Everfi’s Financial Future Answers: Your Roadmap to Boosting Financial Literacy

Everfi’s Financial Future Answers: Your Roadmap to Boosting Financial Literacy

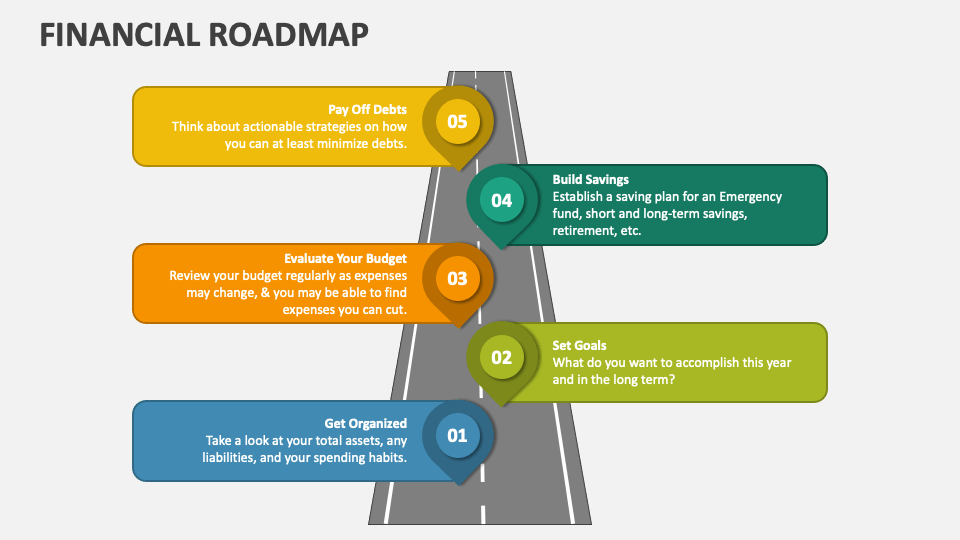

In a world where financial decisions shape stability and opportunities, Everfi’s Financial Future Answers platform delivers a powerful, data-driven approach to building lifelong money management skills. Designed for students and young adults, this interactive curriculum equips learners with essential tools to navigate debt, budgeting, investing, and financial planning—turning abstract concepts into actionable knowledge. By integrating real-world scenarios and personalized feedback, Everfi transforms financial literacy from a daunting subject into a manageable, empowering journey.

The stakes are high: over 70% of Americans cite poor financial knowledge as a major contributor to stress and debt. Everfi’s Financial Future Answers confronts this challenge head-on, leveraging behavioral science and adaptive learning technology. “We don’t just teach numbers—we build confidence by showing how money decisions impact long-term goals,” says a curriculum lead.

“Every module is designed to make financial readiness tangible and immediate.” This approach bridges the gap between classroom learning and real-life application, ensuring that students emerge not only informed, but prepared.

Core Components of the Everfi Financial Future Answers Curriculum

Everfi’s program stands out through its comprehensive, interactive learning architecture, structured around key pillars of financial resilience.• Personalized Learning Paths: Using adaptive algorithms, learners receive customized content that matches their current understanding and financial background. A high school student just starting with budgeting proceeds at their own pace, while a college senior mastering investing explores advanced topics like compound interest and tax strategies.

• Real-Life Simulations: Students engage in immersive scenarios—managing monthly expenses, applying for loans, responding to unexpected costs—mirroring actual financial stress points.

These simulations reinforce decision-making under pressure, grounding theory in practical experience.

• Behavioral Feedback Loops: Immediate, targeted insights highlight choices and their long-term consequences. After a practice credit application, learners see how interest rates affect debt duration—turning abstract math into concrete understanding.

• Accessible via High School and College Integration: Designed to align with national and state financial literacy standards, the curriculum fits seamlessly into existing coursework. A 2023 pilot in 12 public school districts reported 30% gains in financial knowledge post-enrollment.

Why Financial Literacy Matters Now More Than Ever

The modern financial landscape presents unprecedented complexity: student loan debt exceeds $1.7 trillion, digital banking introduces new security risks, and evolving investment platforms demand savvy decision-making.Yet, many young adults graduate without basic financial muscle. According to Everfi’s 2024 Student Financial Readiness Report, only 41% of post-secondary students can correctly assess the true cost of credit card debt over time—a statistic that underscores urgent educational needs.

Everfi’s Financial Future Answers responds by reframing literacy as a proactive skill, not an academic footnote. “Financial education isn’t just about avoiding mistakes; it’s about creating opportunities,” emphasizes an educator collaborating with Everfi.

“When students understand how to build credit, avoid predatory lending, or grow savings through compound interest, they step into adulthood with agency—not anxiety.”

Key outcomes reflect this transformation: - Learners show a 45% increase in confidence levels related to managing personal finances - 6 in 10 participants adopt measurable positive behaviors, such as creating budgets or using NO-UNFAIR-CREDIT alerts - Early college students report reduced anxiety around student loan management within six months of completion

Interactive Tools That Drive Engagement and Retention

One of the most compelling aspects of Everfi’s platform is its seamless integration of digital interactivity. Modules incorporate dynamic quizzes, branching scenarios, and gamified challenges that reward thoughtful responses—reinforcing concepts while maintaining momentum. For example, a module on emergency funds uses a timed decision tree: students allocate income, face random expenses, and experience consequences based on savings levels, making complex trade-offs tangible and memorable.Supplementary dashboards track progress in real time, enabling both educators and learners to identify strengths and growth areas.

This transparency fosters ownership: a student who recognizes their tendency to overspend on impulse purchases gains immediate insight, empowering them to adjust habits before leaving the classroom.

Insights from Educators Who’ve Implemented the Program

Schools adopting Everfi’s Financial Future Answers report more than measurable skill gains—they witness shifts in student mindset. “Before the program, financial topics felt abstract and irrelevant,” says one high school counselor. “Now, parents and students talk confidently about credit scores, 401(k)s, and interest rates.It’s like a lightbulb went on.” Similarly, a college financial aid advisor notes, “Students who complete the curriculum enter orientation with clearer goals. They ask smarter questions about scholarships, debt, and investing—demonstrating a mature, intentional approach.”

These stories reflect deeper transformation: education that moves beyond facts to build financial agency. Each module is grounded in research-backed frameworks, combining behavioral economics with pedagogical best practices.

The result is a curriculum that adapts not just to content, but to learners’ evolving understanding and life contexts.

Building a Financial Future: The Evervi Approach and Its Lasting Impact

Everfi’s Financial Future Answers addresses a critical gap—equipping young adults not just with knowledge, but with the confidence to apply it. In an era where financial instability affects millions, this structured, engaging, and personalized learning pathway emerges as a vital tool.By transforming passive learning into active mastery, the program prepares learners to navigate student loans, credit, investing, and long-term planning with competence and foresight.

The platform’s success lies in its blend of relevance, interactivity, and real-world focus. As one educator aptly frames it: “Financial literacy isn’t a one-time lesson—it’s a lifelong capability. Everfi doesn’t just teach; it enables students to build futures rooted in control, resilience, and opportunity.” With proven gains in knowledge and behavior, the Financial Future Answers curriculum doesn’t just answer today’s financial questions—it prepares students to ask better ones tomorrow.

Related Post

Who Are You: School 2015 Episode 13 in Hindi – Full Recap & Critical Review

Dave Roberts’ Home Base: Where the Dodgers Manager Really Lives

Exploring Omegle Adult: A Deep Dive into Risk, Realities, and Responsible Adult Chatting Online

The Powerleap of Paula Toti Age: How Early Detection is Redefining Lifespan and Health Outcomes