Capital One Checking Account: The Smarter Choice for Modern Banking Needs

Capital One Checking Account: The Smarter Choice for Modern Banking Needs

A Capital One checking account delivers the simplicity, speed, and flexibility modern professionals demand—without the Bank Plan’s strings. Designed for everyday use, from mobile payments to budget tracking, the account combines no monthly fees, instant access to funds, and robust digital tools to streamline financial management. In a financial landscape where convenience is currency, Capital One’s offering stands out as a lean, powerful, and user-first solution.

Zero Fees, Maximum Control: No Hidden Costs, Full Flexibility

One of the most compelling advantages of the Capital One Checking Account is its transparent pricing. Despite being a national bank, Capital One charges no monthly maintenance fee—unlike many traditional checking accounts that trap cardholders in recurring costs. This core benefit reflects a customer-centric philosophy, allowing users to own their money without surprise charges.Beyond the absence of fees, the account thrives on flexibility. With integrated direct deposit, instant transfer capabilities, and early paycheck access through extended ACH, members enjoy real-time financial control. There are no minimum balance requirements, no excessive transaction limits, and no fees for using a debit card—making it ideal for freelancers, students, and working professionals alike.

“This account was built for people who value direct control over their finances,” says a Capital One financial services representative. “No firewalls, no clutter—just clear access and predictable pricing.” The emphasis is on transparency and practicality, ensuring every dollar serves a purpose.

For routine transactions, the account performs with lightning speed.

From transferring funds between accounts in seconds to paying bills without delays, Capital One’s digital platform integrates seamlessly with modern workflows. The Capital One Mobile app, engineered for intuitive navigation, enables users to manage their checking balance, view real-time transaction history, and set spending alerts—all from the palm of their hand. The app’s intuitive design eliminates the frustration of convoluted banking interfaces, putting powerful tools within reach of anyone familiar with smartphones.

Perhaps most notably, the checking account supports enhanced security without sacrificing convenience. Advanced fraud detection algorithms monitor for suspicious activity, pausing transactions that trigger alerts. Two-factor authentication, biometric login, and card freezing features add layers of protection, ensuring users stay in control.

As cybersecurity threats evolve, Capital One’s proactive approach reinforces trust, enabling customers to focus on their daily tasks—without constant worry about fraud.

Budgeting Made Simple: Tools That Turn Numbers into Action

Managing personal finances thrives on clarity, and Capital One checking accounts deliver exactly that. The built-in budgeting features transform raw transaction data into actionable insights.Users can link recurring expenses, set monthly spending limits, and receive real-time notifications when nearing their thresholds—turning passive banking into active money management. Unlike one-size-fits-all bank experiences, Capital One’s tools adapt to individual financial habits. Whether tracking grocery spending, monitoring utility costs, or forecasting savings goals, the budgeting toolkit evolves with users’ needs.

As financial commentator Suze Orman once noted, “The best banks don’t just hold your money—they help you grow it.” Capital One’s integration of data analytics and user-friendly design makes that

Related Post

John Krasinski’s Commanding Presence: Why His Height Has Become Part of His On-Screen and Public Identity

Jason Lee Hollywood: From Indie Grit to Mainstream Spotlight

Ozil OSM: Your Ultimate Guide to OpenStreetMap’s Power and Purpose

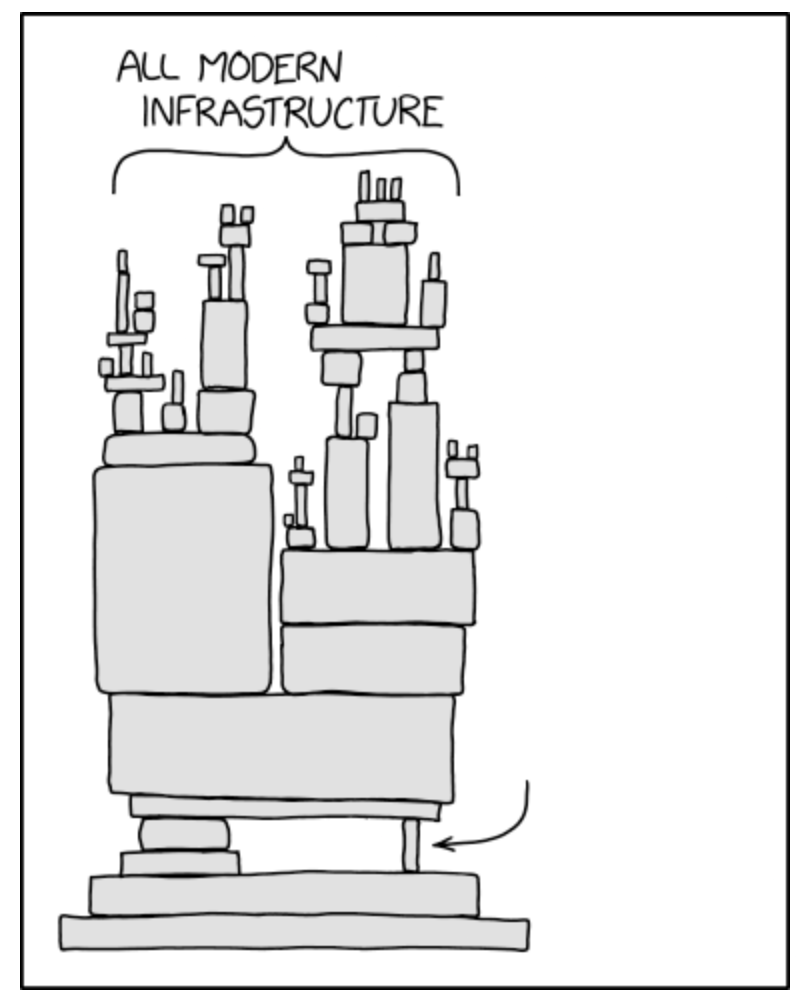

1010Lat: Unlocking the Potential of the 1010Lat Precision Standard in Modern Digital Infrastructure