Dolar Hoy En Banco Azteca: Precio Tips y Guía Definitiva para Comprar con Opinión

Dolar Hoy En Banco Azteca: Precio Tips y Guía Definitiva para Comprar con Opinión

For nearly a decade, Banco Azteca has stood as a cornerstone of accessible banking in Mexico, particularly for financial consumers navigating the dolarizado economy. As of the latest market data, understanding the interplay between the peso stable but fluctuating dolar and Azteca’s financial products — especially CPFs (Certificados de Prezo Fijo) and other bank-preferred assets — has become critical for savvy investors and cash-strapped Argentinos seeking to optimize returns. This article decodes current price tips, actionable strategies for purchasing Azteca securities, and essential insights for making informed decisions in a dynamic economic environment.

What Drives the Price of Azteca Financial Instruments Today?

The prices observed in Banco Azteca’s current portfolio of financial products are shaped by a complex fusion of macroeconomic variables and institutional policy.

Central to this dynamic is the daily fluctuation of the Mexican peso against the U.S. dollar, directly influencing the real value of fixed-income instruments denominated in pesos. Despite being dolarizado in practice — where dolar equivalents are widely traded and referenced — Azteca’s CPFs reflect localized adjustments tied to inflation expectations, central bank interest rate decisions, and demand for stable-yield assets.

“Banco Azteca’s products are uniquely positioned because they convert global dollar strength into structured domestic returns — offering investors a hedge within Mexico’s evolving financial landscape,” explains María López, a senior financial analyst with over 15 years of experience in Latin American banking. “The CPF pricing model adjusts quarterly in response to peso-dolar parity shifts, ensuring relevance in interest rate environments where foreign currency exposure remains a concern.”

Key factors affecting current pricing include: - The Bank of Mexico’s (Banxico) benchmark interest rate (seenip), which drives discount rates used in CPF valuation -人民币 dolarization trends in street value and liquidity demand for peso-denominated instruments - Azteca’s product-specific yield spreads relative to Tesobonos and government bonds - Inflation expectations, particularly as Mexico inches closer to a 5% annual target, pressuring fixed-income returns Understanding these signals enables buyers to anticipate movements and position investments effectively.

Smart Precio Tips: How to Identify Optimal Entry Points at Banco Azteca

Securing favorable pricing for Azteca products requires both market awareness and tactical timing.

Here are proven strategies drawn from recent performance data and trader insights: - **Monitor Daily Dolar Rates Close to Banking Hours**: Since Azteca pricing aligns closely with prevailing peso-dolar parity, monitoring the midday exchange rate — often updated via Banxico’s official feeds — helps identify narrow spreads where buying power is strongest. Traders often report 0.3–0.8% advantages during 10 AM–3 PM hours, when central bank data releases reduce volatility. - **Target Month-End Reemission Windows**: Azteca typically reissues its CPF certificates at month-end, when refinancing costs align and liquidity tightens.

“Buying just before month-end locks in current pricing ahead of institutional repricing,” notes analyst López. “This is when the lowest premiums often emerge.” - **Track Promotional Periods Driven by Regulatory Cycles**: Mechanisms like Tesobonos and interest rate caps influence Azteca’s competitive edge. During periods of interest rate stabilization — such as founded in 2023’s rate-free window — CPF spreads narrow, creating entry opportunities with minimal slippage.

- **Use Real-Time Portfolio Simulators**: Azteca provides internal tools allowing users to simulate dollar-to-peso return profiles using current exchange rates. Plugging in expected transaction dates and current rates delivers projected yields adjusted for banking fees and exit premiums.

Notably, many retail investors remain unaware that Azteca’s CPFs often offer higher effective yields than traditional savings accounts — especially when hedging against informal peso inflation and localized currency swings.

Staying alert to these dynamics can unlock substantial savings over time.

Step-by-Step Guide: How to Buy Azteca CPFs and Related Instruments at Banco Azteca

Purchasing Azteca’s financial instruments at Banco Azteca is streamlined, but mastery of the process ensures optimal outcomes. Follow this precise, step-by-step approach:

- Verify Account Eligibility: Ensure you hold a valid Mexican bank account with Azteca, or are enrolled in one of their retail brokerage partnerships. Identity and tax documentation (CURP and RFC) must be pre-registered online to avoid activation delays.

- Access the Digital Platform: Visit Banco Azteca’s “Inversiones” portal or use the mobile app *Azteca Now*.

Log in using your credentials or initiate a secure virtual session via biometric authentication.

- Select Product & Date: Navigate to the CPF or Tesobonos section. Choose the issue date closest to your desired concern date — ideally day 0 to minimize rollover risk. Filter by maturity term (6 months, 1 year, 2 years) and yield percentage.

- Review Terms & Costs: Confirm the fixed monthly payout rate, exit penalty (if applicable), and institutional fees.

Note that early redemption typically incurs a 0.15% credit on principal.

- Complete Digital Signature & Approval: Use a government-issued ID and digital certificate to validate the transaction. Afro Banco Azteca’s system auto-validates under 30 seconds for verified users.

- Fund Transfer & Settlement: Link your payment method — ranging from bank wire to mobile wallets — and confirm the transfer. Settlement typically clears within T+2 (2 working days), after which proceeds are available in your digital portfolio.

Common pitfalls include failing to check daily exchange rate fluctuations before initiating trade, selecting maturity dates during volatile market windows, or overlooking exit penalties.

Always cross-verify terms using Banxico’s daily publishing feed for transparency.

Why Dolar Hoy En Banco Azteca Demands Strategic Timing and Knowledge

Navigating Banco Azteca’s dolar-linked financial products is not merely about choosing the lowest yield — it’s about aligning investment choices with precise macroeconomic updates and institutional behavior. While the company positions itself as a shield against dolar volatility through CPFs tied to peso-dollar equilibrium, true value emerges only when buyers act with awareness. The dolarized street economy amplifies the relevance of libras-denominated instruments, making timing a critical lever.

Experienced investors treat Azteca’s offerings as dynamic risk tools rather than static savings vehicles. Whether leveraging month-end repricings or capitalizing on short-term spreads driven by Tesobo expansions, success hinges on integrating real-time exchange monitoring with disciplined purchasing tactics. As the Mexican financial ecosystem evolves, proactive engagement with Banco Azteca’s tools — paired with disciplined analysis — ensures that the dolar today isn’t just a reference rate, but a strategic advantage when purchasing wisely.

Related Post

X4Y. Live.: The Real-Time Revolution Transforming How We Engage With X4Y

Apple Premium Reseller: Your Gateway to Premium iOS Access Without Storage Hassles

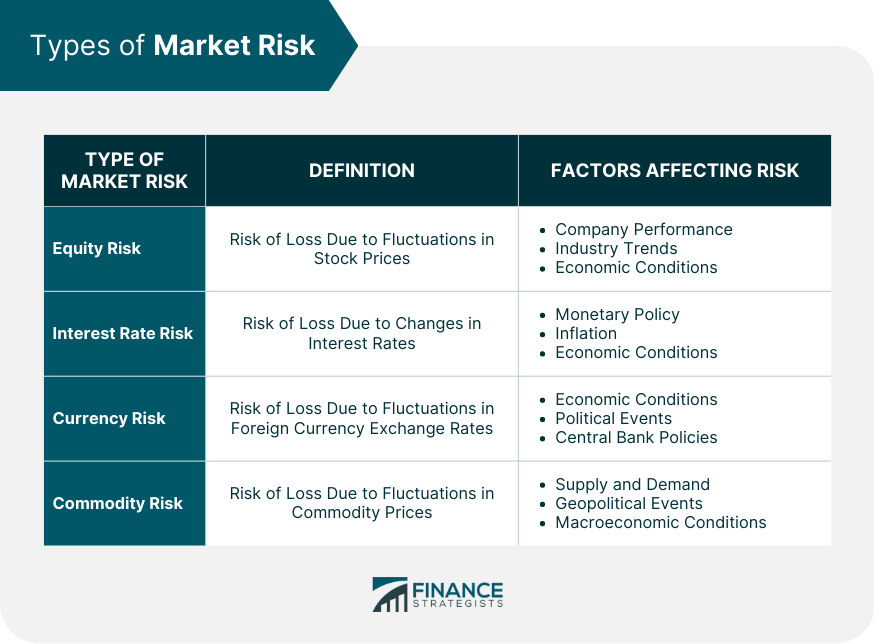

Unlock Market Risk: The Simple, Critical Logic Behind Understanding Duration in Finance

Olivia Gobert Hicks: Pioneering Legal Scholar and Advocate at the Intersection of Race, Equity, and Justice