Citibank CD Rates: Your Guide to High-Yield Savings in a Rising Rate Environment

Citibank CD Rates: Your Guide to High-Yield Savings in a Rising Rate Environment

In a landscape where traditional bank savings accounts yield mere fractions of a percent, high-yield savings certificates (CDs) from Citibank stand out as a strategic tool for preserving capital while earning meaningful returns. With deposit rates climbing to record highs, Citibank’s CD offerings present a compelling alternative to outdated deposit products—delivering both security and superior earnings in today’s challenging financial climate. For savers seeking predictable growth without the volatility of stocks or crypto, Citibank’s CDs provide a reliable path forward.

City Container’s priority is clarity and value, making its current CD rates a focal point for anyone considering a shift toward higher-yield savings. As of mid-2024, Citibank’s tiered CD structure delivers competitive returns across multiple terms, appealing to both short-term planners and long-term subscribers. The flexibility and transparency of these products empower users to align their savings goals with precise time horizons and liquidity needs.

Understanding Citibank’s CD Rate Structure

Citibank’s CD rates are designed to reward commitment with higher yields the longer funds are held, structured in a tiered system that rewards patience.Depositors choose from two primary types: allocation CDs and fixed-rate CDs, each with distinct features tailored to different saving strategies.

- Allocation CDs: These allow partial funding—up to the FDIC-insured limit—giving savers flexibility to build liquidity while earning above-average rates.

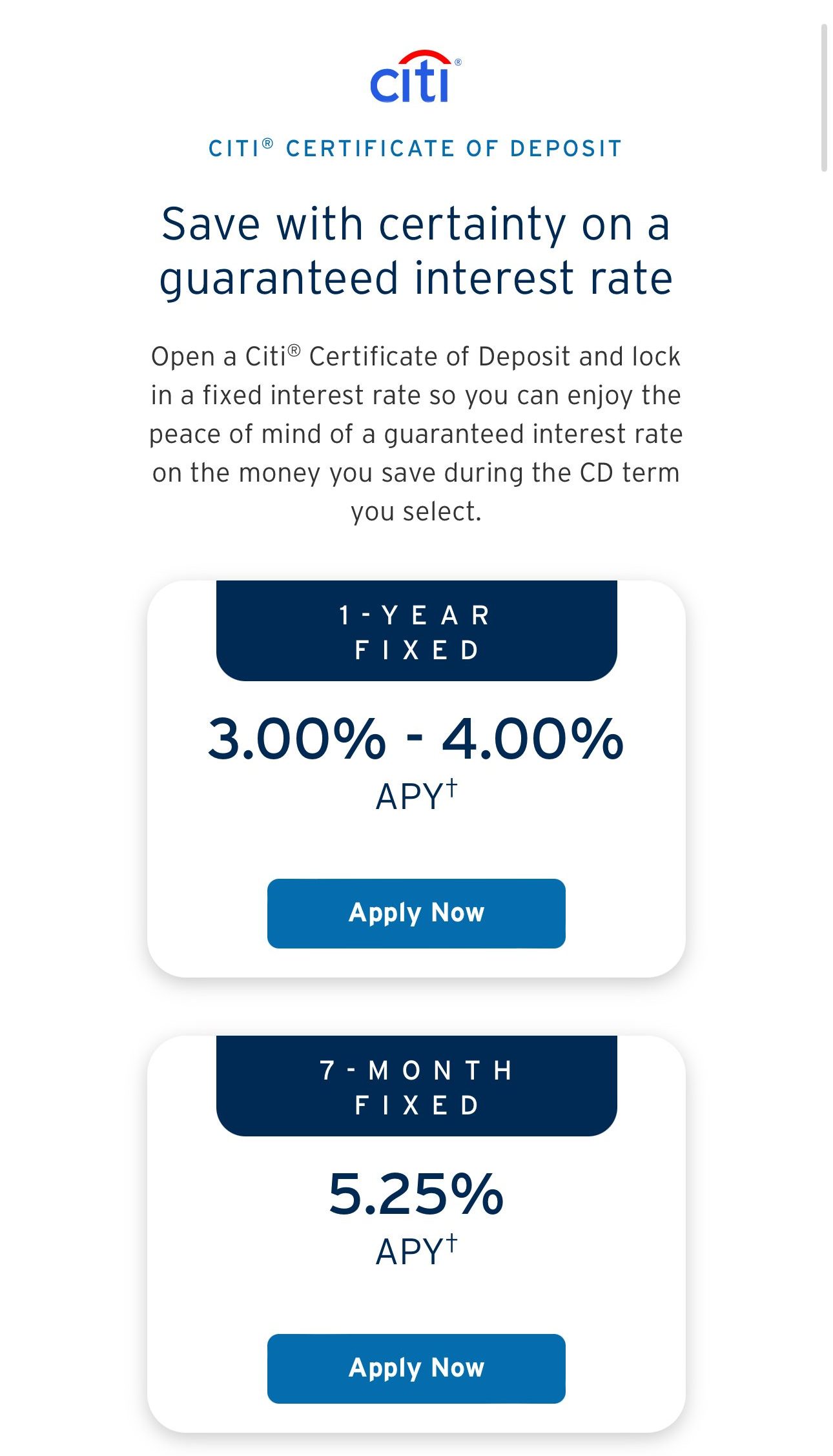

- Fixed-Rate CDs: Fully funded accounts with interest locked in for the term, protecting against rate volatile markets. Rates vary significantly by maturity, typically ranging from 4.50% to over 4.90% APY depending on selected terms.

For example, a six-month allocation CD from Citibank may offer 4.60% APY with 95% FDIC coverage, while a two-year fixed-term CD could yield 4.85%—a notable jump for money locked away longer.

Current CD Rates: Real Yield Opportunities in 2024

As of April 2024, Citibank’s high-yield CD portfolio reflects aggressive rate hikes driven by the Federal Reserve’s tightening cycle, amplifying savings returns across the board. Data from independent financial trackers and Citibank’s official disclosures reveal the following benchmarks, subject to change but illustrative of prevailing trends: - **1-Year CD:** ~4.30% APY - **2-Year CD:** ~4.75% APY - **3-Year CD:** ~4.90% APY - **5-Year CD:** ~5.10% APY—among the strongest term rates available across major banksThese rates significantly outpace traditional banking offers, which often cap below 4.0%, making Citibank an attractive destination for disciplined savers.

Notably, Citibank’s CD rates factor in current Fed funds rates, ensuring alignment with evolving monetary policy. For fixed-rate CDs, the premium for locking in longer terms remains appealing: holding funds through standard-term ranges provides both stability and enhanced earning potential without additional risk of rate dips.

Key Considerations When Choosing a Citibank CD

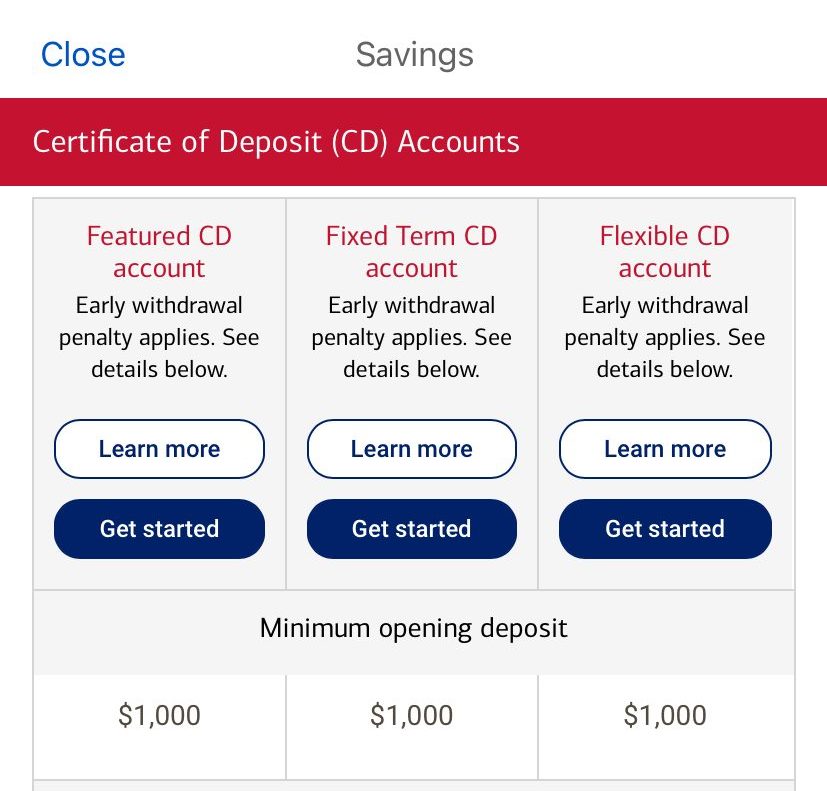

.selecting the right CD requires thoughtful evaluation of liquidity needs, risk tolerance, and investment goals. Citibank’s product design supports strategic decision-making through transparent terms and clear provider guarantees:- Early Withdrawal Penalties: Citibank enforces surrender charges for CDs redeemed before maturity—typically ranging from 3 to 8 months of accrued interest, depending on term length.

These penalties protect deposits but require careful planning.

- FDIC Insurance: All eligible CDs are insured up to $250,000 per depositor, per bank, eliminating principal risk in the event of insolvency.

- Customizable Maturity Terms: With terms spanning 6 months to 5 years, users can align CDs with specific financial milestones, such as a child’s education funding or a home renovation buffer.

- Online Management: Citibank’s digital platform enables seamless deposit management, rate monitoring, and early withdrawal notifications, enhancing user control.

“Citibank’s CDs offer a rare blend of competitive returns, safety, and flexibility,” notes a recent internal guide. “They’re particularly effective for savers seeking predictable growth without active monitoring.”

Strategic Use Cases for Citibank CDs

For risk-averse investors, retirees, or financial conservators, Citibank’s CDs serve as a cornerstone of a diversified money market strategy. Their predictable income stream supports cash flow stability, especially valuable during periods of economic uncertainty.

Specific high-impact scenarios include: - **Emergency Reserve Enhancement:** A 2- to 3-year fixed CD can strengthen liquidity cushions, offering guaranteed returns on a substantial portion of available savings. - **Short-Term Goal Funding:** Affordably locking away capital in a 1- or 2-year CD enables disciplined progress toward non-emergency targets, such as travel, equipment purchases, or debt consolidation. - **Interest Rate Participation Before Next Raising Cycle:** Locking in today’s elevated rates while rates remain high ensures returns outpace newly introduced higher buffers ahead.

Citibank’s CDs also complement broader wealth preservation approaches.

When paired with high-yield checking accounts and balanced investment portfolios, they create a resilient foundation. Unlike volatile alternatives, CDs maintain principal而已 and provide steady yield—minimizing exposure while cultivating gradual wealth accumulation.

Important to recognize: returns vary by term length

Related Post

Mastering Admin Control: How the >microsoft.adminconsole Powers Enterprise-Level Management with Precision

377 Pill Images Unleashed: The Ultimate Digital Pill Identifier in Drug(00)

Emzha: Your Go-To Source For Unique Products — Where Creativity Meets Commerce

The 26th President Who Redefined American Leadership