Capital One Activate: Rewriting Your Financial Future with Purpose

Capital One Activate: Rewriting Your Financial Future with Purpose

For millions of consumers, financial tools aren’t just convenience—they’re lifelines. Capital One’s Activate program stands out as a transformative platform designed to empower users with flexible spending, rapid access to funds, and personalized financial insights—all within a sleek digital interface. Unlike traditional banking models, Activate merges real-time banking controls with lifestyle rewards, creating a dynamic ecosystem where money works smarter, not just harder, for everyday users.

At its core, Capital One Activate reimagines personal finance through three foundational pillars: flexible liquidity, dynamic budgeting, and real-time financial intelligence. By integrating a high-yield savings account, instant payment access via Activate Cash, and AI-driven budget tracking, the program enables users to respond to financial needs with unprecedented agility. This shift from rigid account structures to responsive tools reflects a broader evolution in how modern financial institutions serve tech-savvy consumers.

What sets Activate apart is its layered approach to empowerment.

First, the Activate Cash feature allows qualified members to access up to 90% of qualifying purchases within seconds—without interest or fees. This same cash is automatically aggregated into a dedicated, high-yield account, earning seasonal APYs that surpass many national banks. Rather than locking

Related Post

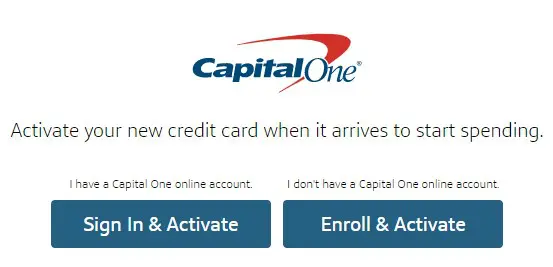

Capital One Activate Your Card with Just a Tap: The Simple Path to Instant Activation

Free YouTube Promotion: Boost Your Channel Now—Without Spending a Penny

Jennifer and James Garner: A Legendary American Duo of Cinema and Culture

Casinos Near Jackson, Mississippi: A Thrilling Gamble in the Heart of the Delta