounds: The Global Benchmark No One Can Ignore

War Zone Rebirth: Unraveling the Stark Contrast Between World War Z’s Chaos and Its Aftermath’s Silent Transformation

Who Is The Cute Person in the World? The Evidence Behind Global Awe