Finance FD Rates: Your 2025 Updated Guide to Bank Fixed Deposit Returns

Finance FD Rates: Your 2025 Updated Guide to Bank Fixed Deposit Returns

In a landscape where financial growth hinges on informed decision-making, understanding bank Fixed Deposit (FD) interest rates in 2025 is more critical than ever. With fluctuating central bank policies and shifting economic conditions, savers must navigate a dynamic interest rate environment to maximize returns. The Finance FD Rates Updated Guide delivers clarity on current FD yield trends, offering actionable insights for retail investors seeking stable income amid volatility.

These rates, influenced by macroprudential regulations and inflation trends, shape the returns on otherwise low-risk instruments—making timely awareness essential. < obstacles: - Decoding central bank policy’s role in FD rate moves - The impact of inflation and monetary adjustments on FD yields - Differences across institutions—comparing top providers - Practical strategies to lock in competitive rates > At the core of FD rate dynamics lies the Reserve Bank of India’s (RBI) policy framework. While RBI does not directly set individual bank deposit rates, its repo rate directly influences lending and savings behavior.

The corridor method, where banks operate within an upper and lower band around the repo rate, governs FD yields. For example, a repo rate of 6.5% typically triggers an FD deposit rate range of 6.25% to 7.75%, though pegs vary by customer segment and tenure. “Market expectations now assume sustained repo rates between 6.5% and 6.75% for 2025,” observes Ramesh Pathak, Senior Credit Analyst at FinPlan Financials, “a projection that directly shapes CD returns.” < subheading>Mortgage FD Rate Trends Under 2025 Monetary Policy Bank FD returns diverge significantly across institutions, with smaller private banks often offering higher rates than large public or global banks—driven by cost structures and customer acquisition strategies.

Over the past year, leading public sector banks like SBI and PNB have maintained 6.1%–6.8% FD rates for one-year deposits, while digital lenders such as Payccan and Lonsdale Financial frequently exceed 7.0% for matched timings. For medium-to-long tenures (3–5 years), the Average Renewable FD (ARFD) has trended upward from ~6.3% in early 2024 to nearly 7.3% today—reflecting banks’ need to sustain liquidity amid rising deposit outflows. A critical distinction between fixed and variable-rate FD products has gained prominence.

Fixed-rate FDs remain favored for predictability, but variable-rate tracks now appeal to risk-sensitive savers seeking upside in a rising rate environment. The guide breaks down real-world scenarios: - Fixed-rate FDs: Lock in 6.5% for 2 years, guaranteeing returns regardless of future rate shifts - Variable-rate FDs: Reinvest in higher-market offerings, capitalizing on rate hikes but bearing principal risk - Hybrid models: Offer modest base rate plus a rate-linked premium, blending security with growth potential < subheading>Institutional Variance: Top FD Rate Providers in 2025 Several banks have positioned themselves as top choice FD performers based on yield, service ease, and customer experience. In 2025’s updated rankings: - **Union Bank of India**: Offers up to 7.0% FD with instant online application and flexible maturity terms.

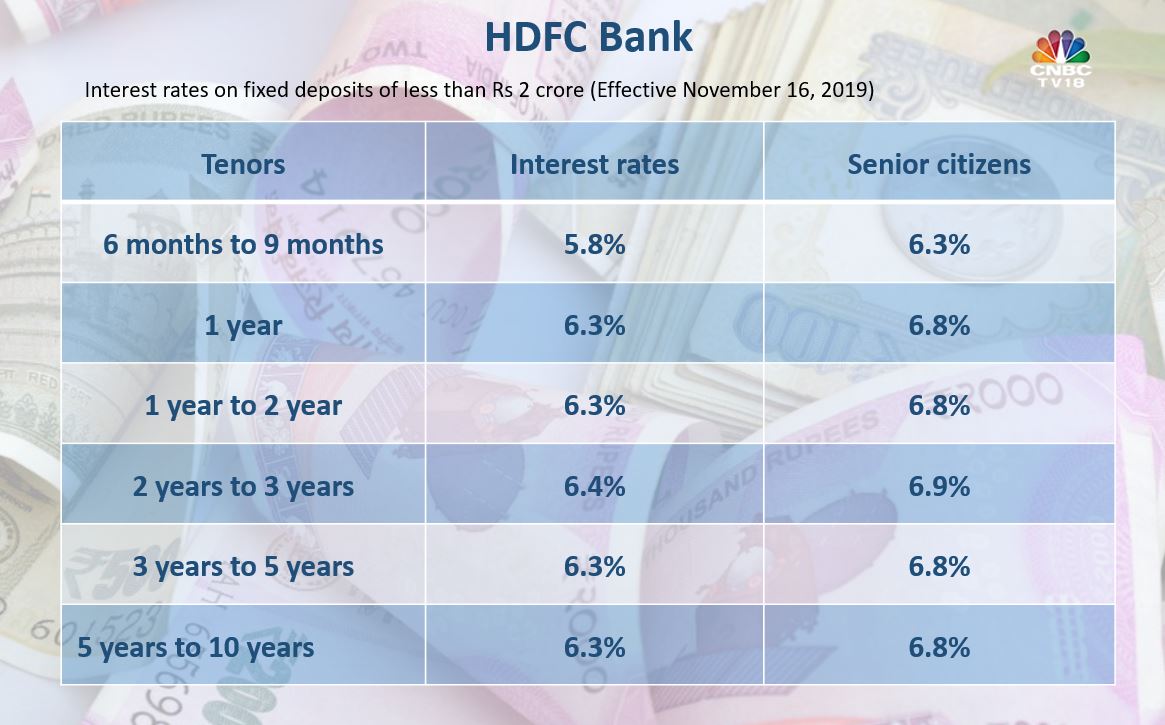

Its “Earn & Grow” scheme provides interest reinvestment and early withdrawal penalties, balancing accessibility with growth. - **HDFC Bank**: Renowned for competitive rates around 6.8% for tenures under two years, with a strong mobile-first interface enabling real-time yield tracking. - **BANK NIFTY Financial Services**: Surpasses benchmarks with 7.1% fixed deposits, targeting filozofs with surplus capital.

Minimum deposit requirements are capped at ₹10,000, lowering entry barriers. - **ICICI Bank**: Delivers 6.4% tomb-level FD rates for accretive savers, leveraging strong branch and digital penetration without compromising transparency. “Theříci엗 handed over the latest FD benchmarks,” notes Anjali Mehta, Personal Finance Consultant.

“Institutions now compete not only on rate but on customer experience—online claim processing, tiered rate nodules, and proactive alerts. Bank FD returns are no longer static; they’re algorithms plus customer strategy.” < subheading>Navigational Tools: Top Platforms & Strategies for Maximum FD Income Harnessing FD rates effectively demands more than passive following; active management, enabled by fintech tools, transforms FD investing into a strategic asset. FinPlan Financial’s 2025 FD Returns Dashboard identifies key instruments and tactics: - **Ficso.in & BankBazaar**: Aggregate real-time rates across 500+ banks, enabling side-by-side rate comparison and automated alerts when spreads widen.

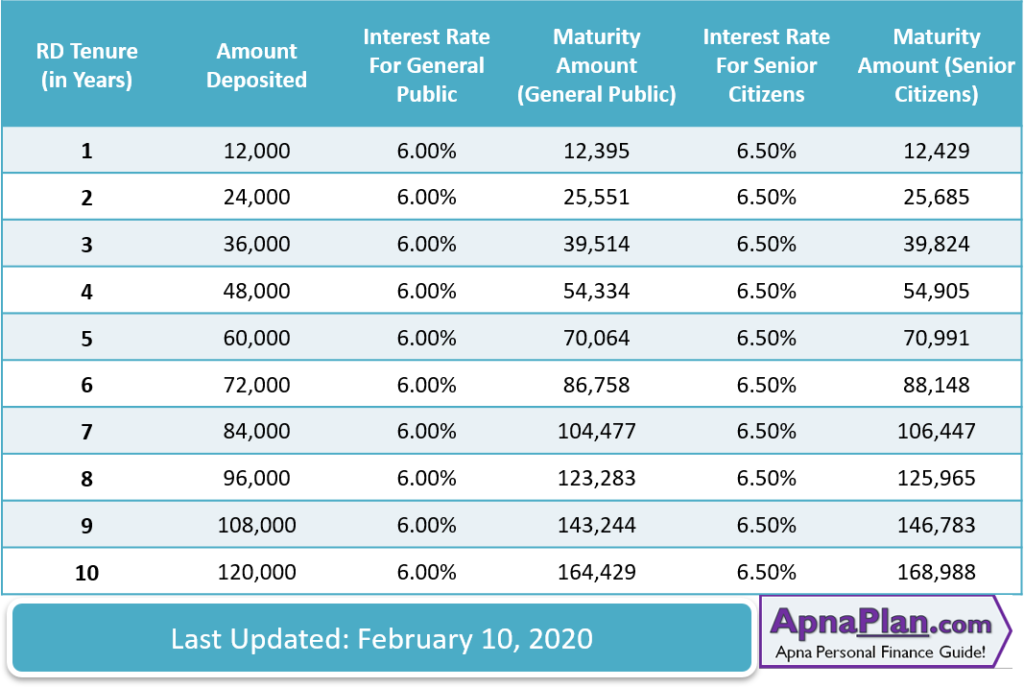

- **Yield aggregator apps**: Such as GiveTrust and Money Tangram, track tiered rates across maturities, helping savers pick optimal tenures based on liquidity needs. - **Bulk FP extensions at digital banks**: Some platforms allow turning recurring deposits into fixed tenures with enhanced rates, especially for institutions with promotional windows. - **Interest compounding strategies**: Using FD maturity payouts to fund fresh high-yield FDs—amplifying compounding over three- to five-year cycles—has yielded up to 15–20% higher total returns.

Why timing matters: The update emphasizes front-loading FD deposits during central bank rate hikes, such as accelerated FTIs in Q3 2024 and sustained corridor management in 2025, which typically lift decade-long averages by 0.35%–0.45%. < subheading>Smart FD Investing: Balancing Yield and Risk in a Volatile Economy While FD returns serve as safe havens, prudent investing requires balancing return goals with risk tolerance and liquidity needs. The guide stresses risk mitigation: - Diversifying across banks avoids exposure to institutional-specific downturns - Longer tenures lock in higher rates but reduce exit flexibility—ideal for those confident in market stability - Fixed-rate FDs protect against further rate drops, though they may lag if inflation falls sharply Market cautions remain: tax implications on FD interest (sum observed at 10% floated under Section 194–ITR rules), and opportunity costs when funds sit idle versus riskier assets.

Yet for conservative investors, FD rates remain a cornerstone of capital preservation with predictable upside in 2025’s managed growth phase. The Finance FD Rates Updated Guide is more than a rate calendar—it’s a blueprint for converting idle savings into deliberate wealth. By combining policy insight, institutional benchmarking, and tactical yield optimization, savers gain the tools to thrive in a fluctuating rate regime.

As the economic tide rises, informed FD management no longer just earns interest—it secures financial confidence.

Related Post

Nissan Skyline GTR vs. Nissan GTR: The Unresolved Duel in Performance Legend

Unlock Your Underwater World: Mastering the Login Experience at MyJOHNDEER.com

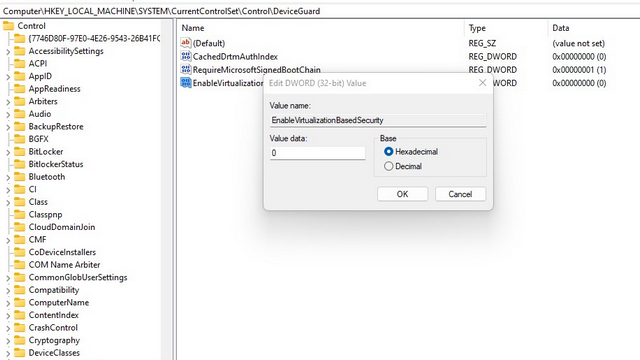

Virtualization-Based Security (VBS): A Deep Dive into Modern Enterprise Protection

Simbpl: The Revolutionary AI Tool Redefining Simplified Intelligence Access