El Paso Property Taxes: Decoding the Budget Engine Behind the City’s Infrastructure and Services

El Paso Property Taxes: Decoding the Budget Engine Behind the City’s Infrastructure and Services

At $1.2 billion annually — a staggering yet vital investment — El Paso’s property taxes keep the city’s courts running, schools teaching, roads intact, and emergency services operational. For the nearly 850,000 residents of El Paso, these levies are more than numbers on a tax form; they are the lifeblood of community development, shaping everything from public safety to urban growth. With property values driven by the region’s desert landscape and border economy, understanding how property taxes are calculated, collected, and allocated reveals not just fiscal mechanisms but the values embedded in El Paso’s civic fabric.

Every year, the El Paso Community College Board, the City of El Paso, and local school districts depend on property tax revenue to fund operations, capital improvements, and workforce development—the backbone of the metropolitan economy. But behind the broad strokes of tax rates lies a detailed system shaped by law, public input, and evolving economic realities.

The Structure of El Paso Property Tax Rates and Assessment

El Paso’s property tax landscape is governed by a blend of state statutes and local ordinances, with oversight from the El Paso Assessor’s Office and the City’s Financial Management Department.The city employs a dual system: millage rates apply to assessed property values, with assessments recalculated periodically to reflect market worth. The millage rate — a measure in dollars per thousand of assessed value — in El Paso currently stands around 12.5 mills for general fund operations, meaning a $100,000 home generates roughly $1,250 annually. School taxes follow a slightly different formula, with a rate premium allocated specifically to El Paso Independent School District (EPISD), currently set at 61 mills, accounting for nearly half of all local taxes.

How Property Assessment Drives Your Bill

Assessment is the cornerstone of determining property taxes in El Paso. The city’s appraiser evaluates properties based on recent sales data, land value, condition, and location, updating assessments every three years to ensure fairness and accuracy. Discrepancies are resolvable through formal appeals, available directly from the El Paso Assessor’s Office, where taxpayers can contest valuations with supporting evidence such as recent comparable sales or building condition reports.This process is transparent and public, with online portals and community outreach ensuring residents understand how their home is valued. As said by City Tax Administrator Robert Lopez, “Every assessment is subject to verification — we want to make sure you’re paying what you owe, with no room for error.”

For example, a $150,000 single-family residence in north El Paso may be assessed at 80% of market value, meaning its taxable base becomes $120,000 — subject to the millage rates above. However, vacant lots, commercial properties, or agricultural land are assessed differently, often at market premium or using alternative valuation models designed to encourage development and discourage speculation.

Tax Rates: Who Pays What in El Paso?

El Paso’s tax structure is notable for its balance.While local rates remain competitive with regional peers, the dual system — general fund and school taxes — allows tailored investment in critical services. The general fund, which supports parks, libraries, transportation, and public safety, leverages both residential and commercial assessments. Meanwhile, EPISD relies heavily on voter-approved levies to fund education, underscoring the community’s commitment to early childhood and K–12 outcomes.

As of 2024, a typical residential property valued at $200,000 and located in a moderate-income neighborhood sees annual taxes hovering around $2,500. In contrast, high-value downtown or industrial properties can rise well into the six figures, triggering higher assessments and proportionally larger contributions to city services.

Resistance to tax increases remains a sensitive topic, especially in economically diverse parts of the city.

Yet public forums hosted by City Councils and Taxpayer Advisory Committees reflect a commitment to inclusive budgeting, where citizens debate priorities such as infrastructure renewal, homelessness services, and climate-resilient construction — all funded in part by property contributions.

Appeals, Disputes, and Transparency in Action

Navigating property tax assessments can be complex. Recognizing this, El Paso has streamlined appeal pathways. Residents dissatisfied with valuations may file within 180 days using forms available online or at city halls, accompanied by odometer readings, renovation receipts, or neighborhood comparables.The city’s Appeals Board, composed of independent civic representatives, reviews cases impartially, often resulting in adjusted assessments that redistribute tax burdens more equitably. Lopez emphasizes, “Our goal is accuracy and fairness — no one escapes scrutiny, no one pays unfairly. We’ve seen appeal success rates rise with easier access to data and clearer guidance.” This openness fosters trust in an otherwise opaque fiscal process, reinforcing the idea that property taxes fund shared prosperity, not just extraction.

El Paso’s Property Taxes in Regional Context

Compared to nearby Sun Land Park, Las Cruces, or Juárez, El Paso’s tax rates fall within a moderate range — about 0.85% of assessed value annually, slightly below the national average for similar urban centers. This balance reflects decades of managed growth, a mix of historic neighborhoods and modern development, and deliberate policies to attract industry while preserving affordability. Yet economic shifts — including border-related commercial volatility and housing market fluctuations — challenge stable revenue streams.In response, city planners are exploring diversified funding models, including green bonds and targeted fees, without undermining the foundational role of property taxation.

The View Ahead: Strengthening Communities Through Fair Assessment

Looking forward, El Paso’s property tax system remains central to civic identity. As the city grows — projected to exceed 900,000 residents by 2030 — maintaining equitable, transparent, and responsive tax practices will be essential.Success depends on continued public engagement, robust assessment accuracy, and a commitment to directing every dollar back into infrastructure, education, and opportunity. As the El Paso Community College Board chair noted, “When property taxes grow, they grow with us — funding skills training,revitalizing neighborhoods, and empowering future leaders.” This vision, funded by a system built on fairness and clarity, ensures that every contribution strengthens the city’s resilience and shared purpose.

In El Paso, property taxes are far more than a local obligation — they are a covenant between residents and the city, financing the very environment in which communities thrive.

From every homeowner to every commercial enterprise, responsibility is clear: fair assessment today builds the cities of tomorrow.

Related Post

Flight Attendant Pay Southwest: How Much Do Aviation Professionals Earn in One of the Industry’s Fastest-Growing Markets?

.jpg)

From Crisis to Cuddles: The Unforgettable Bond Between Liz Landon and Baby Alina

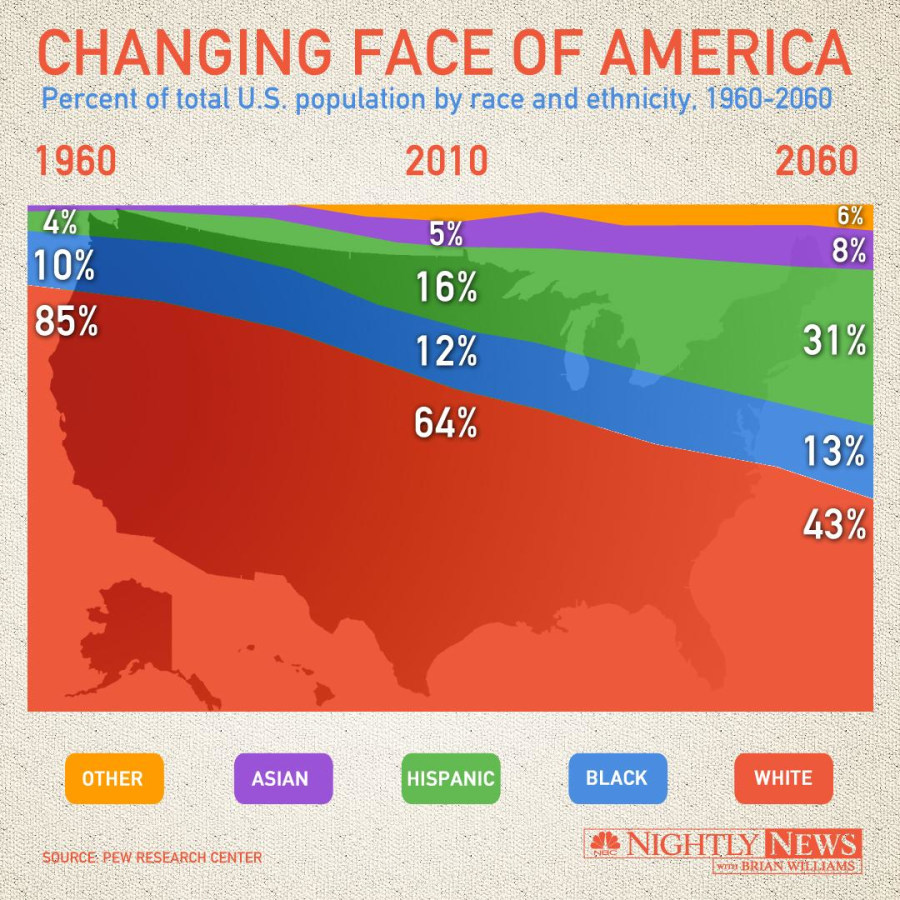

How Many People Call the USA Home? A Comprehensive Look at U.S. Population Dynamics

Do Seniors Really Get a Break? The Truth Behind Ikea’s Senior Discount Policy