How To Get A Card From Paypal

How To Get A Card From Paypal: A Step-by-Step Guide to Securing Your Virtual Payment Method

Controlling access to a PayPal card is a critical step in protecting your digital finances, enabling seamless global transactions while minimizing fraud risk. Whether you’re opening a new debit card for instant spending or setting up a prepaid card for budgeting, the process of obtaining and activating a PayPal card is both practical and evolve-saving. With clear instructions and trusted security protocols, PayPal provides a straightforward path to acquiring and managing your virtual card—empowering users to transact safely across borders and platforms.Understanding the mechanics of acquiring a PayPal card begins with recognizing that PayPal offers multiple card types, including Visa debit-style cards and prepaid options, each designed to suit different spending needs. The foundation of the process lies in account setup and verification, a required step that ensures identity authenticity and regulatory compliance. PayPal mandates robust identity verification to prevent unauthorized access, often requiring government-issued ID and proof of address—a procedure designed to safeguard accounts while streamlining legitimate card issuance.

Step 1: Meet PayPal’s Eligibility Requirements

To begin, ensure you meet PayPal’s mandatory eligibility criteria.These standards protect users and reinforce platform integrity, focusing primarily on identity confirmation and financial legitimacy. - Active verified PayPal account with no unresolved disputes or suspension status - Proof of identity through valid government-issued documents such as a passport or driver’s license - Proof of address, typically utility bills or bank statements accepted in multiple countries - Minimum age of 13 (with parental consent in some regions) - Compliance with local financial regulations, including anti-money laundering (AML) and know-your-customer (KYC) policies “PayPal’s verification process is not just a formality—it’s a shared responsibility between the user and the platform to maintain trust and safety,” explains a PayPal customer service representative. “This ensures your card remains a secure and reliable tool for everyday use.” Meeting these criteria not only accelerates your application but also sets the stage for faster card delivery—often within one to three business days after full approval.

Step 2: Navigate the Wallet or Donation Section to Apply for a Card

Once eligibility is confirmed, access the card issuance portal through the PayPal interface, typically found under “Manage” or “Default” settings within mobile or desktop apps. Navigate to the “Cards” or “Manage Account” section, where a dedicated “Apply for a Card” option appears—this is where the formal request begins. Pathway to application: - Open PayPal app or web platform and sign in - Select “Wallet” or “Navigation” menu to access financial tools - Tap or click on “Apply for a Card” (alternatively, under “More settings” → “Card services”) - Choose your preferred card type (debit, prepaid, or recurring) based on spending goals - Confirm all details, including currency and expiration dates if applicable The interface guides users through a streamlined form, requesting essential information such as billing address and contact details—critical elements in finalizing card activation.For users in select countries, PayPal also integrates with local banking rails, speeding up verification by cross-referencing financial institutions in real time. This reduces delays and enhances the accuracy of identity validation.

Step 3: Complete Identity and Document Verification

Upon submitting the application, the system triggers PayPal’s multi-layered verification protocol. This multi-step review combines automated checks with potential human review to authenticate your identity securely.Key verification stages: - Automated ID scanning: PayPal uses AI-powered document authentication to verify passports, driver’s licenses, or other ID types against global databases - Address proof validation: Submitted utility bills or bank statements are cross-checked for legitimacy and relevance to your account - Biometric verification: In many regions, users receive a prompt to confirm identity via facial recognition or fingerprint verification through their device - Manual review (in ambiguous cases): Senior compliance officers assess flagged applications to ensure full regulatory adherence “Verification is the cornerstone of PayPal’s security model,” notes a PayPal compliance executive. “While technology handles initial checks, human oversight ensures no red flags go unnoticed—protecting everyone in the ecosystem.” Failure during this phase usually stems from incomplete documentation, mismatched ID details, or identity discrepancies. Users are encouraged to prepare clear, unblemished copies of

Related Post

Dota 2: Where Strategy Meets Electrifying Gameplay at Eg Gaming

Alpha Wolf Twitter Meme Origins and the Funniest Examples That Captured Internet Consciousness

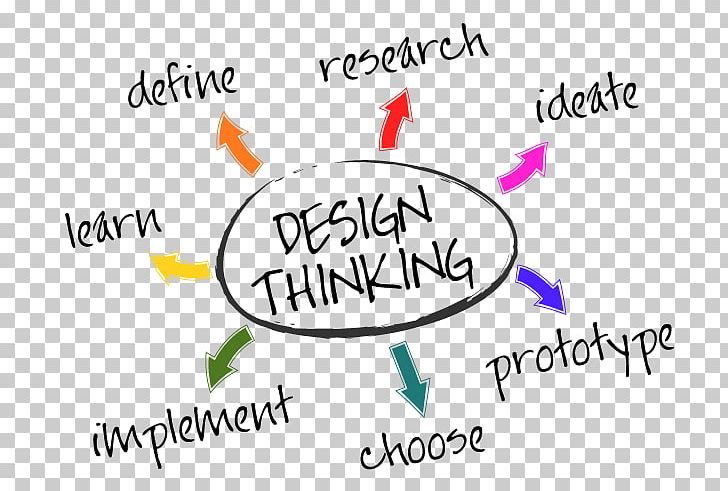

Planet Clicket: Revolutionizing Accessibility Through Innovation and User-Centered Design