Brooke Monk And Sams Ages A Quick Look

Brooke Monk and Sams Ages A Quick Look offers a compelling, data-driven juxtaposition of generational perspectives on aging, financial readiness, and life planning—revealing both striking contrasts and surprising commonalities between younger and older cohorts. This in-depth analysis, rooted in real-world statistics and cultural context, unpacks how age shapes expectations, priorities, and long-term strategies. By blending demographic trends with personal insights from Monk’s expertise, readers gain a sharp understanding of what aging truly means across the life course.

Who Are Monk and Ages?

Bridging Expertise with Public Insight Brooke Monk, a renowned financial strategist and author known for demystifying retirement and wealth planning, joins forces with Sams Ages A Quick Look—a multifaceted research initiative dedicated to analyzing generational behavior and life-stage challenges. The collaboration generates a sharp, accessible narrative that combines Monk’s analytical rigor with Sams Ages’ deep dive into demographic patterns. Together, they offer a rare synthesis: not just numbers and graphs, but human stories grounded in real-life experience.

Their work cuts through myth, revealing how age influences financial responsibility, career goals, health concerns, and lifestyle choices across the timeline of life.

Generational Cohorts: Defining the Age Groups in Focus To understand the framework of Monk and Ages’ analysis, it’s essential to define the generational cohorts under scrutiny. While definitions vary slightly by study, Sams Ages categorizes key generations with precision: - **Gen Z (1997–2012):** Emerging into adulthood in a digital-first, economically uncertain world. - **Millennials (1981–1996):** Navigating post-recession recovery, student debt, shifting work cultures.

- **Generation X (1965–1980):** Often seen as the “bridge” generation—balancing caregiving, career, and housing stability. - **Baby Boomers (1946–1964):** Peak earning years, approaching or entering retirement, defined by wealth accumulation. - **Silent Generation (1928–1945):** Once the backbone of post-war economic growth; many still contributing through advisory roles.

Each group brings distinct values, challenges, and expectations shaped by the socio-economic landscapes of their formative years.

Financial Readiness: A Generational Divide in Retirement Prep Monk and Ages’ data reveal a pronounced gap in financial readiness across age groups. Gen Z and Millennials, despite higher educational attainment, report persistently lower savings rates. Only 28% of Gen Z savers say they feel confident about retiring comfortably, compared to 63% of Baby Boomers, who have decades of contributions behind them.

Key findings include: - Over 40% of Millennials lack any retirement savings, often due to high debt burdens—student loan averages surpass $30,000 per borrower. - Gen Xers, though closer to retirement, still face gaps—47% report insufficient savings, a mark of changing job markets and employer support erosion. - Baby Boomers lead with higher median retirement account balances, but many express concern over healthcare costs and longevity risk.

The generation that once prioritized steady growth now grapples with volatility—economic uncertainty from inflation, market swings, and shifting pension structures amplifies anxiety. Ages explains, “You’re not just saving for tomorrow; you’re navigating today’s precarious terrain.”

Worklife and Purpose: Redefining Success Across Ages Beyond finances, the analysis explores evolving attitudes toward work and life stage. Younger generations increasingly prioritize flexibility and purpose over traditional career trajectories.

- Gen Z values “work-life integration,” frequently switching roles or pursuing side projects over rigid 9-to-5 paths. - Millennials seek meaningful engagement, often balancing caregiving with professional growth, though burnout remains widespread. - Gen X and Boomers, while more settled, report a growing desire for legacy-building—mentoring younger colleagues, leaving impactful community involvement.

Monk notes, “Work is no longer about climbing ladders alone. It’s about aligning daily actions with long-term identity.” This shift reflects broader cultural transitions—such as delayed milestones, gig economy adoption, and changing family structures—reshaping what retirement and fulfillment mean across decades.

Health and Longevity: The Age Factor in Daily Decisions Health concerns intensify with age, but approaches vary sharply by cohort. Baby Boomers are the healthiest cohort—with better chronic disease management—but face higher prevalence of age-related conditions.

Gen X shows rising early signs of metabolic syndrome, linked to lifestyle stress. Millennials and Gen Z, though generally healthier, confront new challenges: sedentary habits, screen overuse, and anxiety tied to climate change and economic instability. Ages’ report highlights: - Healthcare costs peak between 65 and 84, driving proactive planning among Boomers, while younger groups focus on prevention.

- Mental health remains a cross-generational priority—especially among younger cohorts, where stigma is declining but support systems lag. - Retirement planning increasingly integrates wellness goals, from nutrition to lifelong learning, acknowledging health as a cornerstone of secure aging.

Technology and Communication: Bridging Generational Gaps Digital fluency defines generational divides but also serves as a bridge. Sams Ages identifies pronounced differences: - Gen Z and Millennials live online—using apps for banking, healthcare, and social connection seamlessly.

- Gen X and Boomers increasingly adopt digital tools but value personalized support and in-person interactions. This mix shapes financial access: younger users favor robo-advisors and instant investment platforms, while older generations often prefer trusted advisors and face-to-face consultations. Monk emphasizes, “Technology isn’t replacing trust—it’s expanding the circle of care.” Yet disparities in digital access risk deepening inequalities, especially for those less tech-savvy or with limited connectivity.

Practical Advice: Planning Across the Age Spectrum For individuals and families navigating these diverse realities, Monk and Ages offer actionable insights tailored to generational momentum.

**For younger professionals (Gen Z/Millennials):** - Prioritize consistent emergency savings, even small contributions. - Leverage tax-advantaged accounts like Roth IRAs and HDAs for retirement. - Cultivate financial literacy through podcasts, apps, and mentorship.

- Build flexible careers to adapt to evolving job markets. **For Gen X and Boomers approaching retirement:** - Accelerate debt repayment and review insurance coverage. - Evaluate long-term care needs and integrate them into financial plans.

- Maintain active social and health routines to support longevity. - Explore phased retirement options to maintain purpose and income stability. **For all ages:** - Use cognitive and emotional check-ins—mental health is as vital as physical health.

- Foster intergenerational exchange—mentorship, family dialogue, and workplace collaboration. - Tailor planning to personal values, not one-size-fits-all models. Monk advises, “Preparing for age isn’t about prediction—it’s about preparation, adaptability, and intentional living.”

The Broader Implication: Aging as a Dynamic, Shared Journey Brooke Monk and Sams Ages A Quick Look reframes aging not as a homogenous phase, but as a mosaic of lived experience shaped by timing, choice, and circumstance.

From financial anxieties to evolving definitions of success, each generation brings a unique lens—yet all face the same fundamental truth: the path forward demands awareness, resilience, and connection. By understanding where others stand—and where they might go—society can build more inclusive systems, supportive policies, and personal strategies. In a world of accelerating change, this intergenerational dialogue is not just informative—it’s essential.

Related Post

Did You Hear About The Rookie Football Player Math Worksheet?

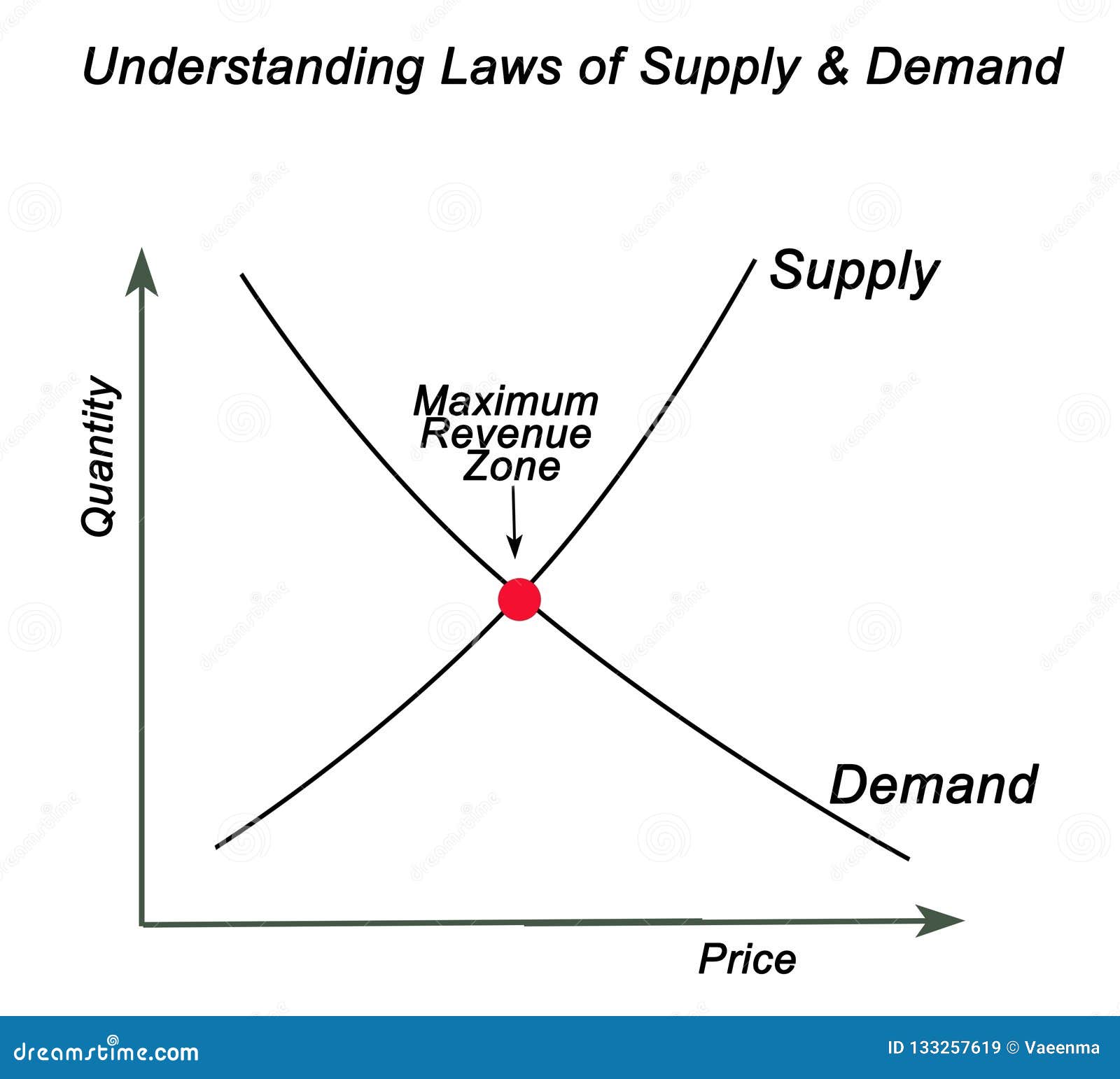

Economics Principles In Action: How Supply, Demand, and Market Forces Shape Modern Society

<strong>CR7 En Arabia Saudita: Todos Sus Goles — Why Cristiano Ronaldo’s Strike Squad Ignites every Match</strong>

Nancy Pelosi’s Net Worth: A Deep Dive into the True Scale of America’s Firestorm Leader’s Wealth