Indo Global Trade: Unlocking Massive Opportunities Amid Complex Challenges

Indo Global Trade: Unlocking Massive Opportunities Amid Complex Challenges

The dynamic evolution of Indo Global Trade stands at a critical crossroads—offering unprecedented growth potential while navigating intricate geopolitical, economic, and logistical hurdles. As India strengthens its position as a key player in Asia’s trade ecosystem, businesses and policymakers alike face a landscape rich with opportunity yet constrained by structural bottlenecks. From digital transformation reshaping supply chains to shifting global alliances redefining market access, the story of India’s trade expansion is one of bold promise tempered by real-world complexity.

India’s Trade Expansion: Scale Driven by Digitalization and Diversification India’s push to become a global trade hub has yielded tangible progress over the past decade. With exports growing at an average annual rate exceeding 10% since 2020, the country has diversified its trade portfolio beyond traditional commodities to include pharmaceuticals, IT services, renewable energy components, and high-tech manufacturing. Digital platforms have played a pivotal role—enabling SMEs to access international markets through e-commerce gateways and blockchain-powered logistics.

“The rise of digital trade corridors has reduced transaction costs and shortened deal cycles, placing Indian exporters on par with global counterparts,” notes Dr. Rajiv Mehta, Trade Strategy Analyst at the Federation of Indian Export Organizations (FIEO). “This shift isn’t just about volume—it’s about resilience.”

Major economic corridors, including the Indo-Pacific Economic Framework (IPEF) and enhanced bilateral agreements with ASEAN, the Gulf, and the European Union, are unlocking preferential market access.

India’s participation in supply chain diversification initiatives—particularly in semiconductors and critical minerals—positions it as a strategic alternative to over-reliance on single-source manufacturing. According to a 2023 report by the Ministry of Commerce, exports to망 geeignet new markets now account for nearly 35% of total outward trade, a figure projected to surpass 45% by 2027 if current momentum continues.

Digital Innovation as a Double-Edged Sword

Rapid technological adoption is transforming Indo Global Trade, yet it brings new layers of complexity.Automation, artificial intelligence in customs clearance, and integrated trade platforms have enhanced efficiency and transparency across supply chains. For instance, the India-Bhutan Digital Economy Initiative has reduced border delay times by 40%, proving that digital infrastructure drives real-world gains.

However, disparities in digital readiness across regions and sectors pose significant challenges.

While metropolitan hubs like Mumbai and Bengaluru thrive with advanced fintech and logistics APIs, rural and peripheral trade nodes often lack reliable internet connectivity and digital literacy. “Technology adoption must be inclusive,” warns Anjali Rao, CEO of TradeNova, a Singapore-India trade facilitation firm. “Without bridging this digital divide, the benefits of e-trade risk being confined to a privileged few, undermining long-term competitiveness.”

Geopolitical Tensions and Trade Policy Uncertainty Global trade dynamics are increasingly shaped by geopolitical friction—US-China trade disputes, Indo-Pacific strategic realignments, and shifting tariffs—all of which ripple through Indian export corridors.

India’s balancing act between strategic autonomy and market pragmatism demands careful diplomatic and economic navigation.

India faces complex export-restriction regimes in key destinations. While the US and EU remain major markets, stringent rules of origin under the IPEF, phased implementation of the EU’s Carbon Border Adjustment Mechanism (CBAM), and evolving import policies in Southeast Asia create compliance burdens.

“Navigating these rules requires not just legal expertise but adaptive supply chain agility,” states Dr. Meera Nair, a senior policy advisor at the India NVCM Forum. “India’s trade negotiators must anticipate and shape rules—not just react to them.”

Additionally, the ongoing trade policy volatility in partner nations—such as India’s recent renegotiation of logistics agreements with Vietnam or delays in EU free trade talks—introduces unpredictability.

Multinational firms cite delayed tariff decisions and fluctuating non-tariff barriers as key obstacles to scaling exports. “Stable, transparent trade rules are the bedrock of investor confidence,” reiterates Mehta. “Without them, even the best digital platforms cannot fully unlock trade potential.”

Infrastructure Gaps and Logistics Bottlenecks

Physical infrastructure remains a critical constraint in India’s trade expansion.While investments in ports, railways, and airports have improved throughput, last-mile connectivity and multimodal logistics infrastructure lag behind demand. Stagnant rail freight efficiency, port congestion in key export hubs like Visakhapatnam and Chennai, and fragmented cold chain networks hinder time-sensitive shipments.

For example, per a 2024 McKinsey study, India’s port productivity ranks 35th globally—limiting vessel turnaround times and increasing shipping costs.

Cold chain losses for perishables exceed 20%, directly impacting export quality and competitiveness. “Modernizing inland logistics—with better intermodal terminals, digital tracking, and climate-controlled storage—is not optional,” warns Rao. “These improvements are essential to reduce transit times by even 15% and shrink operating costs.”

Bureaucratic inefficiencies compound these challenges.

Despite reforms like the ICEGATE single-window clearance system, customs clearance times vary significantly across states and can double during peak seasons. Del

Related Post

GMA Showbiz News Today: Breaking Star Updates, Unexpected Cameos, and Hollywood’s Latest Fever

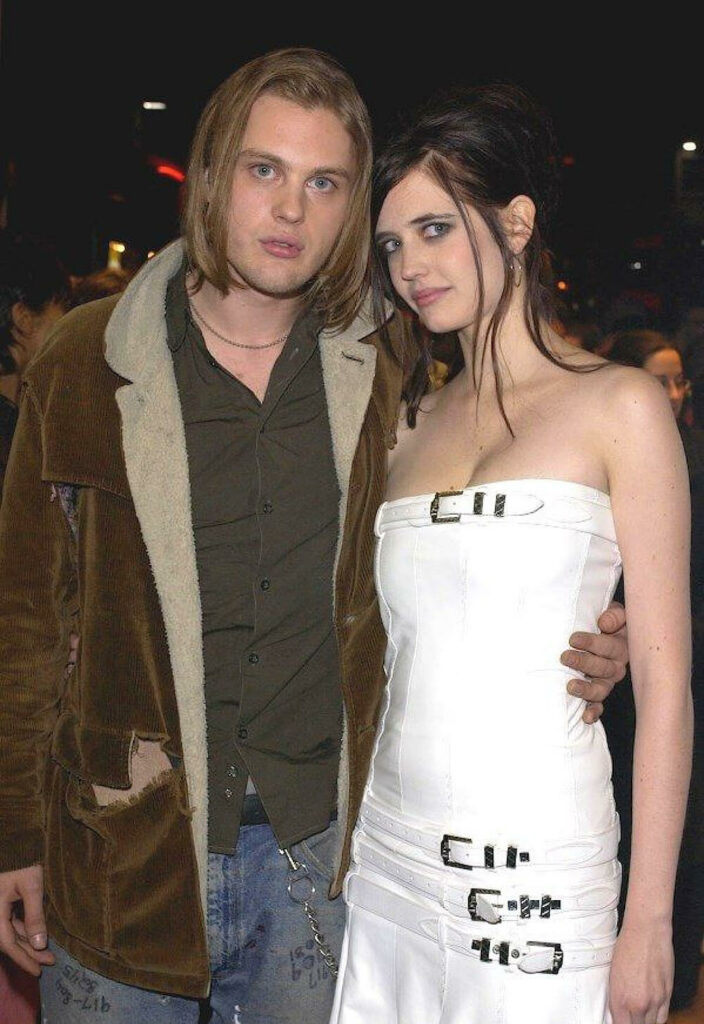

Unraveling the Intriguing Eva Green Dating History: A Star’s Personal Life Under Public Scrutiny

A Journey Through Jackerman Quot’s Quot: Motherly Warmth in Chapter 3

Puerto Escondido Hotels: Your Reddit-Approved Guide to Finding Comfort, Culture, and Coastal Bliss