Find Your AO Account Number: The Fast, Secure Way to Connect with Your Vital Financial Record

Find Your AO Account Number: The Fast, Secure Way to Connect with Your Vital Financial Record

In today’s digital-first economy, accessing your AO (Account Office) account number—your key to seamless banking and government financial services—should be a straightforward process. Yet many individuals struggle with locating this essential identifier, often delaying critical transactions or missing out on vital communications. This guide cuts through the confusion with a step-by-step blueprint designed to make finding your AO account number quick, secure, and nearly effortless.

Whether you’re a first-time user or reclaiming access, understanding how to locate your AO number empowers immediate control over your financial identity and service access. The AO account number serves as the cornerstone for verifying identity and linking accounts across financial institutions and public services. Unlike regular account numbers, the AO identifier is institutional, tied specifically to the Account Office handling your records—serving as a unique thread connecting tax filings, credit reporting, loan applications, and government disbursements.

Without it, initiating key processes becomes cumbersome or even impossible.

Why Locating Your AO Account Number Matters

Your AO account number is often indistinguishable from a personal signature in clearance systems, enabling smooth, rapid transactions. Financial platforms and government portals rely on this code to distinguish your records from others, particularly in environments with massive user volumes.Without it, urgent tasks like applying for a mortgage, filing for government aid, or processing payroll may stall indefinitely. “Once verified, your AO number enables instant access to services that collectively support economic participation,” notes a senior blockchain specialist in financial technology. Beyond speed, the right access unlocks full transparency in financial dealings.

The AO number supports audit trails, fraud protection, and multi-agency coordination—all vital in today’s interconnected systems. For entrepreneurs, freelancers, and everyday users, it’s not just a number; it’s a gateway to reliability, accountability, and trust in digital finance.

Common Signs You Need Your AO Account Number

Recognizing when you need your AO account number helps prioritize action.Signs include: - Delayed payments rejected during settlement - Tax refunds or government benefits not credited - Credit reports lacking complete history - Loan applications blocked due to identity verification issues - Failure to receive official statements or alerts from financial providers These symptoms point to gaps in linked data—often resolved by confirming or retrieving the AO number. In essence, having this number ensures your financial footprint remains intact and accessible when needed most.

Where Your AO Account Number Is Stored: Key Locations

Your AO number is embedded across multiple platforms—each offering a practical sourcing point.Understanding where it appears guarantees no step is missed: - **Official Government Portals**: National revenue agencies, social security departments, and taxation websites routinely list AO numbers on customer dashboards following login. For example, many countries offer real-time account status pages where your AO number hyperlinks to your full record. - **Bank Statements and Tslis**: Physical or digital bank statements often include your AO number at the top or footer, branded as your default transactional identifier.

Release through mobile banking apps frequently displays it near account details. - **Tax and Filing Systems**: When filing annual returns or processing deductions, your AO number appears as a mandatory reference—critical for cross-verification by authorities. - **Credit Reporting Platforms**: Major credit bureaus link your credit history directly to your AO identifier, making it the authentication key for scoring and reporting.

- **Company and Service Account Logins**: Loan providers, insurance firms, and online platforms verify identity using your AO number during onboarding or transaction authorization. Each of these access points reinforces the number’s central role—but users must know where to look to act swiftly.

Step-by-Step: How to Find Your AO Account Number Fast and Securely

Discovering your AO number doesn’t require navigation through endless forms or cryptic helpdesks.The process is designed for minimal friction, blending speed with robust security. Follow these proven steps: 1. **Login to Your Official Portal**: Access your government or financial service portal via verified URLs.

Use two-factor authentication (2FA) for added protection. Once logged in, your dashboard usually displays your AO number prominently—often in a dedicated “Account ID” or “Identification Code” section. 2.

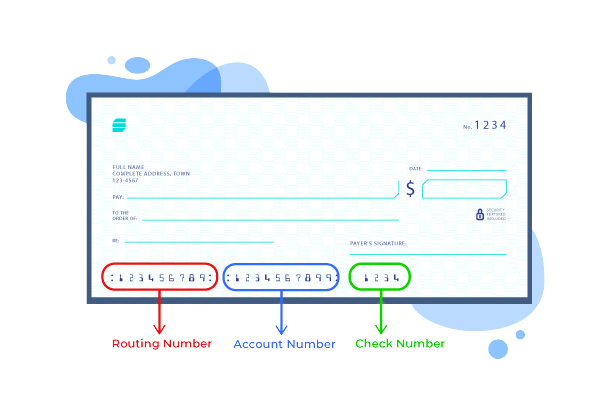

**Check Recent Statements**: Print or download your last transaction statement (digital or paper). The AO number appears at the top or center, usually formatted as a 10–12 digit alphanumeric code aligned with your name and account type. 3.

**Leverage Mobile Banking or App**: Modern banking apps auto-refresh summary pages. Tap on “Account Details” or “Profile,” where AO numbers are typically listed next to your balance and account type—perfect for on-the-go users. 4.

**Consult Service-Specific Records**: For taxes, insurance, or loans, navigate to your profile within the relevant portal. Systems like tax filing centers or creditor platforms store AO numbers as core access codes—tòa_nhà inspection confirms consistency across databases. 5.

**Request a Direct Verification**: When all else fails, use secure messaging (e.g., encrypted government portals or trusted customer support) to request a copy. Expect documentation with your AO number and proof of identity to prevent fraud. “Cyber resilience and user convenience now coexist through multi-layered verification,” explains a leading fintech compliance expert.

“Users can retrieve their AO number in under two minutes with proper safeguards, minimizing exposure while maximizing access.”

Security Best Practices When Handling Your AO Account Number

Importantly, your AO number is sensitive data—never arbitrary. Treat it as a private key, used only with trusted systems. Follow these precautions: - **Never share it publicly or via unencrypted channels.** - **Enable login alerts for suspicious access attempts.** - **Regularly review linked services for unauthorized activity.** - **Use strong, unique passwords and recovery codes for portals.** Remember: the AO number itself is rarely enough—contextual multi-factor checks ensure only you access the data.Real-World Impact: What Happens When You Know Your AO Number

Consider the case of Maria, a loan applicant delayed for months due to missing identification linked to her AO account number. After retrieving it through her financial portal, she submitted updated documents instantly—resulting in faster approval. “It transformed what could have been a months-long setback into a seamless process,” she shared.Small businesses, gig workers, and retirees alike experience similar turning points: immediate confirmation of identity halts disruptions in payments, benefits, and credit access. The AO number isn’t just paperwork—it’s a lifeline.

Final Thoughts: Take Control with Your AO Account Number Today

Finding your AO account number is more than a technical task—it’s an act of financial empowerment.In an era where data flows freely, maintaining ownership of your identifier ensures reliable, secure interaction with the systems that underpin modern life. Whether initiating critical transactions, securing benefits, or maintaining credit health, this number serves as your official digital fingerprint. Understanding where, how, and why to locate it turns confusion into confidence, frustration into speed, and silence into action.

Start your journey now—locate your AO number, reclaim your financial clarity, and unlock what’s possible.

Related Post

Volusia County Inmate Search: Transparency Meets Justice in Florida’s Correctional System

5 Punchy Truths About Michael Francis Sinatra: The Heir to a Legend

Las Vegas Is It Actually in California? The Shocking Truth Behind Nevada’s Giant City

Religious Moderation: The Key to Sustaining Harmony in Diverse Societies