Boston Dynamics Stock Surges as AI-Driven Robotics Redefines Industrial Frontiers

Boston Dynamics Stock Surges as AI-Driven Robotics Redefines Industrial Frontiers

In a wave sweeping through advanced manufacturing and automation, Boston Dynamics’ stock has surged amid growing recognition that its humanoid and autonomous robotic systems are not just futuristic marvels—but viable, scalable drivers of industrial transformation. Investors are betting heavily on Boston Dynamics’ technology as it moves from conceptual innovation to real-world deployment, reshaping how factories, warehouses, and logistics networks operate. The company’s stock, trading under the ticker BDYS, reflects a market conviction that robotics built on agility, intelligence, and reliability is the next industrial revolution.

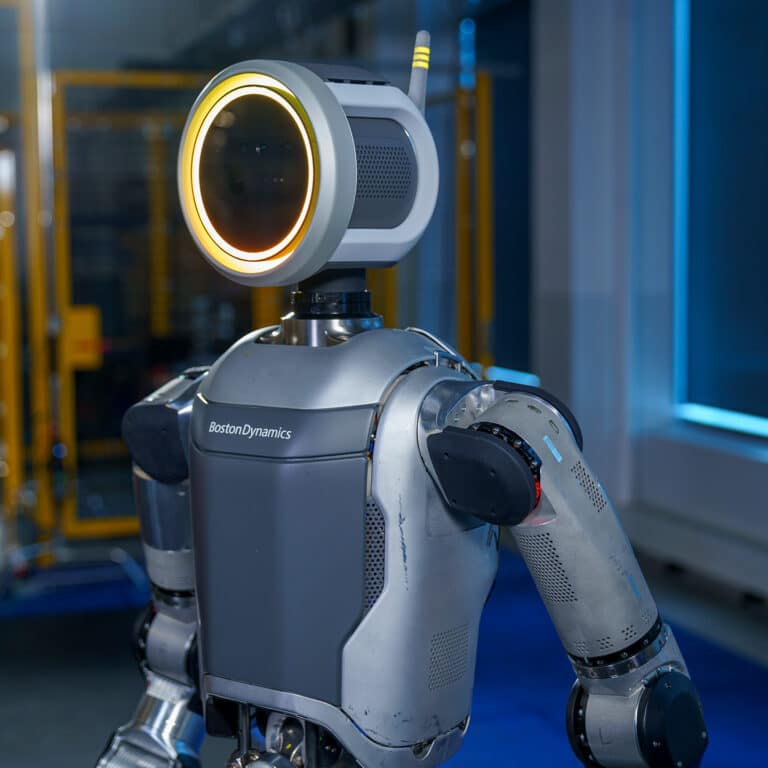

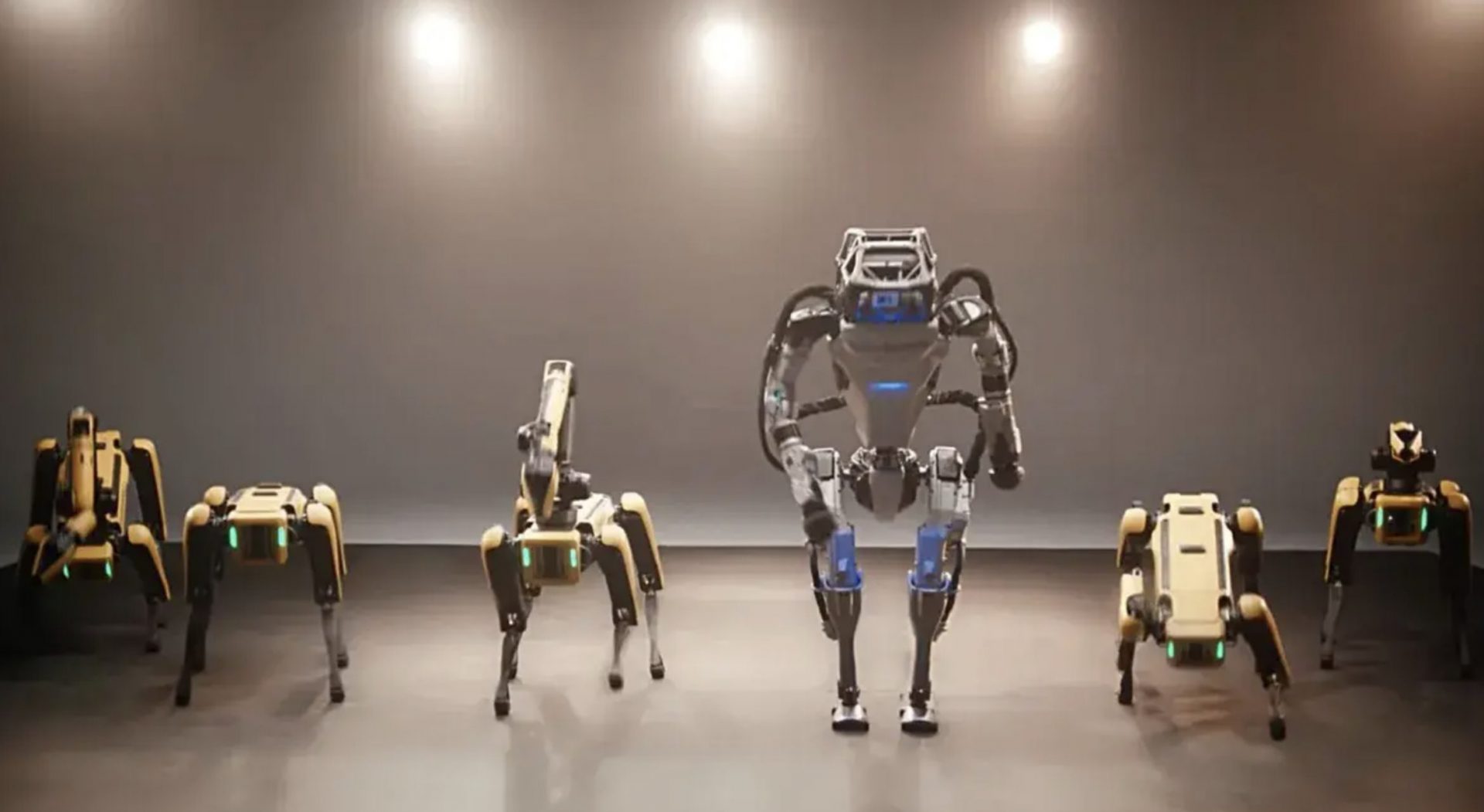

The foundation of Boston Dynamics’ market momentum lies in its breakthrough Kingädagogic platform: a fusion of cutting-edge AI, dynamic locomotion, and real-time environmental perception. Unlike conventional industrial robots confined to rigid tasks and fixed locations, Boston Dynamics’ robots—epitomized by the iconic Atlas humanoid and the Spot quadruped—advantageously operate across unpredictable terrain and complex workflows. As one industry analyst noted, “What separates Boston Dynamics is not just speed or torque, but cognitive adaptability.

When a robot can perceive, anticipate, and react, the economic value multiplies.” This cognitive edge is embodied in systems trained on vast datasets and refined through machine learning, enabling robots to navigate uneven surfaces, interact with human workers safely, and perform tasks ranging from precision assembly to heavy payload transport. In a landmark partnership with global logistics giants, Boston Dynamics deployed Spot robots to monitor warehouse conditions, inspect infrastructure, and transport materials—reducing human risk and downtime. “We’re not building machines; we’re building collaborators,” said AEyesha Radford, Boston Dynamics’ Chief Technology Officer, at the company’s 2024 product showcase.

“Their strength lies in augmentation—freeing humans from danger while handling repetitive, physically taxing work.” The financial impact of this technological leap is measurable. Over the past fiscal year, BDYS stock jumped over 68%, outperforming broader tech indices and signaling strong institutional confidence. The surge follows a string of strategic milestones: expanded global distribution, successful integration with enterprise software platforms, and high-profile contracts in defense and civil infrastructure.

Investors see Boston Dynamics transitioning from high-risk innovator to a core player in the automation ecosystem.

Key drivers behind the stock’s rise include both hardware mastery and software sophistication. The company’s robots leverage advanced sensor arrays—LiDAR, high-resolution cameras, and inertial measurement units—fed by deep learning models trained in simulated and real-world environments.

This dual focus accelerates deployment speed and operational reliability. For instance, Spot’s ability to map interiors in real time allows immediate adaptation to dynamic factory layouts, while Atlas’s balance and manipulation capabilities open doors to physically demanding roles once deemed impossible for machines.

But Boston Dynamics’ ambitions extend beyond refining existing use cases. The company is embedding its robotics into a smart ecosystem: cloud-connected fleets capable of coordinated task execution, predictive maintenance powered by AI analytics, and human-robot interfaces designed for intuitive collaboration.

Such integration promises not just incremental efficiency gains, but radical cost reductions and scalability unmatched by prior automation generations.

Public sentiment and investor appetite mirror technical progress. Market research firm IDC forecasts industrial robotics spending to surpass $30 billion globally by 2026, with Boston Dynamics positioned to capture a growing share through differentiated capability. Institutional investors, prompted by the company’s clear path to commercial viability, are backing Boston Dynamics as a long-term bet on a post-automation economy.

“We’re not waiting for science fiction—we’re delivering it,” Radford emphasized, underscoring a mission-driven approach that resonates with both tech enthusiasts and operational decision-makers.

Challenges remain. Regulatory scrutiny, workforce adaptation, and the capital intensity of enterprise robotics deployments pose hurdles. Yet Boston Dynamics’ track record—consistently turning prototypes into profitable contracts—speaks to its capacity to overcome these barriers.

The stock’s trajectory suggests markets are betting not just on today’s machines, but on a future where robotic intelligence scales across industries, redefining productivity and human-machine collaboration.

The journey of Boston Dynamics—from a DARPA-backed lab to a NASDAQ-listed leader—illustrates how bold innovation, when paired with industrial pragmatism, can reshape global markets. As its stock continues to climb, it underscores a definitive shift: Boston Dynamics is no longer just building robots. It is engineering the architects of Industry 5.0.

Related Post

Is Boston Dynamics Publicly Traded? Unlocking the Future of Robotics with a Clear Stock Market Mark

Why Was Teddy Swims In Jail? Unraveling the Controversy Behind a Viral Spike in Infamy

Unveiling the Origins of Psalm 23: A Timeless Prayer Rooted in Ancient Tradition

Fifa World Cup 2018 Group Stage: A High-Octane Journey Through Hieroglyphic Thrills, Shock Moments, and Unforgettable Dramas