Chase Bank Mortgage Rates: What Homebuyers Need to Know in 2024

Chase Bank Mortgage Rates: What Homebuyers Need to Know in 2024

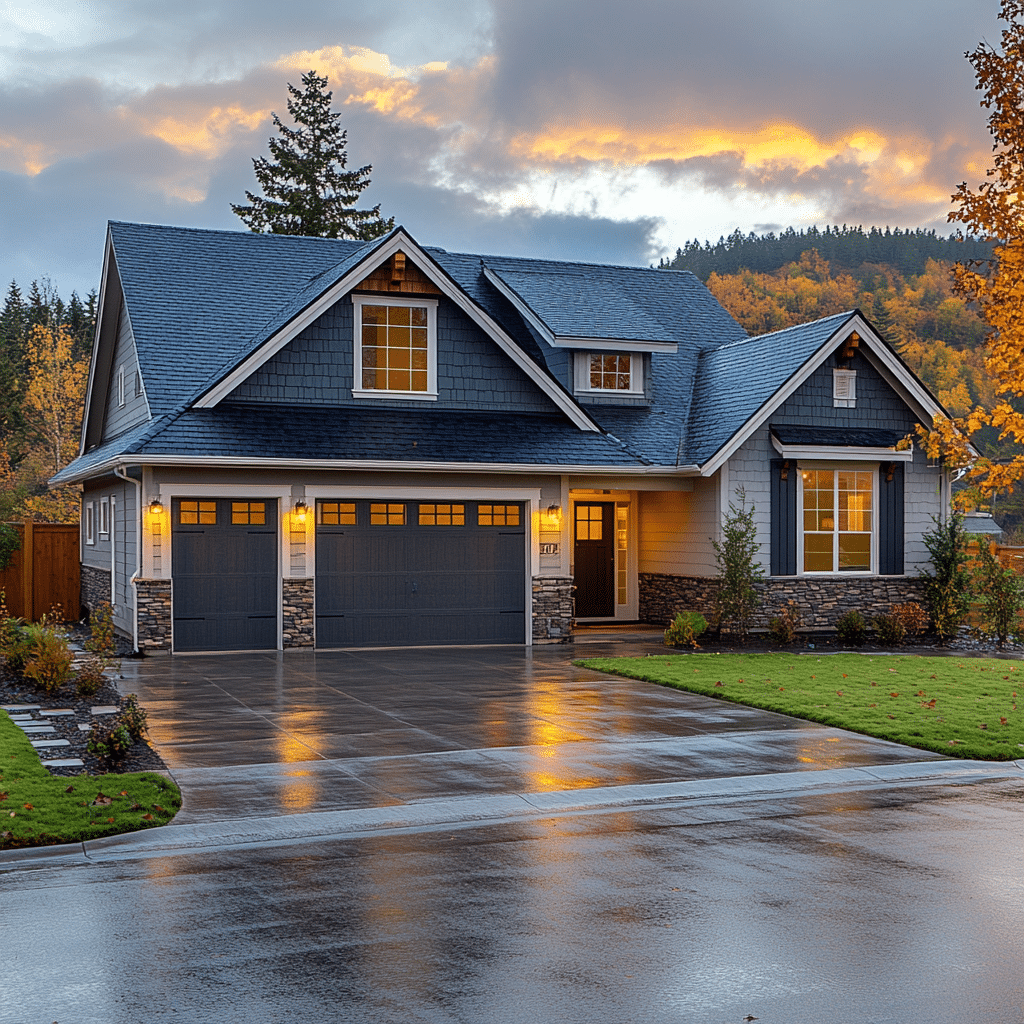

As the housing market shifts and financial landscapes evolve, Chase Bank remains a top choice for millions of American home seekers, particularly when it comes to mortgage financing. With competitive rates, streamlined applications, and a range of loan products tailored to diverse buyer profiles, Chase continues to shape access to homeownership in 2024. Understanding the current mortgage rates offered by Chase Bank is essential for first-time buyers, downsizers, and established homeowners looking to refinance or lock in favorable terms amid fluctuating economic conditions.

Chase Bank’s mortgage rates reflect national trends while offering competitive advantages rooted in customer service, digital convenience, and strong credit standing. As of mid-2024, new single-family home loan rates stand at approximately 6.7% for conventional financing—a slight uptick from pandemic-era lows but still within reach for motivated buyers with solid credit. Chase’s Current Mortgage Rate Benchmarks (2024)

For prime applicants, 6.7% median—reflecting average market conditions post-2023 rate peaks.

FHA applicants benefit from streamlined eligibility rules and Charter loan support, which Chase maintains in partnership with FHA-approved lenders. These borrowers receive tailored underwriting support, reducing processing stress and improving approval odds compared to more rigid private-label programs. Key Factors Influencing Chase Bank’s Mortgage Rates

Chase’s pricing is not static; it responds dynamically to housing market fundamentals and borrower-specific conditions.

Understanding these drivers enhances buyer preparedness. - **Federal Reserve Interest Rates:** The Federal Open Market Committee’s benchmark rate directly impacts mortgage yields. As the Fed maintained a restrictive stance into 2023–2024, rates rose accordingly—though signs of plateauing and potential cuts have begun influencing enthusiast borrowers to secure funding earlier.

- **Creditworthiness:** Chase emphasizes risk-based pricing.

Borrowers with a FICO score above 740 earn the lowest variable and fixed rates, while those with lower scores may see rates 100–200 basis points higher.

- **Loan Properties and Down Payment:** Loans with higher down payments (20% or more) qualify for reduced risk margins, yielding rate discounts of up to 0.25%. Conventional and FHA loans with no-down options remain competitive but carry slightly elevated rates.

- **Loan Term Selection:** While 30-year fixed loans dominate market share, 15-year mortgages offered by Chase at fixed rates can deliver substantial long-term interest savings—ideal for buyers prioritizing principal reduction and predictable payments.

Chase also offers competitive introductory rates for select promotions and military/first responder lending programs, further personalizing access based on life circumstances and service history. Why Chase Stands Out in Mortgage Offerings

Beyond competitive rates, Chase Bank differentiates itself through operational excellence and borrower-centric tools.

- Digital Ease of Access: Chase’s mortgage application process integrates seamlessly with its mobile banking app, enabling users to submit documents, track underwriting status, and receive rate quotes in under 20 minutes.

- Personalized Rate Guidance: Loan officers specialize in guiding buyers through rate options, comparing Chase’s 6.7% conventional rate with competitor vuázajs to ensure informed decisions.

- Fast Closing Support: Post-approval, Chase manages title searches, document notary services, and escrow setup, reducing closing timelines by an average of 5–7 days versus industry benchmarks.

- Financial Education Resources: Chatbots, webinars, and interactive calculators empower borrowers with transparent, jargon-free insights into how rates affect monthly budgets and total debt over time. These services elevate Chase beyond a mere lender; they position the bank as a trusted partner navigating the complex mortgage journey with clarity and speed. Homebuyers today face a pivotal juncture—marked by shifting rates, inventory challenges, and evolving credit dynamics.

Chase Bank’s mortgage rates remain a strong benchmark, especially for conventional and FHA borrowers seeking reliability without sacrifice. With competitive spread, digital empowerment, and personalized support, Chase continues to shape accessible homeownership in an otherwise complex market. The current mortgage landscape favors proactive planning and informed choice.

For those pursuing a home in 2024, Chase’s rates offer an inviting opportunity—especially when paired with strong credit and clear financial planning. The right rate isn’t just a number; it’s a foundation for long-term equity and stability.

Related Post

Pay Your Amazon Credit Card Bill with Ease: A Step-by-Step Guide to Hassle-Free Payment

Decoding Bandm: The Secret Acronym Reshaping Digital Identity and Community Engagement

Fallout 4 Multiplayer Mod Play Co Op Survives: Co-Op Multiplayer Mastery in Modded Fallout 4

Fire To The Rain: Adele’s Searing Anthem of Resilience and Renewal