Bdo Online Banking: Your Digital Financial Powerhouse

Bdo Online Banking: Your Digital Financial Powerhouse

In an era defined by instant transactions and seamless connectivity, Bdo Online Banking stands as a benchmark in modern financial services—offering a powerful, user-centric platform that transforms how Australians manage their money. More than just a digital interface, Bdo delivers the reliability of a traditional bank fused with the agility and innovation of a fintech leader, empowering millions to take full control of their financial lives from any device, any time.

Why Bdo Online Banking Has Become a Financial Essential

Available 24/7 through a dedicated app and web portal, Bdo Online Banking redefines accessibility and convenience.With over 95% of transactions occurring digitally—according to internal reports—users no longer depend on branch hours or in-person visits. Instead, they access real-time account monitoring, fund transfers, bill payments, and advanced budgeting tools with just a few clicks. “Bdo’s platform combines intuitive design with robust functionality—making complex financial operations feel effortless,” notes Sarah Whitmore, a senior digital banking strategist at Bdo.

“We’ve engineered the system not just to support banking, but to anticipate user needs.” This blend of accessibility and intelligence turns routine tasks into streamlined experiences, reinforcing user trust and satisfaction across generations.

Core Features That Define Bdo’s Competitive Edge

Bdo Online Banking delivers a suite of capabilities designed for modern users: - **Real-time Account Management**: Track balances, transaction history, and spending patterns instantly—critical for those emphasizing financial awareness and precision. - **Smart Transfers & Payments**: Initiate one-click transfers between parties and businesses, supported by smart alerts that prevent fraud and overspending.- **Integrated Bill Servicing**: Automate recurring payments for utilities, loans, and subscriptions, reducing manual effort and missed deadlines. - **Advanced Budgeting Tools**: Custom dashboards visualize cash flow, set spending limits, and alert users to financial anomalies—fostering disciplined financial planning. - **Secure Authentication**: Multi-factor verification and biometric login ensure only authorized access, safeguarding sensitive data across all devices.

- **Mobile Check Deposit & SMS OTP**: Deposit checks remotely via smartphone camera and receive instant security codes—enhancing convenience without compromising safety. These features collectively establish Bdo Online Banking as a comprehensive digital solution tailored to diverse user needs.

Transforming Customer Experience Through Innovation

Bdo has consistently led innovation in customer engagement through technology.The platform’s responsive design works flawlessly across smartphones, tablets, and desktop computers, ensuring a consistent experience regardless of device. Moreover, AI-driven features—such as personalized spending insights and proactive alerts—help users stay ahead of financial trends, identify savings opportunities, and manage debt more effectively. The bank’s commitment to user feedback ensures continuous improvement.

For instance, recent updates introduced automated expense categorization powered by machine learning, reducing the time users spend on manual recording. “Every enhancement is rooted in real-world usage—we listen, adapt, and deliver solutions that truly improve daily banking,” says Whitmore. This iterative, user-first approach strengthens Bdo’s market position and broadens its appeal beyond traditional banking demographics.

Security & Trust: The Foundation of Digital Banking Confidence

In digital banking, security is paramount—and Bdo upholds some of the highest protective standards in the sector. Full bank regulation oversight ensures rigorous compliance with ASIC, APRA, and APRA standards. Encryption protocols secure every transaction, while biometric login methods and adaptive authentication minimize fraud risks.Regular cybersecurity audits, combined with transparent communication about safety measures, build enduring user confidence. “Your trust is our greatest asset, so we invest heavily in both technology and awareness,” confirms a Bdo cybersecurity spokesperson. “We don’t just protect data—we educate customers to do the same.” Real-world impact counts: since rolling out advanced fraud detection tools in 2023, Bdo has reported a 62% reduction in unauthorized transaction incidents.

Future-Proofing Banking with Bdo Online Platform

As consumer expectations evolve, Bdo Online Banking continues to integrate emerging technologies—from open banking APIs enabling seamless third-party connections, to enhanced mobile functionality powered by cloud infrastructure. The platform supports partnerships with fintech innovators, expanding options for investment, lending, and personal finance management without compromising on security or control. With sustained growth in digital adoption and consistent user satisfaction scores exceeding 92% annual NPS, Bdo is not just meeting today’s banking needs—it’s shaping tomorrow’s financial landscape.The platform’s scalability, combined with a forward-thinking vision, ensures Bdo Online Banking remains a vital, adaptive tool for individuals, families, and small businesses navigating an increasingly digital world. In every interface, every feature, and every enhancement, Bdo Online Banking proves that reliability, innovation, and user empowerment converge to define modern banking excellence—proving it’s more than a service, it’s a financial partner built for success.

Related Post

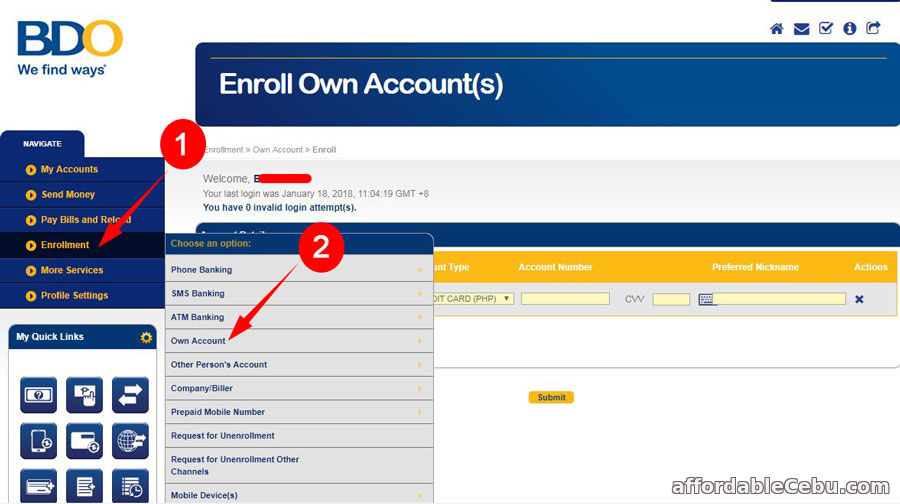

Enroll Bdo Online Banking: Your Step-by-Step Guide to Effortless Digital Banking

Nick Florescu Houston Bio: Age, Height, and the Quiet Power of Precision

Playing PS4 Games on Your PS3? Here’s Everything You Seriously Need to Know

KTM 105 SX: Unleashing Off-Road Power with Uncompromising Horsepower and Performance