Edward Jones Layoffs What You Need to Know: What Employees Must Prepare for in Tough Times

Edward Jones Layoffs What You Need to Know: What Employees Must Prepare for in Tough Times

In a wave of restructuring that underscores shifting demands in the financial services sector, Edward Jones—one of the nation’s largest independent financial planning firms—has announced significant workforce reductions. These layoffs, which have drawn attention across the industry, reflect broader economic pressures, regional realignments, and efforts to adapt to digital transformation. For both current and prospective clients, and especially for employees facing job insecurity, understanding the scale, causes, and implications of these cuts is essential to navigating the changing landscape of trust-based financial advisory services.

## The Scale and Scope of the Layoffs Edward Jones’ recent announcement revealed plans to reduce its nationwide workforce by approximately 4%—impacting several hundred positions across corporate, technology, and regional operations. The decision was not a sudden shock but the culmination of internal assessments into cost structures, regional performance variances, and evolving operational models. While exact numbers remain fluid, sources confirm the cuts primarily affect back-office functions, client services support roles, and mid-level managers in underperforming regions.

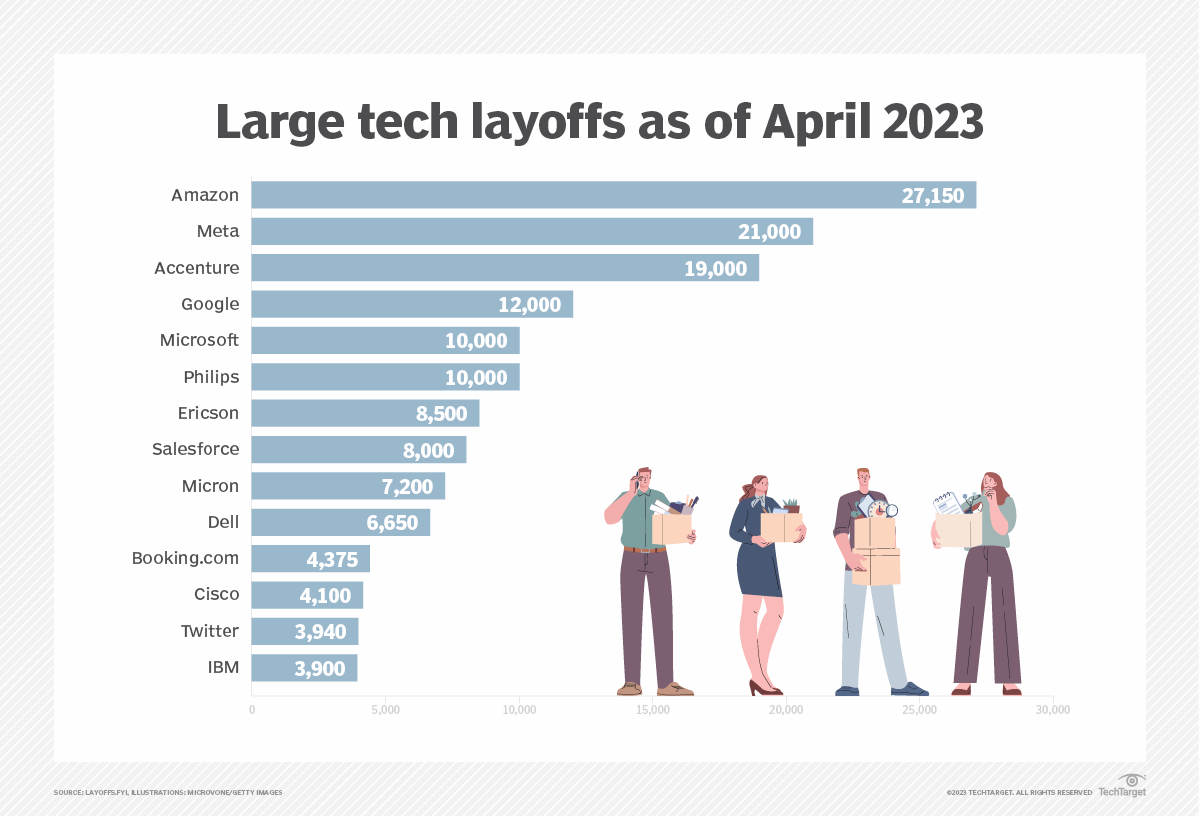

“This is a strategic realignment, not a collapse,” stated an internal memo later confirmed by company leadership. “We are streamlining operations to strengthen long-term sustainability while preserving the core values of client-centric service and advisor development.” Such workforce reductions follow a broader trend in financial services, where firms are consolidating roles to offset rising operational costs, automation, and shifting consumer behaviors toward digital engagement. Edward Jones’ move echoes similar actions from competitors, signaling industry-wide adaptation rather than isolated instability.

## The Real Drivers Behind the Cuts Behind the headlines, several structural and economic factors are shaping Edward Jones’ restructuring. <

“We’re reallocating human capital toward high-touch client relationships and strategic advisor training,” explained a senior operations executive. “This isn’t about replacing people—it’s about empowering advisors with better tools to deliver deeper value.” <

The company emphasized these decisions were made with local impact in mind, supported by transition programs offering redeployment and severance. <

“We’re not cutting for cuts’ sake,” stated the leadership. “Every role is being evaluated for its strategic contribution in a modernized firm.” ## Impact on Employees: What to Expect For employees facing layoff discussions or priority across management qualifiers, several key concerns arise. ### Severance and Transition Support Edward Jones has committed to robust severance packages, including extended health benefits, outplacement services, and career counseling.

Firmed up by union negotiations in select regions, affected workers gain access to resume workshops, LinkedIn profile optimization, and direct introductions to gaps in the job market. “We take this responsibility seriously,” said HR leadership. “Our goal is to ease the transition while honoring years of dedication.” ### Career Reassessment and Next Chances Many remaining advisors and consultants anticipate a shift toward higher-value client advisory work.

Layoffs have accelerated a trend toward specialization—senior advisors are now expected to lead complex financial plans, retirement strategies, and estate coordination, with basic client follow-ups increasingly supported by digital platforms. “This isn’t a dead end—it’s a pivot,” noted one long-time executive. “Advisors who embrace deeper client education and integrated solutions will thrive, supported by the firm’s evolving infrastructure.” ### Regional Variability in Impact Not all areas face equal change.

Reports indicate heavier cuts in the Northeast and mid-Atlantic regions, where face-to-face client volume remains high but digital penetration lags. Conversely, growing markets in the South and Southwest, with stronger digital adoption, are better positioned to maintain stable staffing levels. ## Navigating the Future: What Clients Should Consider Clients of Edward Jones shouldn’t view layoffs as volatility, but as a sign of strategic recalibration aimed at enhancing service quality and long-term stability.

The firm’s emphasis on advisor retention and digital integration suggests a future focused on personalized, tech-enhanced financial guidance. For employees, staying informed through internal communications, proactively engaging with transition resources, and upskilling—whether via firm-sponsored training or personal development courses—remains critical. The evolution also presents a quiet opportunity: firms rebuilding for efficiency often create pathways for internal mobility, mentorship, and leadership roles in emerging advisory models.

Edward Jones’ layoffs reflect a broader chapter in financial services’ transformation—one where adaptability, technology adoption, and client-centric innovation define resilience. For stakeholders navigating this change, understanding both the immediate effects and long-term trajectory offers clarity amid uncertainty. The firm’s chosen path—streamlined, digital-first, and humanly supported—positions it to meet

Related Post

Dodgers vs Padres: Star Power and Stats That Drove a Thrilling Showdown

Jon Jones Height: The Measured Power Behind a Fighting Icon’s Stature

Wivb Newscasters Uncover How AI Is Revolutionizing Modern Journalism

Campeonato Paulista A1: The Pulse of Brazilian Football’s Most Tradition-Rich Tournament